This devaluation of financial wealth–and its transformation to a dangerous liability– will reach extremes equal to the current extremes of wealth-income inequality. Financial capital–money–is the Ring that rules them all. But could this power fall from grace? Continuing this week’s discussion of the idea that that extremes lead to reversions, let’s consider the bedrock presumption of the global economy, which is that money is the most valuable thing in the Universe...

Read More »Dollar Continues to Soften Ahead of FOMC Decision

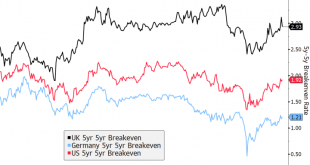

Optimism on a stimulus deal remains high; the FOMC decision will be key; the dollar tends to weaken on recent FOMC decision days November retail sales will be the US data highlight; Markit reports preliminary December PMI readings; Canada reports November CPI The latest Brexit headlines are sounding optimistic; UK November CPI came in weaker than expected; eurozone December preliminary PMI provided an upside surprise; EU regulators lifted their curb on bank...

Read More »Deflation: Friend or Foe?

Deflation is the most feared economic phenomenon of our time. The reason behind this a priori irrational fear (why should we be afraid of prices going down?) is the Great Depression. The most severe economic crisis of the 20th century was accompanied by a massive deflationary spiral that pushed prices down by 25% between 1929 and 1932 (this is equivalent to an annualized inflation rate of minus 7% over that period). Given the impact that the Great Depression...

Read More »What Is the Great Reset? Part I: Reduced Expectations and Bio-techno-feudalism

The Great Reset is on everyone’s mind, whether everyone knows it or not. It is presaged by the measures undertaken by states across the world in response to the covid-19 crisis. (I mean by “crisis” not the so-called pandemic itself, but the responses to a novel virus called SARS-2 and the impact of the responses on social and economic conditions.) In his book, COVID-19: The Great Reset, World Economic Forum (WEF) founder and executive chairman Klaus Schwab writes...

Read More »Countries still far from achieving sustainable development

Reliance on fossil fuels is putting the planet under increasing pressure. Keystone / Larry W. Smith The latest United Nations Human Development Report has found that countries, including Switzerland, still struggle to achieve high levels of human development without straining the planet. My specialty is telling stories, and decoding what happens in Switzerland and the world from accumulated data and statistics. An expatriate in Switzerland for several years, I...

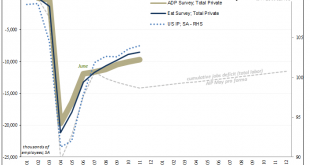

Read More »It Should Shock Us That There’s Any Consumer Price Inflation at All

Thanks to lockdowns, high unemployment, and general uncertainty and fear over covid-19, the personal saving rate in the United States in October was 13.6 percent, the highest since the mid-1970s. This is down from April’s rate of 33.7 percent, which was the highest saving rate recorded since the Second World War. Moreover, among those who received “stimulus” checks under the CARES Act, only 15 percent of those surveyed in a National Bureau of Economic Research (NBER)...

Read More »Consumers, Too; (Un)Confident To Re-engage

There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend). Once the snowball of macro contraction begins rolling downhill, rational prudence dictates some degree of caution on all parts (pro-cyclicality). Bathed in the unearned glow of the Great “Moderation”,...

Read More »Krankenzusatzversicherer: FINMA sieht umfassenden Handlungsbedarf bei Leistungsabrechnungen

Die Eidgenössische Finanzmarktaufsicht FINMA stellt aufgrund ihrer jüngsten Analysen fest, dass Rechnungen im Bereich der Krankenzusatzversicherung häufig intransparent sind und zum Teil unbegründet hoch oder ungerechtfertigt scheinen. Die FINMA erwartet von den Versicherern ein wirksameres Controlling, um solchen Missständen zu begegnen. Zudem fordert die FINMA die Versicherer auf, die Verträge mit den Leistungserbringern zu überprüfen und wo nötig zu verbessern....

Read More »Fed Recommits to Misleading the Public About Inflation

Did the Federal Reserve just usher in the next phase of the U.S. dollar’s decline? On Wednesday, the central bank recommitted to leaving its benchmark interest rate near zero for the foreseeable future. Fed officials also vowed to keep pumping cash into financial markets. Following Fed chairman Jerome Powell’s remarks, the wavering U.S. Dollar Index turned down – hitting a fresh new low for the year. Gold gained modestly on the day while silver got a bigger boost to...

Read More »Inflation Fairy Tale: Why It’s Deflation We Should Worry About (w/ Steven Van Metre & Jeff Snider)

Is inflation on the horizon? Should bank reserve balances stored with the Federal Reserve count as "money"? According to Jeffrey Snider, head of global research at Alhambra Investment Partners, and Steven Van Metre, macro fund manager and founder of Portfolio Shield, the answer to these questions is a resounding "no." Drawing upon a data ranging from Treasury auction sales to Eurodollar futures curves, van Metre and Snider explain why low yields are, in fact, deflationary...

Read More » SNB & CHF

SNB & CHF