The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the...

Read More »Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the...

Read More »Ministry of Manipulation: No Wonder Trust and Credibility Have Been Lost

Now that every financial game in America has been rigged to benefit the few at the expense of the many, trust and credibility has evaporated like an ice cube on a summer day in Death Valley. Here is America in a nutshell: we no longer solve problems, we manipulate the narrative and then declare the problem has been solved. Actually solving problems is difficult and generally requires sacrifices that are proportionate to one’s wealth and power. But since America’s...

Read More »Ministry of Manipulation: No Wonder Trust and Credibility Have Been Lost

Now that every financial game in America has been rigged to benefit the few at the expense of the many, trust and credibility has evaporated like an ice cube on a summer day in Death Valley. Here is America in a nutshell: we no longer solve problems, we manipulate the narrative and then declare the problem has been solved. Actually solving problems is difficult and generally requires sacrifices that are proportionate to one’s wealth and power. But since America’s...

Read More »Can Economic Data Explain the Timing and Causes of Recessions?

Most economists are of the view that through the inspection of economic data it is possible to identify early warning signs regarding boom bust cycles. What is the rationale behind this way of thinking? During the 1930s the National Bureau of Economic Research (NBER) introduced the economic indicators approach to ascertain business cycles. A research team led by W.C. Mitchell and Arthur F. Burns studied about 487 economic data points in order to establish what...

Read More »Can Economic Data Explain the Timing and Causes of Recessions?

Most economists are of the view that through the inspection of economic data it is possible to identify early warning signs regarding boom bust cycles. What is the rationale behind this way of thinking? During the 1930s the National Bureau of Economic Research (NBER) introduced the economic indicators approach to ascertain business cycles. A research team led by W.C. Mitchell and Arthur F. Burns studied about 487 economic data points in order to establish what...

Read More »Govt "Forgets" Evidence In Avenatti Case, Jake Sullivan Lies, Charles Hugh Smith, & Liberal Hivemind

Two awful people and two good ones. Avenatti and Sullivan are examples of what's wrong with our society and government. Charles Hugh Smith (OfTwoMinds blog fame) and Liberal Hivemind (YouTube) are examples of what we do right.

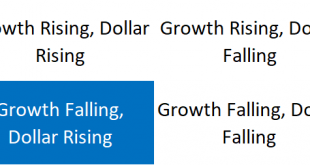

Read More »The Dollar is Aided by Speculation of a Hawkish Fed, Will It Sell-off on the Fact or Disappointment?

The US dollar continued to trend higher last week, helped by the unexpectedly strong retail sales report. Despite disappointing August jobs growth and the moderation in consumer prices, the Fed has no compelling reason not to move forward with plans to taper before the end of the year. The Norwegian krone had been bid most of last week, ahead of the central bank's likely rate hike next week, but it lost nearly 1% before the weekend. It was the second consecutive...

Read More »The Dollar is Aided by Speculation of a Hawkish Fed, Will It Sell-off on the Fact or Disappointment?

The US dollar continued to trend higher last week, helped by the unexpectedly strong retail sales report. Despite disappointing August jobs growth and the moderation in consumer prices, the Fed has no compelling reason not to move forward with plans to taper before the end of the year. The Norwegian krone had been bid most of last week, ahead of the central bank's likely rate hike next week, but it lost nearly 1% before the weekend. It was the second consecutive...

Read More »What They Really Mean When They Say “Do the Right Thing”

[unable to retrieve full-text content]As a senior in high school, I ran for class president with “Do the right thing” as my campaign slogan. Though I realized years ago how utterly pretentious that message is, I’m often reminded that it’s good politics, which proves the point that politics is poison.

Read More » SNB & CHF

SNB & CHF