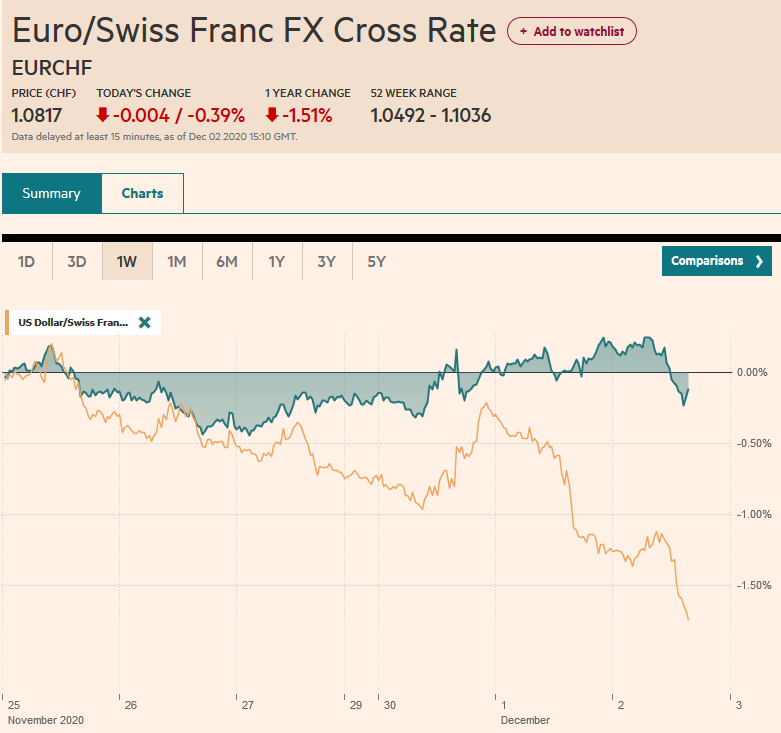

Swiss Franc The Euro has fallen by 0.39% to 1.0817 EUR/CHF and USD/CHF, December 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The selling pressure that drove the dollar lower yesterday has abated, and the greenback is paring yesterday’s loss, though the dollar-bloc currencies are showing some resilience. EC negotiator Barnier briefed ministers that the same three issues that have bedeviled the trade talks with the UK remain unresolved (fisheries, level playing field, and a conflict resolution mechanism). Sterling has retreated a full cent from the high posted near .3440. Emerging market currencies are mixed, leaving the JP Morgan Emerging Market Currency Index slightly softer after posting its

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, Brexit, China, Currency Movement, Europe, Featured, newsletter, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

