Conference jointly organized by CEPR’s RPN FinTech & Digital Currencies and the European Central Bank. Welcome speech by Piero Cippolone, keynote by Fabio Panetta. Organizers: Toni Ahnert, Katrin Assenmacher, Massimo Ferrari Minesso, Peter Hoffmann, Arnaud Mehl, Dirk Niepelt. CEPR’s conference website. ECB’s website with videos. Website with pictures.

Read More »Panel on the Economics of CBDC, Riksbank, 2023

Panel at the Bank of Canada/Riksbank Conference on the Economics of CBDC, November 16, 2023. Video. Fed Governor Christopher Waller, UCSB professor Rod Garratt and myself assess the case for central bank digital currency and stable coins and respond to excellent questions from the audience.

Read More »“Das Große Gehege”

Caspar David Friedrich: Das große Gehege, 1832.Wikipedia.

Read More »“A Macroeconomic Perspective on Retail CBDC and the Digital Euro,” EIZ, 2023

In Christos V. Gortsos and Rolf Sethe, editors: Central Bank Digital Currencies, EIZ Publishing, ch. 3, Zurich, October 2023. PDF.

Read More »Mapping the History of Palestine and Israel

The long view: The current war:

Read More »“Retail CBDC and the Social Costs of Liquidity Provision,” VoxEU, 2023

VoxEU, September 27, 2023. HTML. From the conclusions: … it is critical to account for indirect in addition to direct social costs and benefits when ranking monetary architectures. … the costs and benefits we consider point to an important role of central bank digital currency in an optimal monetary architecture unless pass-through funding is necessary to stabilise capital investment and very costly. … the interest rate on CBDC should differ from zero and from the rate on reserves. From...

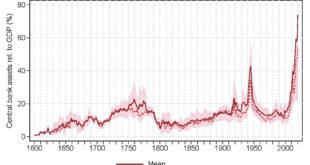

Read More »Central Bank Balance Sheets, LOLR Safety Nets, and Moral Hazard

Niall Ferguson, Martin Kornejew, Paul Schmelzing and Moritz Schularick in CEPR dp 17858: From the introduction: … time and again, central banks deployed their power to create liquidity in a bid to insulate economies from disasters. … first began to be linked to geopolitical tail events during the 17th and 18th centuries – occurring with increasing regularity during wars and revolutions –, … the context of central bank liquidity support gradually but consistently shifted...

Read More »On the Credibility of the ‘Credibility Revolution’

Kevin Lang argues in NBER wp 31666: When economists analyze a well-conducted RCT or natural experiment and find a statistically significant effect, they conclude the null of no effect is unlikely to be true. But how frequently is this conclusion warranted? The answer depends on the proportion of tested nulls that are true and the power of the tests. I model the distribution of t-statistics in leading economics journals. Using my preferred model, 65% of narrowly rejected null hypotheses...

Read More »Conference on “The Future of Payments and Digital Assets,” Bocconi/CEPR, 2023

Conference jointly organized by Bocconi’s Algorand FinTech Lab and CEPR’s RPN FinTech & Digital Currencies. Keynotes by Hyun Song Shin and Xavier Vives. Organized by Claudio Tebaldi and Dirk Niepelt. CEPR’s conference website with program. Bocconi’s website with videos and more.

Read More »“Macroeconomics II,” Bern, Fall 2023

MA course at the University of Bern. Time: Monday 10:15-12:00. Location: A-126 UniS. Uni Bern’s official course page. Course assistant: Stefano Corbellini. The course introduces Master students to modern macroeconomic theory. Building on the analysis of the consumption-saving tradeoff and on concepts from general equilibrium theory, the course covers workhorse general equilibrium models of modern macroeconomics, including the representative agent framework, the overlapping generations...

Read More » Dirk Niepelt

Dirk Niepelt