Hear it Here - adbl.co/3OFQ1MB When I burned out, what I wanted but could not find was a practical guide by someone who had experienced burnout themselves. None of the material I found spoke to what I was experiencing or to my sense that our economy is now optimized to burn people out. I decided to write the guide I wanted but could not find. This is my experience of burnout, reckoning and renewal. This book is my account of what helped me. The intended audience is other burnouts and...

Read More »Fed Official: Inverted curve means Fed is awesome [Ep. 268, Eurodollar University]

James Bullard, St. Louis Fed chief, says the yield curve is twisted by the inflation surge, and may not be a recession message. Indeed, markets are twisting it because they have confidence the central bank will get control of consumer prices. ----EP. 268 REFERENCES---- Derby’s Take: Fed’s Bullard Says Yield-Curve Signal Might Not Be So Ominous: https://on.wsj.com/3PNKFAc Since When Does the Fed Funds Rate Have Anything To Do With Anything?: https://bit.ly/3ougulL RealClear...

Read More »Ethereum Classic erlebt intensive Rallye

In den letzten beiden Wochen hat Ethereum Classic an Fahrt aufgenommen. Nachdem es vor ein paar Jahren zu einer Fork gekommen war, die uns den von Buterin unterstützen Ethereum und einen Alternative Cryptocoin mit dem Namen Ethereum Classic brachte, ist der Classic Cryptocoin schrittweise aus den vorderen Positionen des Marktes verschwunden. Doch diese Woche ist der Classic Coin sogar wieder in den Top 20 gelandet. Ethereum News: Ethereum Classic erlebt intensive...

Read More »Regional Territories: A Decentralization Plan for the USA

There is more talk of secession and civil war in the United States today than at any time since the 1850s, and popular confidence in government appears to be at an all-time low. As a foreigner, I have no particular red or blue loyalties, but I have deployed with Americans on many occasions, and in some ways, their history is also mine. There is a chance that history will look at the culture wars of the 2010s as a prelude to the great disintegration of the 2020s, so...

Read More »Austrians vs. Neoclassicists on Monopolies

A monopoly is often seen as one of the gravest and most concerning manifestations of market failure. In the neoclassical tradition, the existence of a monopolist in a market is generally seen as sufficient justification for government intervention to put a halt to the monopolist's exploitative ways. The Austrian tradition, however, has historically remained skeptical of this alleged problem of monopoly. Two of the most prolific Austrian theorists, Murray Rothbard and...

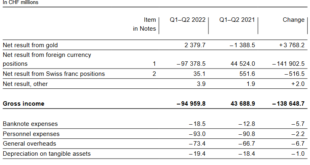

Read More »No money likely from Swiss National Bank after large loss

Like most central banks the Swiss National Bank (SNB) is tasked with monetary stability. However, in the process it can inadvertently generate large profits and losses. SNB – BernWhen monetary policy is expansionist and the resulting assets held by the SNB rise in value it can generate large profits as it has over the last few years. However, when the Swiss franc strengthens and asset values slump the bank can generate large losses as it did in the first half of...

Read More »Investment Versus Speculation: Is There a Difference? | Finance Friday With Jim Brown

In today's episode of Finance Friday, Jim Brown will moderate a discussion between Seth Levine & Keith Weiner. The theme of the discussion will be a contrast between two great historical experts: - Benjamin Graham, the father of value investing (and Warren Buffett's mentor), made a significant distinction between "speculation" and "investment." - Ludwig Von Mises, the central figure of the Austrian School, said speculation is inherent in all investment. Therefore,...

Read More »The Fed Just Ruined Everything Jeff Snider || Economic Crisis

The Fed Will End Everything You Must Do This Now Jeff Snider Jeff Snider is one of the foremost experts on the global monetary system. #jeffsnider#recession#bearmarket#inflation credit https://www.youtube.com/watch?v=mg4ksE3SBrw DISCLAIMER : I am not a financial advisor. The ideas presented in this video are for entertainment purposes only. You (and only you) are responsible for the financial decisions that you make. This information is what was found publicly on the internet. This...

Read More »Interim results of the Swiss National Bank as at 30 June 2022

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More »EMU GDP Surprises, while the Yen’s Short Squeeze Continues

Overview: The month-end and slew of data is making for a volatile foreign exchange session, while the rash of earnings has generally been seen as favorable though weakness was seen among the semiconductor chip fabricators. China, Hong Kong, and Japanese equities fell but the other large markets in the region rose. Europe’s Stoxx 600 is up around 0.8%. It is the eighth advance in the past 10 sessions. US futures are higher and the S&P 500’s advance of nearly 7.6%...

Read More » SNB & CHF

SNB & CHF