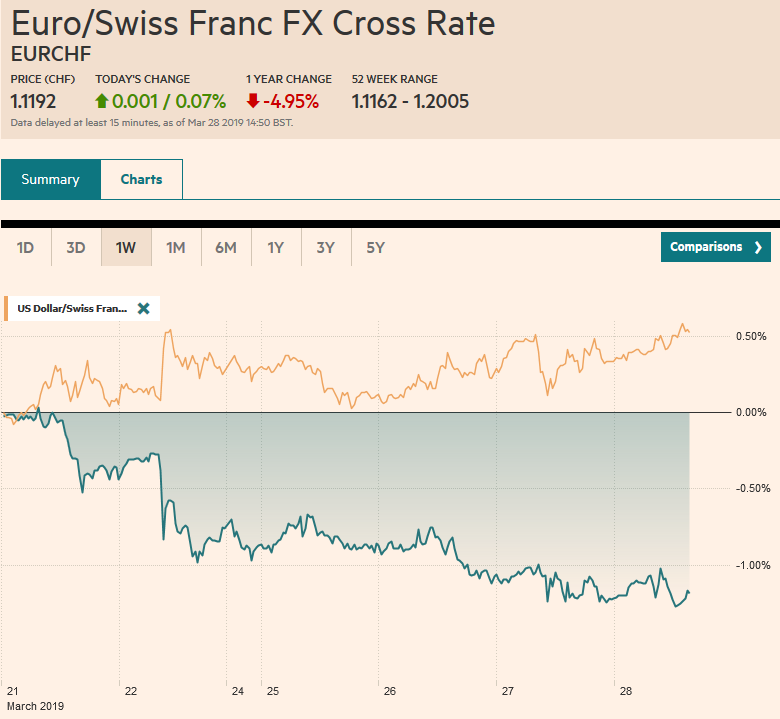

Swiss Franc The Euro has risen by 0.07% at 1.1192 EUR/CHF and USD/CHF, March 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The lurch lower in global interest rates continue. The US 10-year yield is at new 15-month lows, five basis points through the average effective Fed funds rate. Late yesterday, it appeared that 10-year German Bund yields slipped below similar Japanese government bond yields for the first time since Q4 16, but when the JGB market opened, it the 10-year JGB yield fell a couple more basis points to minus 10, the most negative since August 2016, The 10-year Bund yield is steady near minus eight basis points. Peripheral European yields are

Topics:

Marc Chandler considers the following as important: $TRY, 4) FX Trends, AUD, CAD, EUR, EUR/CHF, Featured, FX Daily, GBP, JPY, MXN, newsletter, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.07% at 1.1192 |

