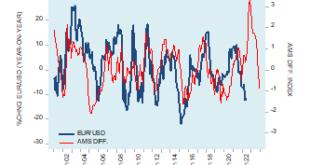

In the July 26 Financial Times article entitled “Is the Dollar about to Take a Turn?,” Barry Eichengreen writes that the US dollar has had a spectacular run, having risen more than 10 percent against other major currencies since the start of the year. According to Eichengreen, the key reason behind the spectacular strengthening in the US Dollar is that the Federal Reserve has been raising interest rates faster than other big central banks, drawing capital flows...

Read More »What You Need To About Oil and Oil Price Jeff Snider

What You Need To About Oil and Oil Price Jeff Snider. #jeffsnider#emil#eurodollar#economy#oilprice credit https://www.youtube.com/watch?v=Tlfiq4WPseU&t=382s DISCLAIMER : I am not a financial advisor. The ideas presented in this video are for entertainment purposes only. You (and only you) are responsible for the financial decisions that you make. This information is what was found publicly on the internet. This information could’ve been doctored or misrepresented by the internet....

Read More »The Economy Improved In July

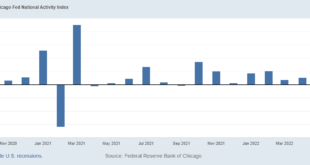

The Chicago Fed National Activity Index rose to 0.27 in July with all four categories of indicators rising. The 3 month average was unchanged at -0.09. That indicates growth is slightly below trend and is far from the recession threshold of -0.7. The index had been down for two consecutive months and both May and June were revised slightly lower. The data in August so far has been positive as well, particularly the production data with IP last week surprising to...

Read More »No Relief for the Euro or Sterling

Overview: The euro traded below parity for the second time this year and sterling extended last week’s 2.5% slide. While the dollar is higher against nearly all the emerging market currencies, it is more mixed against the majors. The European currencies have suffered the most, except the Norwegian krone. The dollar-bloc and yen are also slightly firmer. The week has begun off with a risk-off bias. Nearly all the large Asia Pacific equity markets were sold. Chinese...

Read More »Weekly Market Pulse: Same As It Ever Was

History never repeats itself. Man always does. Voltaire Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine. I have been a professional investor for now over 30 years and I have seen...

Read More »Swiss prepare for energy shortage ‘extreme scenarios’

Electricity pylons and power supply lines in central Switzerland (archive picture) Keystone / Alessandro Della Bella The Swiss government and cantons are aiming to be prepared for “extreme scenarios” in the face of possible energy shortages this winter, a top cantonal security official says. For example, a power grid shutdown or blackout would have far-reaching consequences, Fredy Fässler, the president of the Conference of Cantonal Justice and Police Directors, said...

Read More »Money Is Not Wealth, Nor Is Wealth Natural Resources

The misconception that money and natural resources are wealth is rampant among intellectuals and other educated individuals, and even economists. Prevailing monetary and economic policy choices reflect this entrenched misconception. Consider the fact that since the 2008 Great Recession, leading central banks have injected trillions of dollars, euros, yens, etc., into economies and have monetized record-setting levels of government debt under the assumption that more...

Read More »Modern Information Control: State Intervention and Mistakes to Avoid

History: Regulation of Communications A hundred years of the public interest standard has been applied to radio and television, with the explicit goal of protecting free speech. The very opposite was the case, as John Samples and Paul Matzko have clearly shown. A 1920–30s radio host, Bob Shuler, had exposed the Julian Petroleum Corporation’s defrauding of investors, and subsequently accused the district attorney and city prosecutor of negligence. Shuler also exposed...

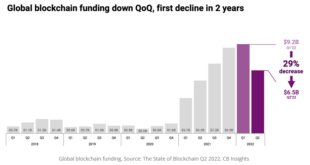

Read More »Global Blockchain Funding Dip; Mega-Rounds Shrink

After a record year 2021, the venture capital (VC) market for blockchain investment is slowing down significantly in 2022 amid uncertain macroeconomic conditions and financial markets turmoil. In Q2 2022, VC investors scaled back cryptocurrency investments due to macroeconomic pressures, concerns about valuations and market volatility. Global funding fell and the number of mega-rounds of US$100 million and up shrank, putting pressure on startup valuations and slowing...

Read More »Warning: Oil Moving Rapidly to "Contango" [Ep. 277, Eurodollar University]

The calendar spread (1- and 3-month) in the oil futures market (West Texas Intermediate) is compressing and is THIS close to being in contango. That would be the oil market saying, 'We don't see the demand. Keep your barrels—don't call us, we'll call you.' ****EP. 277 REFERENCES**** Crude Flattened By Flattening : http://www.marketsinsiderpro.com/ RealClear Markets Essays: https://bit.ly/38tL5a7 Epoch Times Columns: https://bit.ly/39ESkRf ****THE EPISODES**** YouTube:...

Read More » SNB & CHF

SNB & CHF