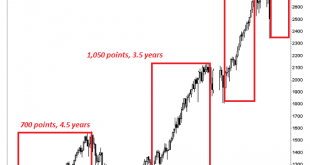

The Fed must now accept responsibility for what happens in the end-game of the Moral-Hazard Monster Bubble it created. Contrary to popular opinion, the Federal Reserve didn’t set out to create a Monster Bubble that has escaped its control. Also contrary to popular opinion, the Fed will be unable to “never let stocks fall ever again–ever!” for the simple reason that the monster it has created– a monster mania of moral hazard in which all risk has vanished...

Read More »Switzerland most expensive country in 2020

© Marekusz | Dreamstime.com It will come as little surprise to many that Switzerland has been ranked the world’s most expensive country. Put together by the magazine CEO World, the ranking pulls cost of living data on accommodation, clothing, taxi fares, utilities, internet, groceries, transport, and dining out, from a number of other studies. Norway ranks second, followed by Iceland, Japan, Denmark, Bahamas, Luxembourg, Israel, Singapore, and South Korea. The United...

Read More »Swiss worry about online data protection, want increased regulation

Despite worries about personal data online, the majority see new technologies in general as an opportunity, particularly in education and the development of smart cities. (© Keystone / Ennio Leanza) A survey on digitalisation released this week shows people’s greatest concern revolves around the fate of their personal data, though just as many believe new technologies hold great promise, especially in the areas of medicine, education and smart cities. Nearly...

Read More »“ECB Is Worst-Run Central Bank In The World” – Felix Zulauf Sees 30percent Plunge In US Stocks “Taking The World With It”

By Lauren Rublin, via Barrons.com Felix Zulauf was a member of the Barron’s Roundtable for about 30 years, until relinquishing his seat at our annual investment gathering in 2017. While his predictions were more right than wrong, it was the breadth of his knowledge and the depth of his analysis of global markets that won him devoted fans among his Roundtable peers, the crew at Barron’s, and beyond. Simply put, Felix, president of Zulauf Asset Management in Baar,...

Read More »Rothbard: The Constitution Was a Coup d’État

[Conceived in Liberty: The New Republic, 1784–1791. By Murray N. Rothbard. Edited by Patrick Newman. Mises Institute, 2019. 332 pages.] We owe Patrick Newman a great debt for his enterprise and editorial skill in bringing to publication the fifth volume, hitherto thought lost, of Murray Rothbard’s Conceived in Liberty. The details of his rescue of the lost manuscript are indeed dramatic, but rather than recount them here, I should like to concentrate on a theme...

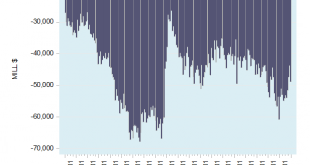

Read More »Government “Fixes” for the Trade Balance Are Far Worse Than Any Trade Deficit

In December 2019, the US trade account balance stood at a deficit of $48.9 billion, against a deficit of $43.7 billion in November and $60.8 billion in December 2018. Most commentators consider the trade account balance the single most important piece of information about the health of the economy. According to the widely accepted view, a surplus on the trade account is considered a positive development while a deficit is perceived negatively. What is the reason for...

Read More »Devisen: Euro stabilisiert sich nach neuem Tief seit fast drei Jahren

Derweil hält die Schwäche des Euro zum Franken weiter an. Aktuell notiert der Euro zwar mit 1,0634 wieder etwas höher als am frühen Morgen, als die Einheitswährung bei 1,0609 das Tagestief erreicht hatte. Unterhalb von 1,06 Franken hat die Gemeinschaftswährung letztmals im Sommer 2015 notiert. Der Dollar kostet aktuell etwas mehr mit 0,9807 Franken. Laut Händlern soll die Schweizerische Nationalbank (SNB) um das Tagestief herum interveniert haben, um zu verhindern,...

Read More »Clariant to cut up to 600 jobs as profit falls

The Basel-based group currently employs around 17,200 people around the world. (© Keystone / Georgios Kefalas) The Swiss specialty chemicals firm Clariant says it will cut up to 600 jobs to save money after a drop in profit in 2019. The firm expects the slow economic situation this year to continue to affect demand. “For 2020, given the current sluggish economic environment and continued adverse foreign exchange conditions, growth will be more limited and additional...

Read More »A Pharmaceutical Stock That Is Often Particularly Strong At This Time Of The Year

An Example of Strong Single Stock Seasonality Many individual stocks exhibits phases of seasonal strength. Being invested in these phases is therefore an especially promising strategy. Today I want to introduce you to a stock that tends to advance particularly strongly at this time of the year: Novo Nordisk. The Danish pharmaceutical group supplies a broad range of products and is a global market leader in diabetes drugs. Danish drug company Novo Nordisk Novo...

Read More »EUR/CHF: SNB does not find love in prices – Rabobank

The Swiss National Bank (SNB) has the mandate to maintain CPI inflation near 2% on a yearly basis but is currently running at just 0.2%. CHF’s strength is not welcomed by SNB, economists at Rabobank reports. Key quotes “The strong performance of the CHF can be associated with Switzerland’s robust fundamentals which ensure that the currency is considered by many investors to be store of value. While there have been a wide number of exogenous factors which have sparked...

Read More » SNB & CHF

SNB & CHF