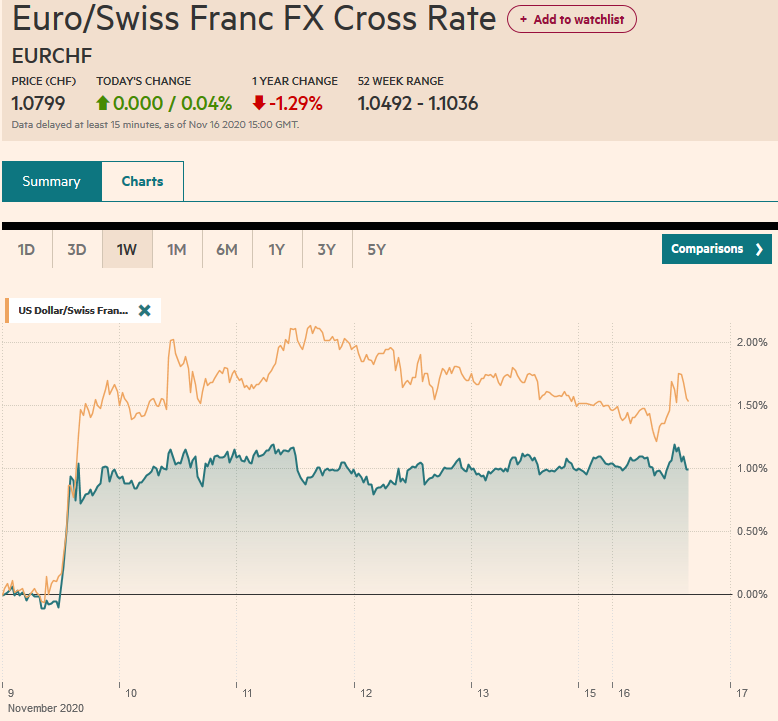

Swiss FrancThe Euro has fallen by 0.39% to 1.0817 |

EUR/CHF and USD/CHF, December 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The selling pressure that drove the dollar lower yesterday has abated, and the greenback is paring yesterday’s loss, though the dollar-bloc currencies are showing some resilience. EC negotiator Barnier briefed ministers that the same three issues that have bedeviled the trade talks with the UK remain unresolved (fisheries, level playing field, and a conflict resolution mechanism). Sterling has retreated a full cent from the high posted near $1.3440. Emerging market currencies are mixed, leaving the JP Morgan Emerging Market Currency Index slightly softer after posting its biggest gain in a month yesterday (~0.7%). US stocks raced to records yesterday, but the spill-over effect was limited. Asia Pacific bourses were mixed, though Korea’s Kospi led the advanced (~1.5%), while Japan’s Nikkei edged to a new high. Europe’s Dow Jones Stoxx 600 is a little softer, as are US shares. The bond market is quieter after yesterday’s US yield surge ostensibly on the back of renewed hopes of a fiscal package ahead of year-end. The Asia Pacific yields played catch-up, while European yields are little changed, with peripheral yields a bit lower. The US 10-year benchmark is around 0.92%. Gold is continuing to recover and, after being pushed below $1800 at the start of the week, is near $1825. The first notable retracement objective is near $1840. Oil has steadying after the January WTI slipped to briefly below $44 a barrel amid ideas that the Saudis and UAE will reach an agreement. |

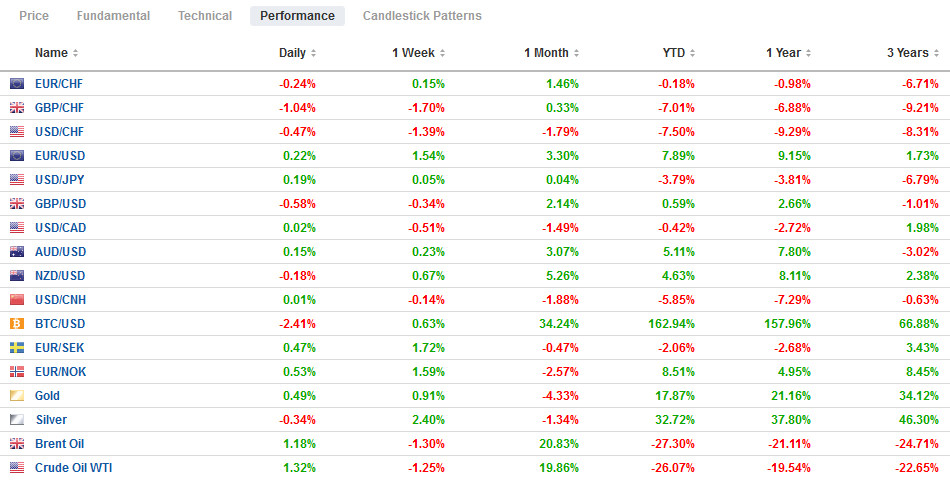

FX Performance, December 2 |

Asia Pacific

Despite talk in some quarters that President-elect Biden would unilaterally drop the controversial tariffs that the Trump administration levied on China, this was never a particularly likely scenario. It is not politically realistic, and Biden confirmed this. According to press reports, the new administration will fully review the existing agreement. It seems quite clear that the US confrontation with China is bipartisan in nature, even if the tactics may vary. The Biden team is more interested in working with allies.

The first thing it could do is speak about China’s economic boycott of a key ally in the region, Australia. China’s economic harassment has widened this week, with new tariffs on Australian wine, ostensibly on dumping grounds. Besides wine, the areas of action include coal, seafood, timber, barley, and cotton, or about $20 bln of Australian exports. China has provided a list of 14 grievances that are political in nature.

Before China escalated its trade protests, Australia’s economy recovered stronger than expected in Q3. The economy grew 3.3% in the July-September period compared with Bloomberg’s median survey forecast of 2.5% and the 7.0% contraction in Q2. Public spending and household consumption rebounded, and inventories were rebuilt. Net exports and business investment were drags. Australia reports October trade figures the first thing tomorrow (as well as the Markit November services and composite PMI).

The dollar has approached a seven-day high against the yen near JPY104.75 in the European morning. A push through here targets the JPY105.00-JPY105.20 area. Tomorrow, there is a $1.2 bln option expiring at JPY104.50. The Australian dollar briefly rose above $0.7400 on Monday for the first time since the peak on September 1, near $0.7415. It tried unsuccessfully to resurface today’s level, which holds an expiring option for almost A$880 mln. Support is now seen around $0.7340. The PBOC set the dollar’s reference rate at CNY6.5611, which was a bit stronger than the market projected in the Bloomberg survey (~CNY6.5572). With the seven-day repo rate at its four-month lows yesterday, the PBOC withdrew CNY110 bln after draining CNY50 bln yesterday. This saw money market rates firm.

