Second quarter of 2022 Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment. The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 241 company talks were conducted between 12 April and 30 May. . Key points • Companies saw continued turnover growth in the second quarter. Growth is increasing in the services sector now that the measures to contain the pandemic have ended. In manufacturing, by contrast, the strong pace of growth has slowed somewhat. Overall, companies expect further increases in turnover though

Topics:

Monetary policy considers the following as important: 1.) Monetary Data, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Second quarter of 2022Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment. The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 241 company talks were conducted between 12 April and 30 May. |

Key points

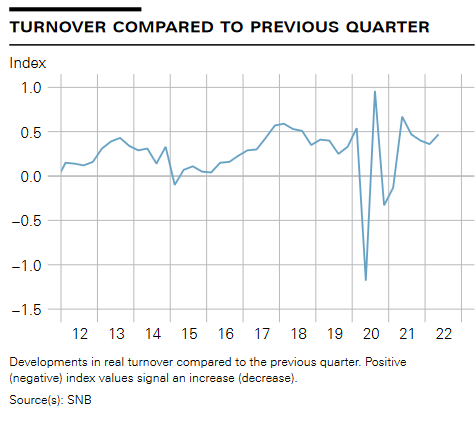

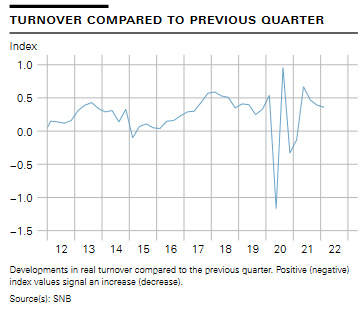

• Companies saw continued turnover growth in the second quarter. Growth is increasing in the services sector now that the measures to contain the pandemic have ended. In manufacturing, by contrast, the strong pace of growth has slowed somewhat. Overall, companies expect further increases in turnover though much higher levels of uncertainty for the coming quarters.

• As in the last quarter, only a few companies are seeing their business directly affected by the war in Ukraine. Company representatives primarily talked about the impact on the energy and raw materials markets.

• The additionally tight supply situation, primarily due to China’s zero-COVID strategy, higher energy prices resulting from the war in Ukraine, and higher inflation internationally, are leading to significant increases in purchase prices. In the majority of cases companies are able to pass rising costs on to their customers.

• Staff shortages worsened in the second quarter. Companies want to employ significantly more staff in the coming quarters. Against this backdrop, many companies see recruitment difficulties as a considerable risk.

• As a result of higher inflation, staff shortages and the generally robust development of the economy, wage growth is stronger but remains moderate overall. Companies expect wages to increase further in the coming year.

Tags: Featured,newsletter