EUR/CHF and USD/CHF, March 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

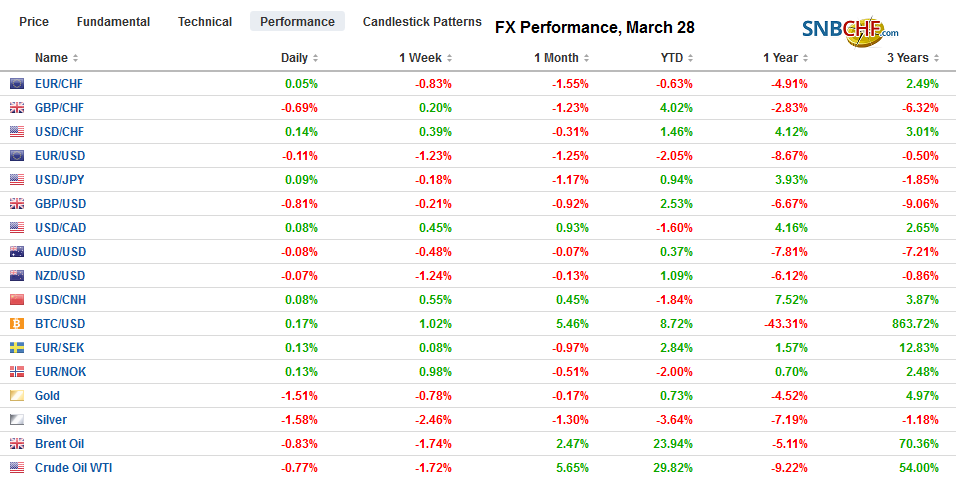

FX RatesOverview: The lurch lower in global interest rates continue. The US 10-year yield is at new 15-month lows, five basis points through the average effective Fed funds rate. Late yesterday, it appeared that 10-year German Bund yields slipped below similar Japanese government bond yields for the first time since Q4 16, but when the JGB market opened, it the 10-year JGB yield fell a couple more basis points to minus 10, the most negative since August 2016, The 10-year Bund yield is steady near minus eight basis points. Peripheral European yields are firmer as they are tarred with the risk-off brush that is keeping equities on the defensive. The large bourses in Asia-Japan, China, Korea, Taiwan, and Australia weakened, but some smaller markets and India were more resilient. Barring a sharp sell-off tomorrow, Indian shares are poised to extend their advance for a sixth consecutive week. European shares are mixed to higher, with the Dow Jones Stoxx 600 trying to extend its gains for third sessions. US shares are trading with a slightly heavier bias. Most of the major currencies are a little lower, with the yen and Antipodean currencies the exceptions. Emerging market currencies are nearly all weaker, with short-squeeze in Turkey have faltered, pushing the lira down nearly 5% at pixel time despite the overnight swap rate soaring above 1000%. The risk is that the short squeeze will deter international investors who will be asked to refinance some $177 bln of foreign currency debt coming due over the next year. |

FX Performance, March 28 |

Asia Pacific

Japan’s Ministry of Finance reported portfolio flows on a weekly basis. The large moves in stocks and bonds and the approaching fiscal year end has seen sharp moves by Japanese and foreign investors. Last week, Japanese investors bought JPY1.1 trillion of foreign bonds. It is the second largest buying spree this year. They were small sellers of foreign shares. Offshore investors were larger sellers of Japanese bonds and stocks. They sold JPY1.5 trillion of Japanese bonds, the most this week, while they sold JPY1.1 trillion of Japanese stocks. Over the past three-weeks, foreign investors sold JPY3.7 trillion of Japanese stocks, which appears to be a record. They have only bought Japanese shares one week here in Q1.

The economic calendar will pick up now. Tomorrow Japan reports employment, industrial output, and retail sales. While jobs reports should be little changed, the February factory output and retail sales are expected to have bounced back from a poor January. Early Monday in Tokyo, the March Tankan Survey will be released, and sentiment is expected to have weakened in most categories, though large non-manufacturers may have fared best. Capital expenditure plans were likely slashed. China reports its official PMI over the weekend. South Korea will report industrial output figures tomorrow and trade figures early Monday in Seoul. Trade seemed to improve as the month, so the year-over-year contraction appears to have eased compared with January and February.

The dollar has traded between JPY110.00 and JPY110.50 today. It found a good bid in early Europe just above JPY110, where a $965 mln option will be cut today. There is an option that expires tomorrow there for $1.2 bln. There is another $840 mln option at JPY110.50 that will also expire today. The Australian dollar is trading near the lower end of the two-week range, which extends to almost $0.7050. There is an A$1 bln option struck at $0.7100 that is expiring. The week’s high was set near $0.7150, where a six-week downtrend is found.

Europe

The UK House of Commons failed to find a majority for any of eight different options to Prime Minister May’s Withdrawal Bill. It intends to narrow the range of options to see if a consensus can be forged. Two proposals did a little better than the Withdrawal Bill’s second attempt: staying in the customs union and a second referendum. May capitulated to demands and offered to resign once Brexit is approved, but understood to be resigning in the coming months in any case. This seemed to have been enough to entice some like Boris Johnson and Duncan Smith, but DUP continued to oppose the Withdrawal Bill on principle, and this seems to have doomed it.

The timetable laid out by the EC gave the UK until the end of this week to pass the Withdrawal Bill, in which case it would leave by May 22, a week before the European Parliament elections. However, if the Withdrawal Bill is not passed, the UK will have until April 12 to either leave without an agreement (among the least favored options by the House of Commons) or seek a longer delay, which would require participation in the European Parliament elections.

