The Swiss Bankers Association said it regretted Raiffeisen’s decision Keystone Raiffeisen, Switzerland’s third-largest banking group, says it will leave the Swiss Bankers Association (SBA) at the end of March 2021. It intends to represent its interests independently. “The banking sector and the interests of the various players in the Swiss financial centre have changed considerably in recent years,” Raiffeisen said in a statement on Tuesday. “As part of its group...

Read More »Dollar Consolidates, Weakness to Resume

Despite rising infections worldwide, the virus news stream has turned positive; the dollar is consolidating its gains today With the 10-year yield rising to near 1.0%, US financial conditions are tightening; the Fed released its Financial Stability report yesterday and it pulled no punches; with the Fed media embargo over, many officials will speak today UK House of Lords altered the Internal Market Bill; UK employment numbers were slightly better than expected;...

Read More »Vaccine and Split Government

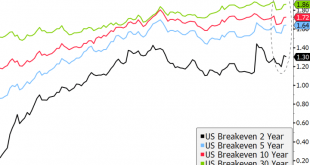

The interplay of a vaccine-driven reflation rally and the (likely) split government in the US are emerging as the driving themes for markets in the months ahead. We think reflation will win out in the end, but it could manifest itself differently this time around. While the policy-driven (fiscal and monetary) reflation theme from earlier in the year helped backstop the worst of the economic fallout, its reflationary impact was skewed towards asset price inflation....

Read More »Gold Is Money – Everything Else Is Credit – J.P. Morgan – Part II

Money – sound and unsound - Click to enlarge Interview with Rafi Farber: Part II of II Rafi Farber, pen name Austrolib, is the publisher of The End Game Investor, a daily market commentary written from an Austrian economics perspective focusing on precious metals, the Comex, and monetary analysis. His work is followed by leaders in the precious metals industry including Eric Sprott. He also writes a weekly column on the gaming industry at CalvinAyre. Contact him...

Read More »Diversification is important – Free lunch in Investing

(Disclosure: Some of the links below may be affiliate links) Diversification is often called the only free lunch in investing. It is a great way to reduce the volatility of a portfolio and sometimes increase its returns. You want to avoid having all your eggs in one basket. So, instead, you are going to use many baskets. The idea of diversification is mostly to invest in many companies and many countries. But there are other forms of diversification that we are...

Read More »A defender of Eritreans’ human rights

Immigration affects everyone in Switzerland, but some people more directly than others. Veronica Almedom, who arrived from Eritrea as a baby with her family, is now an activist for the human rights of Eritreans. Almedom grew up in Martigny in French-speaking Switzerland and is now a student at the University of Geneva. Since 2016 she has been a member of the Federal Commission on Migration. Since 2017 Switzerland has steadily tightened its admission criteria for Eritrean asylum-seekers,...

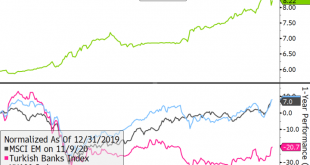

Read More »FX Daily, November 10: Markets Remain Unsettled

Swiss Franc The Euro has risen by 0.18% to 1.0806 EUR/CHF and USD/CHF, November 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Performance Overview: Pfizer’s vaccine announcement eclipsed the US election as the key market driver. It spurred the unwinding of Covid trades in terms of sectors and yields. Emerging market currencies and the majors that benefit from world growth outperformed the perceived safe-havens, like the...

Read More »House View, November 2020

Macroeconomy The upsurge in covid-19 cases will likely hurt global economic prospects in the current quarter. With a Democrat ‘blue wave’ failing materialise in the US elections, hopes of a substantial spending bill have faded and there is risk that US household incomes suffer as existing support measures fade. In the meantime, covid-19 infections continue surge in the US. The Chinese recovery continues, supported by strong exports and solid improvement in fixed...

Read More »Swiss investors still leaning heavily on fossil fuels

Despite concerns about global warning, coal is still being mined and burned all over the world. Keystone / Sascha Steinbach The Swiss financial market invests too much in oil and coal production, according to a review of nearly 200 financial institutions. Some 80% of the banks and asset management firms surveyed by the report have coal mining companies in their investment portfolios. “On average, the Swiss financial centre thus supports additional expansion of...

Read More »Outlook for Precious Metals Amid the Coronavirus Pandemic: Keith Weiner

One asset that has performed well during the pandemic has been precious metals. Keith Weiner, the CEO of Monetary Metals, will discuss the outlook for gold, silver, platinum and palladium under a Biden presidency and during the pandemic. Weiner will also discuss the unique way that Monetary Metals allows investors to earn interest of about 5% on their gold holdings. Bio: Keith Weiner is a leading authority in the areas of gold, money, and credit. After observing investors forced to choose...

Read More » SNB & CHF

SNB & CHF