In Switzerland, all able-bodied men complete compulsory military service, while others opt for a civilian service. But how useful is a conscript army in light of what Russia did to Ukraine? This is one of many questions SWI readers sent to us. Daniel Reist, head of media relations for the Swiss armed forces, takes a shot at answering them. Our fourth question is: how can a neutral country have an army? More questions and answers are to follow in the coming weeks. --- swissinfo.ch is the...

Read More »Gold and Inflation Q&A with David Forsyth

This work is licensed under a Creative Commons Attribution 4.0 International License. Therefore please feel free to share and you can subscribe for my articles by clicking here [embedded content] You Might Also Like Gold: A use case for the modern era 2022-05-04 Part II of II The big picture here is clear and it is essential to...

Read More »The online retail fraud made possible by Swiss billing system

In Switzerland it is possible to order goods online without paying up front. Retailers will send orders with a payment slip included with the goods. Fraudsters are exploiting this quirk of Swiss postal retail. Photo by Karolina Grabowska on Pexels.com Fraudsters order goods online pretending to be someone else. The goods are then shipped without the need to provide any payment details. The fraudster then waits for the order to be delivered and takes it from the...

Read More »Why Nations Fail

The irony is that the suppression of dissent is the suppression of competing ideas that generate systemic stability via rapid adaptation. Nations that appear stable may fail once they’re under pressure.What do I mean by “under pressure”? Pressure can come from many sources: invasion, civil war, prolonged scarcities of essentials, natural disasters, financial crises, droughts, pandemics and social disorder triggered by inequality and corruption. Pressure diminishes...

Read More »The Epistemological Case for Capitalism

[This article is excerpted from chapter 21 of Mises: The Last Knight of Liberalism.] In the early 1950s, Mises’s NYU seminar dealt increasingly with epistemological questions. As he said to Ludwig Lachmann, he felt that the analysis of epistemological problems would be the number one task in the social sciences in the coming years.1 It was the topic of his last two monographs: Theory and History (1957) and The Ultimate Foundation of Economic Science (1962). The...

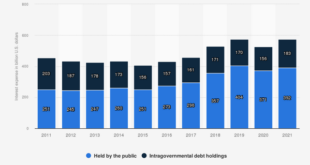

Read More »Rising Interest Rates May Blow Up the Federal Budget

Congress enjoys exorbitant political privilege in the form of cheap deficit spending—but it may soon come to an end. Original Article: “Rising Interest Rates May Blow Up the Federal Budget” In fiscal year 2020, at the height of covid stimulus mania, Congress managed to spend nearly twice what the federal government raised in taxes. Yet in 2021, with Treasury debt piled sky high and spilling over $30 trillion, Congress was able to service this gargantuan...

Read More »When cooperatives wanted to prevent a world war

Blossoming cooperative ideas: a common economy, consumer protection and equality of the sexes. Dora Hauth-Trachsler/Schweizersiches Sozialarchiv The word “cooperative” is everywhere in Swiss daily life. What’s often forgotten is that cooperatives were once at the forefront of a worldwide movement that advocated for consumer rights, affordable rents – and world peace. In his opening speech at the tenth international congress of the International Cooperative Alliance...

Read More »Inflation, Core CPI, and the Federal Reserve: Marc Chandler

Marc Chandler, chief market strategist at Bannock Burn Global FX, discussed the state of inflation in the U.S., the difference between core and headline CPI, and how things are trending with consumer prices. Listen to the full podcast episode here: https://contrarianpod.com/content/podcasts/season4/assessing-precarious-stock-markets-marc-chandler/ Consider becoming a premium subscriber to gain early access to the episodes and to the Daily Contrarian briefing:...

Read More »The Economist Reviews Pandemic Goods Boom 2020-22 [Eurodollar University, Ep. 261]

The Economist recounts how the pandemic led to a goods-consumption-boom and whether post-pandemic economics means normalization, or a services boom or a recession. ----EP. 261 REFERENCES---- Could a shift from goods to services ease inflation?: https://econ.st/3OYNOwQ RealClear Markets Essays: https://bit.ly/38tL5a7 Epoch Times Columns: https://bit.ly/39ESkRf -------THE EPISODES------- YouTube: https://bit.ly/310yisL Vurbl: https://bit.ly/3rq4dPn Apple: https://apple.co/3czMcWN Deezer:...

Read More »Monday Blues

Overview: The US dollar is bid against most currencies today, encouraged not just by good news in the US and poor news out of China, where Covid is flaring up and new social restrictions are fared, while Macau has been lockdown for a week. The energy crisis in Europe is fanning fears of a recession before the ECB lift rates above zero. Japanese markets bucked the global move and advanced, which it often does after the government wins an upper house election. The...

Read More » SNB & CHF

SNB & CHF