US policymakers’ bold actions in response to the coronavirus bear some traces of the free-wheeling deficits, repressed interest rates and central bank activism (money creation) that form the cornerstones of the Modern Monetary Theory (MMT) playbook.

MMT’s popularity is likely to persist, gaining converts among those who previously supported classic assumptions about budget constraints or the ‘crowding out’ of private investment by growing government indebtedness. MMT’s proponents see the bond market’s placid reaction to massive covid-19 fiscal packages as proof that the limits to government debt issuance are indeed much farther away than feared.

In our central scenario, we see a ‘soft’ version of MMT being adopted by US policy makers in the years ahead. Howver,

Articles by Thomas Costerg

Powell plays the ‘insurance’ card again

September 19, 2019In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market.

The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%. Fed Chairman Jerome Powell again justified this second rate cut since July as “insurance” against risks to the US outlook – mostly the weak global growth picture and ongoing trade policy uncertainty. We see the Fed remaining particularly sensitive to the weak global manufacturing picture, even if there is potentially some progress on the US-China trade front. Powell particularly noted the tariff increases on Chinese imports announced in

Powell plays the ‘insurance’ card again

September 19, 2019In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market.The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%. Fed Chairman Jerome Powell again justified this second rate cut since July as “insurance” against risks to the US outlook – mostly the weak global growth picture and ongoing trade policy uncertainty. We see the Fed remaining particularly sensitive to the weak global manufacturing picture, even if there is potentially some progress on the US-China trade front. Powell particularly noted the tariff increases on Chinese imports announced in August. From media reports,

Read More »September Fed meeting preview

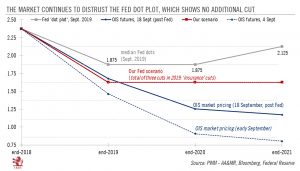

September 17, 2019A rate cut is on the cards, but communication will be more difficultThe Federal Reserve (Fed) is very likely to cut rates again on 18 September, a follow-up to its 25-basis point (bp) rate cut at its last meeting in July. The explanation is likely to again be the need to take “insurance” against growing downside risks to the outlook, including from President Trump’s erratic trade policy as well as weaker foreign growth.Fed Chairman Powell is unlikely to pre-commit to a third rate cut at this stage, even though we still think one is on the cards. The committee’s ‘dot plot’ could also only signal that two rate cuts are enough for now… But the dot plot is a red herring for the direction of rates and we should ignore it. Powell’s communication regarding the future path of rates could be made

Read More »Double pressure from Trump and the yield curve

September 3, 2019We now see two additional Fed rate cuts, one in September and one in in October, versus our previous call of only one in September.We continue to expect the Federal Reserve (Fed) to cut rates by 25 basis points on 18 September.Instead of staying put at its 30 October meeting, we now think the Fed will use it to announce a further 25 bps cut, mostly due to the recent escalation of US-China trade tensions.Those two additional cuts still fit within the Fed’s vaguely-defined ‘insurance’ framework, rather than as a bid to deal with an imminent recession.President Donald Trump’s constant pressure on Jerome Powell is undoubtedly playing a role in the Fed’s stance, as is the Treasury yield curve.The Fed still has to explain where ‘insurance’ cuts stop, and where ‘recession’ cuts start. Powell can

Read More »JULY FED MEETING REVIEW

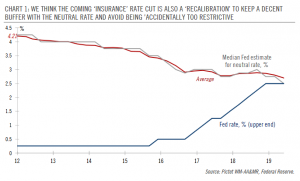

August 2, 2019The Federal Reserve cut rates by 25bps on 31 July for the first time in 10 years. We continue to expect another rate cut in September.As expected and as telegraphed, the Fed cut rates by 25bps on 31 July – the first rate cut since December 2008 – and it ended prematurely its quantitative tightening programme (in August instead of September).Chairman Jerome Powell justified the rate cut as an “insurance” cut, i.e. to insure against the downside risks to US growth, mostly coming from weak foreign growth affecting US manufacturing and investment. He also cited below-target inflation.He also implicitly cited the ‘recalibration’ ground, as the theoretical ‘neutral’ rate is falling and equilibrium unemployment is lower than previously thought.Particularly interesting were Powell’s references to

