Macroeconomy A surge in new covid-19 cases in a number of countries has interrupted progress towards normality, yet the effects of the virus are becoming more manageable and positive world H2 growth is achievable. Prospects for the US economy hinge on the ability of Washington to agree a new fiscal support package. While we have raised out 2020 GDP projection for the US we remain prudent. We expect the Fed to provide more stimulus via increased asset purchases,...

Read More »Versicherungsmarkt Schweiz: deutlich höhere Ergebnisse

Die aggregierten Daten über den Schweizer Versicherungsmarkt zeigen eine deutliche Steigerung der Ergebnisse 2019. Diese fallen pro Teilbranchen zwar unterschiedlich aus, sind aber hauptsächlich auf die Ergebnisse am Kapitalmarkt zurückzuführen. Dies und weitere Statistiken zum Versicherungsmarkt zeigt der heute veröffentlichte Versicherungsmarktbericht der Eidgenössischen Finanzmarktaufsicht FINMA. Die schweizerischen Versicherungsunternehmen erzielten im...

Read More »Pandemic speeds up push to digital as bank branches close

Bricks and mortar is being replaced by digital code in the banking sector. © Keystone / Christian Beutler Swiss lender Credit Suisse is set to launch an overhaul of its digital banking offering, as it uses the coronavirus crisis as a springboard to accelerate the push from bricks-and-mortar branches to online services. Last month the bank confirmed plans to close a quarter of its 146 domestic branches by the end of the year. This would lead to SFr100m ($108m) of...

Read More »Sterling Pounded by Brexit Developments

The dollar rebound continues; odds of a near-term stimulus bill in the US are falling; ahead of inflation readings later this week, the US holds a 10-year auction today Bank of Canada is expected to keep policy steady; Mexico reports August CPI; Brazil reports August IPCA inflation The Brexit fallout widens; UK will have trouble striking new trade deals if it can’t be counted on to honor its past agreements; no surprise then that sterling remains under pressure...

Read More »Where Did the US Government Get the Power to Assassinate People?

In an August editorial, the New York Times called for an investigation into the attack on Russian dissident Aleksei Navalny, who was recently transported to Germany in a coma after apparently being poisoned. No one knows who did the poisoning, but the Times has strong suspicions: A hit on so prominent a figure, with the inevitable eruption of global and domestic fury, would presumably require sanction from the highest echelons of power….Mr. Putin has certainly shown...

Read More »FX Daily, September 10: ECB and Beyond

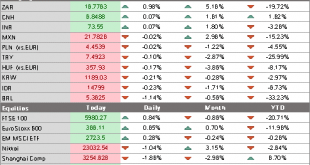

Swiss Franc The Euro has risen by 0.07% to 1.0774 EUR/CHF and USD/CHF, September 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A strong recovery in US stocks, a softer dollar, and higher gold and oil prices may signal the end of the brief though dramatic correction, but the market is in a bit of a holding pattern ahead of the ECB meeting. Most of the major equity markets in the Asia Pacific region...

Read More »Battle of the Scapegoats, Keith Weiner on GDP, Inflation

David Gornoski hosts A Neighbor's Choice LIVE 4-6pm EST. Comment below or call in at 727 587 1040.

Read More »Battle of the Scapegoats, Keith Weiner on GDP, Inflation

David Gornoski hosts A Neighbor's Choice LIVE 4-6pm EST. Comment below or call in at 727 587 1040.

Read More »Weekly View – Election nerves increase

The sell-off in stocks last week showed a certain nervousness about the sharp run-up in tech stocks and the role of big option bets. Indeed, prices in some instances had risen too fast. But this was a technical correction. With the US tech titans generating free cash flow, we do not believe we are facing a repeat of the bursting of the dot-com bubble in 2000. And yet, it could be that Tesla’s ambition to raise USD5bn through occasional share sales will be seen as...

Read More »Valcambi refinery denies sourcing ‘dirty’ gold from Dubai

Valcambi says it is cooperating with NGOs in Peru (picture shows an area in the Madre de Dios province) to improve the working conditions of artisanal miners. Copyright 2018 The Associated Press. All Rights Reserved. The Swiss-based Valcambi refinery has rejected accusations about gold dealings with a controversial company in the United Arab Emirates. Chief executive Michael Mesaric said the claims by the non-governmental Swissaid organisation were unfounded. In a...

Read More » SNB & CHF

SNB & CHF