EuropeThe UK became the first country to approve the new Pfizer-BioNTech vaccine, which will be available next week. It could not come at a better time for the beleaguered Prime Minister. His new tiering system of restrictions was approved yesterday as Labour abstained, and 55 Tories joined the opposition in voting against Johnson’s plan. He sweetened yesterday with a one-ff payment of GBP1000 to pubs hit by the new restrictions. |

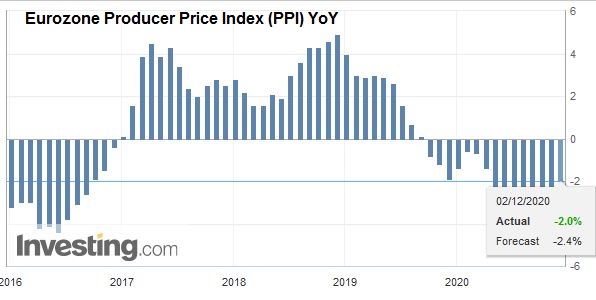

Eurozone Producer Price Index (PPI) YoY, October 2020(see more posts on Eurozone Producer Price Index, ) |

The UK-EU negotiations are pressing on, but EC negotiator Barnier did not seem optimistic as he briefed the EC ministers. The three outstanding issues remain vexing. This weighed on sterling after a rash of hopeful comments from the Irish Prime Minister, the French European Affairs Minister, and the UK’s Rabb. Of course, they are hopeful because the clock is ticking down, and next week’s leaders’ summit has to deal with Poland and Hungary’s blocking of the new EU budget and the much-heralded Recovery Fund. Separately, note that the ESM reform is challenging the Italian government, where the Five-Star Movement and the right parties are opposed. They fear that the reforms will boost the risk of public debt restructuring.

There is much talk about how the EU and the US could have a rapprochement with Washington’s new administration. While it is possible, the partisanship that emphasizes the differences between Trump and Biden may overlook a similar view of national interest. Europe seems to recognize this too. It has gone forward with tariffs on US goods for Boeing’s illegal subsidies, even though the US has stopped the objectionable actions. Yesterday reports suggest that a ship has been found that can finish the controversial Nord Stream II pipeline without fear of US sanctions. A Swiss shipping group had been laying the underwater pipes but withdraw from the project under US threats.

The euro’s gains were extended to almost $1.2090 in Asia but has been sold in Europe and is nearly half a cent off its high. There are no expiring options to note today, but there are at $1.20 over the next two days (1.0 bln euros tomorrow and 2.1 bln euros on Friday). Initial support today may be near $1.2020. Sterling did not extend yesterday’s gains that took it to $1.3440, shy of the high for the year set on September 1, near $1.3480. It has fallen a cent from the session high. A break of yesterday’s low near $1.3315 would lend credence to ideas that a high may be in place. The $1.3300 level may be protected by an option for about GBP600 mln that expires today. Meanwhile, the euro has risen to almost GBP0.9045 today, its highest in about 3.5 weeks. However, by mid-morning in Europe, the momentum has stalled, and the cross is consolidating. Support is likely near GBP0.9000.

America

The US calendar features the ADP private-sector jobs estimate and the Beige Book in preparation for the last FOMC meeting of the year. The Bloomberg survey sees a 430k increase in the jobs in the ADP report, which is better than October’s 365k, which could be revised higher. Recall October’s non-farm payroll report estimated 906k private-sector jobs were filled. Bloomberg’s survey’s median forecast is for a 560k increase in private-sector jobs in November and 486k overall (government sector sheds employment). Separately, the nomination of Waller to the Federal Reserve is expected to be confirmed today. Powell speaks before the House Finance Panel today.

Talk yesterday of a bipartisan group of Senators proposing a $908 bln stimulus package helped send bond yields higher, but it does not have leadership support. It does not appear to be sufficient to break the logjam. Still, there is a pressing date, December 11, when the US government’s spending authorization lapse. Trump is threatening to veto a defense appropriations bill if it does not protect tech companies from liability for user content.

Canada and Mexico have light economic calendars today. The US dollar slipped to a marginal new low for the year today against the Canadian dollar near CAD1.2915. It has bounced back a bit, but watch the CAD1.2950-level, which holds a $1 bln option that expires today. The greenback has not traded below CAD1.29 since October 2018, when it recorded a low near CAD1.2785. The greenback’s downside momentum against the Mexican peso has eased. It briefly traded below MXN19,99 yesterday and remained well above the MXN19.9385 low from last week. The US dollar is recording session highs in late morning trade in Europe near MXN20.1050. It takes a move above Monday’s high (~MXN20.2165) to signal something more than consolidation.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,Brexit,China,Currency Movement,Europe,Featured,newsletter,U.K.