Read More »July FED MEETING PREVIEW

July 25, 2019We still see the Fed’s expected July rate cut as fundamentally of a “recalibration” nature.We expect the Federal Reserve (Fed) to cut its fed funds target rate range by 0.25%, and leave the door open for another cut later, after its two-day policy meeting ending on 31 July.Chairman Jerome Powell has a lot of explaining to do as to why the Fed is making this rate cut, only six months after the last rate hike: this explaining could condition the path of future interest rate moves.The Fed will also likely cut short the shrinking of its balance sheet, which was planned for September anyway.Our view is that the Fed is mostly cutting rates out of fear of US yield curve inversion, to keep a buffer with (and stay below) the theoretical neutral rate and lastly, out of residual regret about

Read More »HAS Modern Monetary Theory ALREADY TAKEN HOLD IN WASHINGTON?

July 22, 2019The interest in Modern Monetary Theory has grown as the limitations of ‘mainstream’ economic theories have become ever plainer to see since the financial crisis.Modern Monetary Theory (MMT) is a theory, initially emanating from left-wing US economists, that argues that since governments, and in particular the US government, issues its own currency, it can never run out of funding.The corollary is that it is possible for the government to spend more to push the economy towards its full growth potential and full employment. The theory argues those limits on spending have not been reached in the US yet, so there is room (and even a need) to cut interest rates to zero and inject more money into the system.The theory invites a change in viewpoint, especially with regards to government

Read More »Is the Fed too focused on corporates?

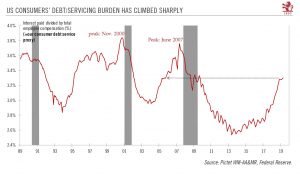

July 16, 2019Fed dovishness is helping to curb financing costs for corporates but does not seem to be percolating down to the US consumer, whose debt-servicing costs are rising. This could be something to watch.

The Federal Reserve (Fed)’s leading priority now is to help sustain the US business cycle, hence the concept of ‘insurance’ rate cuts put forward by Fed chairman Jerome Powell, with some echoes of Alan Greenspan’s philosophy in the 1990s.

Low Fed interest rates tend to percolate quickly down to the corporate sector. Indeed, low borrowing costs help prevent a debt service-induced margin squeeze, which is usually how economic cycles end. (Another risk is margin suffocation due to sharply rising employee costs, but that

Is the Fed too focused on corporates?

July 15, 2019Fed dovishness is helping to curb financing costs for corporates but does not seem to be percolating down to the US consumer, whose debt-servicing costs are rising. This could be something to watch.The Federal Reserve (Fed)’s leading priority now is to help sustain the US business cycle, hence the concept of ‘insurance’ rate cuts put forward by Fed chairman Jerome Powell, with some echoes of Alan Greenspan’s philosophy in the 1990s.Low Fed interest rates tend to percolate quickly down to the corporate sector. Indeed, low borrowing costs help prevent a debt service-induced margin squeeze, which is usually how economic cycles end. (Another risk is margin suffocation due to sharply rising employee costs, but that seems to be in check too as wage growth remains tepid). A preventive focus on

Read More »Powell’s Congressional testimony sets the scene for rate cut

July 13, 2019The Fed will likely cut rates by 25 basis points on 31 July, with a similar cut possible as early as September.

During his testimony before the House of Representatives on Wednesday, Federal Reserve Chairman Jerome Powell repeated the dovish signals he gave at the Fed press conference in June, hinting at a rate cut at the next Federal Open Market Committee (FOMC) meeting on 31 July.