A fixed extension still leaves the UK at the mercy of the EU. It may be preferable to revoke Article 50, with a promise to the UK that it will be triggered again when a compelling solution to the vexing problem of the Irish border is resolved. That seems to be the heart of the problem. The Good Friday Agreement that made for peace between Northern Ireland and the Irish Republic, in essence, requires the UK to stay in the EU. Then in 2016 in a pique, 52% (one percentage point more than the French gave the Maastricht Treaty in what is known as the “petite oui”) of the voters chose to leave the EU, and their leaders seemed to give little thought to their previous commitment. One of the most remarkable aspects of the Brexit mess is how united the EU has been throughout, and the fragmentation of the UK.

Eurozone money supply (M3) growth accelerated to 4.3% in February from a 3.8% pace in January. It is the matches last June’s pace, which was the best since January 2018. Household lending was steady at 3.2% while lending to non-financial businesses to2.6% from 2.2%. The ECB will find comfort in the report. On the other hand, price pressures, which often rise in March, seem a little subdued in both Spain and Germany (ahead of next week’s report for the region). Spain’s harmonized measure rose 1.4% on the month (vs. the median forecast in the Bloomberg survey for 1.6%). The year-over-year pace rose to 1.3% from 1.1% (the median forecast 1.5%). German state reports, leading the national estimate before the end of the day in Germany, saw the year-over-year rates steady to lower. Given the base effect, a 0.6% rise in March for the country, would put the year-over-year rate at 1.6%, down from 1.7% in February. The risk is to the downside. The Bloomberg survey has March eurozone CPI unchanged at 1.5% and the core at 1.0%. Due to the different baskets measured in CPI, if the US were to adopt the harmonized methodology used in Europe, US CPI would be nearly identical with the EMU.

The euro remains continued to narrow ranges, but the narrow ranges are lower. The euro slipped to $1.1235, its lowest level since March 11 in early European turnover, but quickly snapped back to $1.1260. Yesterday’s high was near $1.1285. The euro has not been above $1.13 since early in the US on Tuesday. There is a 700 mln euro option that will expire today at $1.1250 and almost 815 mln euro in an expiring option at $1.1325. There is another option there ($1.1325) for 1.3 bln euros that expires tomorrow. Also tomorrow, there is a 1.2 bln euro in options struck at $1.13 that roll-off and 1.4 bln euros at $1.12 strike. Sterling traded down to $1.3125, a four-day low in Europe after being rebuffed from $1.32 in Asia. Despite the quieter tone, the one-week implied volatility is still a lofty 15.5%. The 20-day average of one-week implied volatility is near 13.6%, and the 100-day average is a little below 11%.

America

No fewer than six Fed officials speak today. It would be surprising if any specifically addressed the nominee Moore’s call for an immediate 50 bp rate cut, which might be a be reminiscent of his call for a rate hike in 2008. By reiterating the neutral stance of the Fed, as stated explicitly, but also with the “wait and see” attitude, Moore will seem out of step with the current team, including all or nearly all of Trump’s appointments. However, Moore’s views are closer to the market. The implied yield of the January 2020 Fed funds futures contract is 2.12%. The current effective average is 2.40. That implies roughly one cut and a 50% chance of a second cut.

The US is expected to shave its estimate for Q4 GDP today as consumption and trade may have been slightly greater drags on growth. However, the data is too old to matter to investors or policymakers. Tomorrow’s report of February income and January expenditures are more important. We expect improvement over January and December respectively and see the US economy emerging from a late-cycle soft patch that may have ground the world’s largest economy nearly to a halt in Q1, bolstered by a robust jobs market and consumption.

Mexico’s central bank meets, and there is little chance of a change in rate. The overnight rate stands at 8.25%. Consumer inflation is running just below 4%, which leaves Mexico will high real rates. However, the high rates are meant to compensate investors for the policy uncertainty as well as the firm inflation. There is also the risk posed by the peso. The peso is used as a proxy for emerging market currencies, which have fallen out of favor this month. The peso is lower for the fourth consecutive session. The dollar’s high for the month is near MXN19.62, and that remains the target. Support now is seen in the MXN19.20-MXN19.25 area. Elsewhere, the Canadian dollar is soft, with the greenback above CAD1.34 and looking to test the month’s high near CAD1.3465.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TRY,EUR/CHF,Featured,FX Daily,MXN,newsletter,USD/CHF