In the New York Times, Susan Dynarski argues that students learn less when they use laptops, tablets and the like during lectures. … a growing body of evidence shows that over all, college students learn less when they use computers or tablets during lectures. They also tend to earn worse grades. The research is unequivocal: Laptops distract from learning, both for users and for those around them. It’s not much of a leap to expect that electronics also undermine learning in high school...

Read More »“Geldschöpfung `aus dem Nichts’ (Money from Thin Air),” NZZ, 2017

NZZ, November 16, 2017. PDF. Ökonomenstimme, November 20, 2017. HTML. On money creation. Some misconceptions. Why money is less special than commonly thought.

Read More »Romanticism in Germany

In The Guardian, Philip Oltermann speculates about a new romanticist era in Germany, exemplified by Simon Strauss’ “Sieben Nächte.” Caspar David Friedrich: Winter Landscape, 1811.

Read More »DSGE Models: A Critique of a Harsh Defense

On Noahpinion.

Read More »Regulation, Economics, and Ideology

In an interview with The Independent, Jean Tirole discusses monopolies, regulation, the role of the state, the “Nobel syndrome,” and much more.

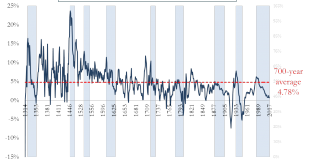

Read More »Real Interest Rates in the Long Run

On Bank Underground, Paul Schmelzing looks at real interest rates over the last 700 years and finds that … the past 30-odd years more than hold their own in the ranks of historically significant rate depressions. But the trend fall seen over this period is a but a part of a much longer ”millennial trend”. It is thus unlikely that current dynamics can be fully rationalized in a “secular stagnation framework”.

Read More »Tax Evasion and Tax Rates

High rates of tax evasion are not necessarily a consequence of high tax rates. In an NBER working paper, Annette Alstadsæter, Niels Johannesen, and Gabriel Zucman provide estimates of countries’ wealth holdings in “tax havens.” Based on BIS statistics the authors find that: Wealth on the order of 10% of global GDP is held offshore. In Scandinavia, the number is much smaller. In continental Europe, it equals roughly 15%. In some Gulf and Latin American countries, almost 60%. In Russia, the...

Read More »Neoliberalism—Narrow and Broad

In the Boston Review, Dani Rodrik discusses neoliberalism and argues that mainstream economics shades too easily into ideology, constraining the choices that we appear to have and providing cookie-cutter solutions. Rodrik emphasizes that sound economics implies context specific policy recommendations. And therein lies the central conceit, and the fatal flaw, of neoliberalism: the belief that first-order economic principles map onto a unique set of policies, approximated by a...

Read More »Conference on “Aggregate and Distributive Effects of Unconventional Monetary Policies” at the Study Center Gerzensee

Jointly with the Council on Economic Policies and the Swiss National Bank, the Study Center Gerzensee organized a conference on Aggregate and Distributive Effects of Unconventional Monetary Policies. The program can be viewed here.

Read More »Climate Science Special Report (and Tax Policy)

From About this Report: [T]he U.S. Global Change Research Program (USGCRP) oversaw the production of this stand-alone report of the state of science relating to climate change and its physical impacts. … The USGCRP is made up of 13 Federal departments and agencies that carry out research and support the Nation’s response to global change. The USGCRP is overseen by the Subcommittee on Global Change Research (SGCR) of the National Science and Technology Council’s Committee on Environment,...

Read More » Dirk Niepelt

Dirk Niepelt