Powell’s priority is to preserve the economic expansion, now 10 years old: the coming monetary easing is about “managing risks”, he said, especially those coming from weakening global growth and President Trump’s trade policies. In other words, the coming cuts are simply ‘insurance’ rate cuts and not designed to counter an imminent

Powell’s Congressional testimony sets the scene for rate cut

July 11, 2019The Fed will likely cut rates by 25 basis points on 31 July, with a similar cut possible as early as September.During his testimony before the House of Representatives on Wednesday, Federal Reserve Chairman Jerome Powell repeated the dovish signals he gave at the Fed press conference in June, hinting at a rate cut at the next Federal Open Market Committee (FOMC) meeting on 31 July.Powell’s priority is to preserve the economic expansion, now 10 years old: the coming monetary easing is about “managing risks”, he said, especially those coming from weakening global growth and President Trump’s trade policies. In other words, the coming cuts are simply ‘insurance’ rate cuts and not designed to counter an imminent economic recession (although Powell did not say how many such ‘insurance’ cuts

Read More »Fragile truce in Osaka

July 3, 2019The US and China reached a ‘trade truce’ on the margins of the G20 summit this weekend, but existing tariffs remain in place. And we are only a tweet away from more Trumpian upheaval.

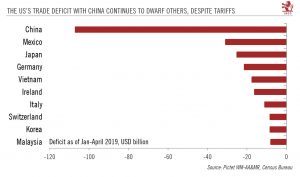

The US and China leaders agreed on a truce during their much-anticipated meeting at the G20 summit in Osaka this weekend. Bilateral trade talks will restart. Trump put to bed the threat of additional tariffs, although the existing tariffs on roughly half of Chinese imports will stay at 25%. Importantly, Trump did not specify a deadline for the end of trade talks. The US president also highlighted China’s willingness to buy more US agricultural products. Trump also eased up on the ban on US companies selling parts to Chinese telco giant

Fragile truce in Osaka

July 1, 2019The US and China reached a ‘trade truce’ on the margins of the G20 summit this weekend, but existing tariffs remain in place. And we are only a tweet away from more Trumpian upheaval.The US and China leaders agreed on a truce during their much-anticipated meeting at the G20 summit in Osaka this weekend. Bilateral trade talks will restart. Trump put to bed the threat of additional tariffs, although the existing tariffs on roughly half of Chinese imports will stay at 25%. Importantly, Trump did not specify a deadline for the end of trade talks. The US president also highlighted China’s willingness to buy more US agricultural products. Trump also eased up on the ban on US companies selling parts to Chinese telco giant Huawei, although this will only apply to US goods outside the scope of

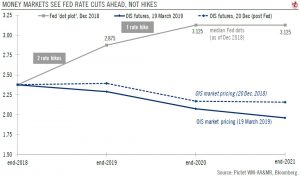

Read More »Fed update – Driving under the (political) influence

June 21, 2019We now see a 25bp cut on 31 July (versus in December in the main scenario prior), followed by another 25bp cut on 18 September.The role of politics including President Trump’s pressure to cut rates (and his call to dismiss Powell) and the anxiety ahead of the G20 summit on 28-29 June – particularly the crucial Trump-Xi meeting – has been even more impactful than we expected (we were wrong!), leading Chairman Powell to signal more firmly an imminent rate cut.This political noise adds to the underlying dovish picture that has prevailed since January 2019. The Fed has been prioritising the extension of the US business cycle and with more focus on (or targeting of?) financial markets as a way of buttressing both consumer and business confidence to support consumer spending and

Read More »The Fed talks the talk, but in no rush to cut

June 17, 2019All eyes will be on the Fed policy meeting this week. We believe thoughts of immediate action are premature, but the Fed will push through ‘insurance’ rate cuts in the coming months.The Fed should remain on hold on 19 June, but Chairman Powell is likely to mention the possibility of cutting rates in the coming months, especially if trade tensions continue. Potential monetary easing would be framed as ‘insurance’ rate cuts, similar to those pushed through in 1995 and 1998, mostly to backstop confidence in an uncertain (trade) policy environment. But we think the Fed still wants to see more data and wait for the pivotal G20 summit in Osaka at the end of this month before being more precise in its rate-cutting signals. In short, we expect no pre-commitment to easing on 19 June. Our central

