Swiss Franc The Euro has risen by 0.07% at 1.1192 EUR/CHF and USD/CHF, March 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The lurch lower in global interest rates continue. The US 10-year yield is at new 15-month lows, five basis points through the average effective Fed funds rate. Late yesterday, it appeared that 10-year German Bund yields slipped below...

Read More »Swiss fear effects of 5G antennas

Fifth-generation (5G) mobile communications antennas are starting to go up in Switzerland. Not everyone is happy about this. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel: http://www.youtube.com/swissinfovideos...

Read More »Swiss chocolate consumption slides

© Astra490 | Dreamstime.com In 2018, Switzerland’s population consumed around 87,000 tonnes of chocolate. However, average chocolate consumption dropped from 10.5 kg per person in 2017 to 10.3 kg in 2018, a decline of roughly 2%. This decline reflects last year’s longer hotter summer, according to the industry association Chocosuisse. The fall in consumption of Swiss chocolate in Switzerland declined further, dropping...

Read More »Monthly Macro Monitor: Well Worried

Don’t waste your time worrying about things that are well worried. Well worried. One of the best turns of phrase I’ve ever heard in this business that has more than its fair share of adages and idioms. It is also one of the first – and best – lessons I learned from my original mentor in this business. The things you see in the headlines, the things everyone is already worried about, aren’t usually worth fretting...

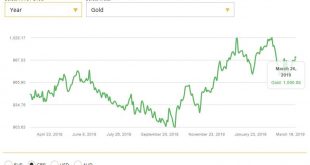

Read More »Gold Gains On Recession Concerns and ‘No Deal’ Brexit Risks

– Gold gains due to concerns about slowing growth, monetary and geopolitical risks – Increasing possibility of ‘No Deal’ Brexit heightens recession risks in UK, Ireland – Brexit uncertainty is impacting UK & Irish economies; Likely do long term damage – UK sees sharp slowdown in mortgage approvals in February as housing market slows – Gold surges to near all time record highs in Australian dollars at $1,860/oz –...

Read More »FX Daily, March 27: Global Bond Rally Continues, Greenback Remains Firm

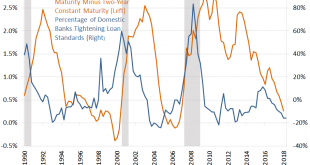

Swiss Franc The Euro has fallen by 0.05% at 1.1194 EUR/CHF and USD/CHF, March 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US 10-year yield is trading below the Fed funds target. The two-year yield is trading below the lower end of the Fed funds target range. A warning by New Zealand that the next rate move could be a cut sent New Zealand and Australian...

Read More »Pound to Swiss Franc Forecast – Will GBP/CHF rates rise or fall on Brexit?

The Brexit date of 29th March has been delayed to the 12th April or the 22nd May as the EU provide a lifeline to the UK to help them avoid a no-deal scenario. This has helped the pound to rise and has provided some of the best rates to buy Swiss Francs in many months. The outlook for the pound is now looking much less rosy as investors await the latest news on Brexit and to see if the House of Commons will be likely to...

Read More »Cool Video: Bloomberg–Sterling and the Euro

I joined Shey Ann and Amanda Lang on the Bloomberg set to talk about sterling and the euro. The media makes it sound like there was a coup in the UK and Parliament has taken control of Brexit. This is an exaggeration. The House of Commons did secure tomorrow to have “indicative votes” on the different alternatives. These votes are not binding on the Prime Minister who as already indicated some alternatives that she will...

Read More »Additional flaw found in Swiss Post e-voting system

This is the second flaw in the Swiss Post future e-voting system discovered during the public intrusion test phase. (Keystone) A second error in the Swiss Post planned e-voting system has been discovered as the public intrusion test phase comes to an end. The Federal Chancellery announced the need for action and confirmed a review of the e-voting certification and approval process. The same computer experts who...

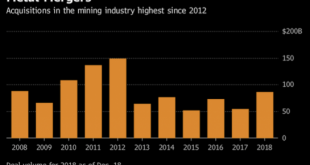

Read More »Merger mania: Consolidation in the gold mining sector

Late last year, Barrick Gold, the world’s largest gold miner in terms of reserves, made headlines when it announced its acquisition of Randgold Resources, in an $18bn mega-merger that marked a key moment for the mining industry. In January, United States gold giant Newmont and principal rival of Barrick, made public its own plans to buy Canada’s Goldcorp, the world’s third-largest bullion producer by market value, for...

Read More » SNB & CHF

SNB & CHF