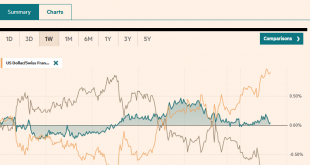

Swiss Franc The Euro has fallen by 0.04% to 1.0816 EUR/CHF and USD/CHF, January 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Julius Ceasar is said to have “crossed the Rubicon” on January 10, 49 BCE, taking the 13th Legion into Rome, defying orders from the Senate, and precipitating the Roman Civil Wat that marked the end of the republic and the birth of the empire. Last week’s events paled in comparison...

Read More »Covid: closing Swiss schools one of most effective measures, says study

The number of Covid cases went down significantly in Switzerland during spring as a result of schools closing, according to a study by ETH Zurich, reported RTS. School closed ©Andrey Zhuravlev -Dreamstime.com - Click to enlarge Researchers at the university analysed anonymised mobile phone data of 1.5 billion movements of the Swiss population between 10 February and 26 April 2020. They used this data to calculate how much certain measures reduced mobility and...

Read More »2021: If It Wasn’t For Bad Luck, We Wouldn’t Have No Luck At All

If we have indeed begun a sustained “reversal of fortune”, it might be prudent to consider the possibility we’re only in the first inning of a sustained run of back luck.In our self-deluded hubris, we reckon we’ve moved beyond the influence of fortune, a.k.a. Lady Luck: our technologies are so powerful and our monetary policies so godlike that nothing as random as luck could ever crush our limitless expansion. Thus does hubris beg for a comeuppance: the greater the...

Read More »Switzerland hit by widespread malware campaign

The aim of such attacks is usually to force organisations to cease operations or to extort ransom money Keystone / Sascha Steinbach Several security bodies in Switzerland have been targeted by emails that appear to come from official organisations such as banks or the police and contain a password for a zip file. When this file is opened, the computer becomes infected with a trojan called Emotet. The Bern cantonal police force is one institution that has been...

Read More »There Ain’t No Success like Failure

Like me you are probably looking over photos of supposed Trump supporters breaching the ramparts and storming the Capitol yesterday. That is if you can find them. To “protect” us from viewing these incredibly “disturbing” scenes, Twitter has helpfully announced that it will severely restrict their distribution across its network. We can all rest easier, I suppose. Though even memory-addled Americans may recall the free-for-all in posting BLM and Antifa violence on...

Read More »The Capitol Riot Wasn’t a Coup. It Wasn’t Even Close.

On Wednesday, a mob apparently composed of Trump supporters forced its way past US Capitol security guards and briefly moved unrestrained through much of the capitol building. They displayed virtually no organization and no clear goals. The only deaths were on the side of the mob, with one woman—apparently unarmed—shot dead by panicky and trigger-happy capitol police, with three others suffering non-specific “medical emergencies.” Yet, the media response has been to...

Read More »They’ve Gone Too Far (or have they?)

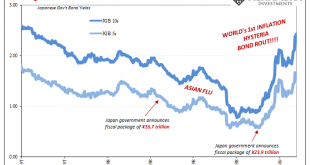

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months. The JGB 10-year yield had dropped to a low of just 77.2 bps during the depths of 1998’s Asian Financial Crisis (or “flu”, so noted for its regional contagious dollar...

Read More »41.2 Copper Prices Signal Inflation (they’re wrong!)

Is the nine-month copper price blastoff due to monetary reasons (central bank printing, government budget deficits) or fundamental reasons (supply and demand)? Jeff Snider explains the fundamental backdrop (along with speculative fever) but dismisses monetary motives. ----------SPONSOR---------- But first, this from Eurodollar Enterprises! Friends, are you confused by the financial press? Are the pretty people on Bloomberg speaking in paradox? Are the esteemed pages of The Economist...

Read More »Company bankruptcies fell sharply in Switzerland in 2020

© Sylvain Robin | Dreamstime.com Despite the economic impacts of the coronavirus, significantly fewer Swiss companies went bankrupt in 2020 than the year before, according to the business data company Bisnode. During 2020, 3,811 Swiss companies filed for bankruptcy, 19% fewer than in 2019. Sectors that experienced the greatest fall in bankruptcies include artisans (-174 bankruptcies), hotels and restaurants (-124), retailers (-68) and wholesalers (-66). The slowdown...

Read More »There’s Always A First Time

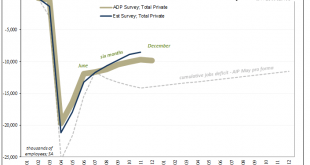

Is it a race against time? Or is it trying to set aside today so as to focus entirely on a specific kind of tomorrow? It’s easy to do the latter especially when today is what it is; you can’t change what’s already gone on. You can, however, think that today won’t impede or even impact a much better tomorrow yet to be determined, especially when the heavy hand of government is anticipated to intervene after sunset. On the one side, more fiscal “stimulus” is purported...

Read More » SNB & CHF

SNB & CHF