Read More »Tory Brexiteers likely to be galvanised by Euro parliament results

May 28, 2019The results mean the next Conservative Party leader could veer towards a harder stance on Brexit, with implications for sterling and UK stocks.The European Parliament elections produced mixed results in the UK and do not seem to offer a clear path out of the current Brexit limbo.Nigel Farage’s Brexit Party came first, while the Tory (Conservative) party suffered heavily. This is likely to induce a new Tory leader to adopt a harder stance on Brexit in the coming months, as the party faces a prolonged ‘existentialist’ crisis over the issue. At the same time, the results showed the resilience of pro-Remain forces among the smaller parties, although they remain very divided.We now think that the risk of a hard Brexit by the 31 October deadline is high (40%), although our central scenario is

Read More »US-China trade: New tariffs – watch the second derivative

May 14, 2019Our view about US-China trade tensions remains largely unchanged. We expect limited direct impact on the US economy, but the indirect costs could be more significant.The direct macro cost on the US economy of the raised tariffs to 25% from 10%, and the fresh counter-tariffs from China, should be limited in our view, at around 0.1% of US GDP.The US economy tends to be much more sensitive to financial conditions than to the narrow question of the tariffs’ impact on end-purchasers in the US. Those financial conditions, which have deteriorated in recent days, hold the key to the US growth outlook.There are mitigating forces that could help support US growth (1) The Trump Administration is stepping up fiscal spending, directly to US farmers affected by the Chinese counter tariffs and

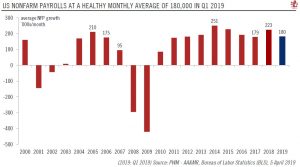

Read More »Fed meeting preview: Play it again Sam

April 30, 2019While we expect the Fed to stay on hold, it could supply new insight into the threshold for a rate cut (which we consider improbable).The Fed meeting concluding on 1 May should provide only limited new information.The domestic growth backdrop is good and equity markets are buoyant, but low core inflation and the proximity of the theoretical ‘neutral rate’ will likely stifle the Fed’s temptations to raise rates. Instead, the Fed should signal it is happy to stay on hold for now.While the market is still pricing a rate cut as more likely than a hike before the end of the year, we think Fed Chairman Jerome Powell will hint that the Fed’s bias is still towards a rate increase in the medium term given the good US macro fundamentals.The press conference (now a fixture at each Fed meeting) could

Read More »Business cycle could define Trump’s re-election chances

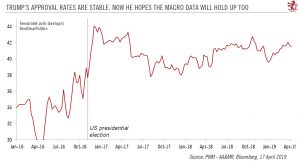

April 20, 2019President Trump’s focus on getting re-elected in November 2020 may have implications for his economic policy choices.

As we move closer to the 2020 presidential election, Trump has been blatantly leaning on the Federal Reserve to be more accommodative and has been trying to appoint nominees who share his preference for loose monetary policy to the Fed board. The countdown to the 2020 elections also seems to be prompting Trump to adopt a mellower stance than before on Chinese trade talks so that he has at least something to show voters for his efforts. There has also been some renewed focus on infrastructure spending, although it is unlikely that the Democrats will agree on the funding of a major spending package.

Business cycle could define Trump’s re-election chances

April 18, 2019President Trump’s focus on getting re-elected in November 2020 may have implications for his economic policy choices.As we move closer to the 2020 presidential election, Trump has been blatantly leaning on the Federal Reserve to be more accommodative and has been trying to appoint nominees who share his preference for loose monetary policy to the Fed board. The countdown to the 2020 elections also seems to be prompting Trump to adopt a mellower stance than before on Chinese trade talks so that he has at least something to show voters for his efforts. There has also been some renewed focus on infrastructure spending, although it is unlikely that the Democrats will agree on the funding of a major spending package. Yet, while Trump and a dovish Fed may help to prolong the business cycle, by

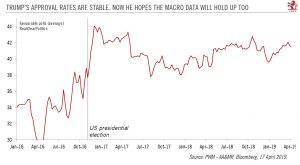

Read More »The US labour market chugs along

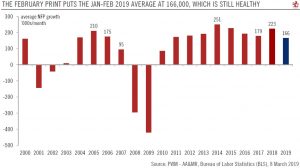

April 5, 2019Latest nonfarm payroll report shows the ongoing resilience of the US economy, although some cyclical sectors are being affected by global headwinds.US employment rose by 196,00 in March, bringing the three-month average to a healthy 180,000/month— less than the 2018 average of 223,000, but more than in 2017.The unemployment rate was unchanged at 3.8%, below the Federal Reserve’s (Fed) ‘full employment’ estimate of 4.4%.Wage growth softened to 3.2% year-on-year (y-o-y) from 3.4% in February.From a Fed perspective, this report shows the ongoing resilience of the US economy with no sign of labour market ‘overheating’. In other words, it contains nothing to shift the Fed from its current ‘on hold’ mode.From a business cycle perspective, while there is some slowing in cycle-sensitive sectors

Read More »Fed meeting review: a strong dovish undertone

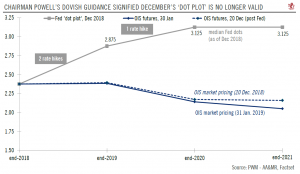

March 22, 2019The outcome of the March Fed meeting had a strong dovish undertone, crystallising the dovish policy shift at play since early January.The Fed confirmed the end of balance sheet reduction for September 2019. Meanwhile, the dot plot showed an overwhelming majority of members expected no rate hike at all this year (versus two rate increases expected at the December meeting).As expected, Powell took his ‘central banker to the world’ hat, expressed concern about the global economy, including the situation in Europe and China (and Brexit).Powell emphasised a strongly ‘neutral’ monetary stance, framed by the proximity of the theoretical neutral rate and the still-muted inflation pressures. At the same time, he remained optimistic about the US economy, pushing back against the idea of cutting

Read More »Jerome Powell, central banker to the world

March 19, 2019We expect the Federal Open Market Committee meeting this week to confirm the Fed’s pivot towards dovishness.We believe the Fed will wear its ‘central banker to the world’ hat during the Federal Open Market Committee meeting on March 19-20. Expressions of continued confidence in the US economy may prove secondary to concerns about Europe (including Brexit ) and China, meaning we expect the Fed to send a dovish message.Meanwhile, the Fed is gradually moving the goalposts on inflation even as core inflation is close to 2% y-o-y, its official target. We think we could see signs that 2.5% is the new target on inflation. In fact, ‘average inflation targeting’ has been making its way into Fed thinking as it signals a bit of overheating would be welcome given past inflation undershoots.While the

Read More »US employment: keeping an eye on the clock

March 8, 2019Despite a weaker than expected February employment report, the three-month average remains robust and we would tend to dismiss this weak print as a mere ‘blip’.With only 20,000 job additions, the US employment report for February was weak. However, with the three-month average remaining robust at 186,000, we would tend to dismiss this weak print as a mere ‘blip’. Furthermore, the weak reading is inconsistent with other labour market data and indicators, including recent consumer and business surveys.Some details of the report reinforce the view that it is too early to conclude that this marks a sharp cyclical turning point in the economy. Employment in temporary help services was up on the month (+6,000) and up 2.2% year-on-year (y-o-y). This is an important positive bellwether, in our

Read More »US GDP update

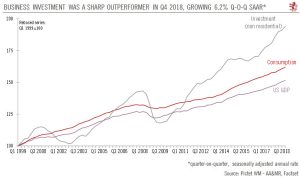

February 28, 2019With stronger US growth than expected in the fourth quarter, we do not expect a recession in 2019.Q4 2018 GDP growth was healthy at 2.6% quarter-on-quarter (q-o-q) seasonally adjusted annual rate (SAAR), close to the average over the previous three quarters (2.5%). Annual growth for 2018 was 2.9%.A particularly bright spot in Q4 was business investment, led by spending on equipment and software. Such business investment strength is particularly good news for the sustainability of the US business cycle. The risk of a recession this year remains remote, in our opinion.Still, US growth is likely to slow this year as both consumer spending and investment may decelerate. We continue to expect 2.2% annual growth in 2019, in line with the average since 2010.Q1 GDP growth could be affected by the

Read More »Fed wrap-up: staying dovish

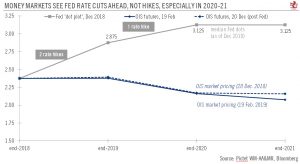

February 22, 2019The Fed enters the ‘acceptance stage’ regarding its debt and market dominance monetary regime.The US Federal Reserve (Fed) is further reinforcing its stance on ceasing its balance sheet shrinkage before year end, essentially yielding to the demands of markets, which have been anxious about the potential for market liquidity shrinkage. Officially, the balance sheet question is still rooted primarily in the technical – commercial banks’ high demand for safe, liquid assets – rather than monetary policy reasons (i.e. buttressing growth and supporting inflation), but the lines are getting increasingly blurred, resulting in confused Fed communication about the reasons behind its recent abrupt change in balance sheet plans.This could lead to an ‘agenda clash’ between a dovish announcement

Read More »Still moderate US inflation

February 14, 2019Latest data released confirm our expectations of modest US inflation this year.CPI inflation in January moderated to 1.6% y-o-y, from 1.9% in December (and versus 2.4% on average over the past twelve months).The biggest driver of this moderation was the sharp drop in global oil prices; given recent oil movements, we estimate that headline inflation could slide towards 1% y-o-y in coming months.Excluding energy and food, core CPI inflation remained at 2.2% y-o-y in January.There are signs that demand-driven price pressures are building as seen in the sharp pick up in haircut prices (our favourite proxy for domestic price pressures), but these are offset by even stronger dampeners: (1) structural drivers such as technology (bringing the price of tech gadgets down) (2) government policy,

Read More »US jobs report shows recession risk is limited

February 1, 2019In spite of the federal shutdown and the loss in growth momentum in other countries, the US continues to churn out jobs, while a dovish Fed may prolong the economic cycle.US employment rose by a solid 304,000 in January (+1.9% year on year, y-o-y), compared with 222,000 in December. The three-month average was a healthy 241,000/month. Meanwhile, the ISM manufacturing survey rose to a robust 56.6 in January from 54.3 in December.Overall, these two pieces of data suggest that US macro momentum remains strong and confirms our long-held view that the US business cycle is still rock solid despite the tightening in financial conditions in Q4 2018.The latest jobs report is consistent with our view that the risk of a near-term US growth slump is limited, despite the advanced phase of the US

Read More »Review of the Federal Reserve’s January meeting

January 31, 2019Fed signals end of rate hikes and that bank reserve liquidity tightening is near.Dovishness was on full display at the Fed meeting on 30 January. The Fed removed its rate tightening bias, and emphasised its “patience” until the next rate move.Chairman Powell seemed particularly anxious about the global growth backdrop and explained the more dovish stance is just “common sense risk management”.Another key focus was the balance sheet reduction as Powell hinted that a decision about ceasing the Fed’s balance sheet run-off – a key concern for markets in recent weeks – would be taken “soon”.This dovish view is in sharp contrast to Powell’s ebullient optimism about US growth a few months ago, when he expressed wariness about accelerating wage growth and the possibility of the Fed having to

Read More »