The US and China reached a ‘trade truce’ on the margins of the G20 summit this weekend, but existing tariffs remain in place. And we are only a tweet away from more Trumpian upheaval. The US and China leaders agreed on a truce during their much-anticipated meeting at the G20 summit in Osaka this weekend. Bilateral trade talks will restart. Trump put to bed the threat of additional tariffs, although the existing tariffs on roughly half of Chinese imports will stay at 25%. Importantly, Trump did not specify a deadline for the end of trade talks. The US president also highlighted China’s willingness to buy more US agricultural products. Trump also eased up on the ban on US companies selling parts to Chinese telco giant

Topics:

Thomas Costerg considers the following as important: 5) Global Macro, Featured, Macroview, newsletter, tariff war, Trade truce, us china trade

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The US and China reached a ‘trade truce’ on the margins of the G20 summit this weekend, but existing tariffs remain in place. And we are only a tweet away from more Trumpian upheaval.

The US and China leaders agreed on a truce during their much-anticipated meeting at the G20 summit in Osaka this weekend. Bilateral trade talks will restart. Trump put to bed the threat of additional tariffs, although the existing tariffs on roughly half of Chinese imports will stay at 25%. Importantly, Trump did not specify a deadline for the end of trade talks. The US president also highlighted China’s willingness to buy more US agricultural products. Trump also eased up on the ban on US companies selling parts to Chinese telco giant Huawei, although this will only apply to US goods outside the scope of national security The trade truce reached this weekend is in line with our central scenario, but we believe it could be fragile. It remains our view that deep-rooted concerns about China’s technological ascent and the lead-up to the 2020 presidential elections will make finding a lasting, broad-based ‘deal’ difficult to reach. |

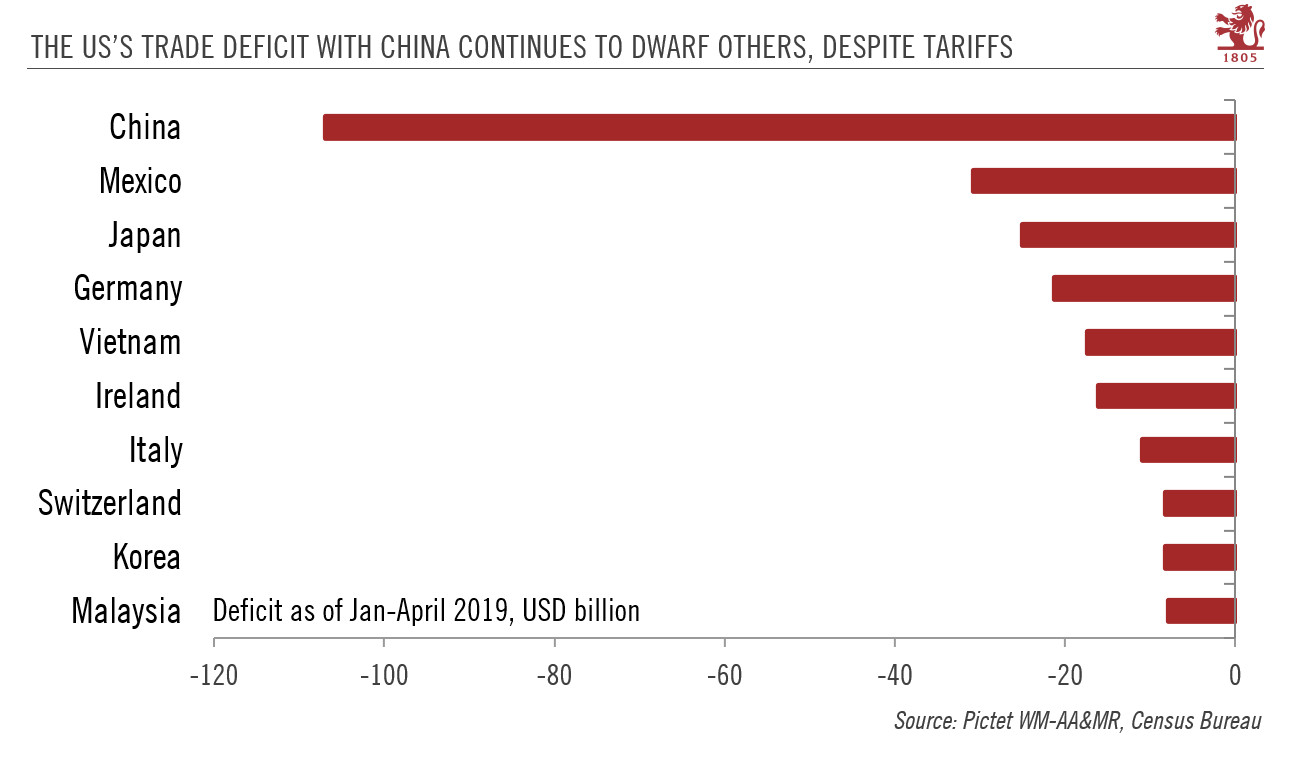

The US's Trade Deficit with China Continues to Dwarf Others, Despite Tariffs |

So far, Trump has made ‘stop and go’ a signature technique in his negotiations with China. There could be further coups de théâtre—maybe in the form of a tweet. It is still more likely than not that Trump will up the ante rather than dial back on trade threats before the November 2020 elections, with a 10% tariff on Chinese imports not already hit by US import duties still our main expectation. Our alternative negative scenario, to which we assign a probability of 35%, sees Trump suddenly deciding to impose a 25% tariff on remaining Chinese imports, imposing more restrictions on Chinese tech and slapping new tariffs on European cars.

Our central scenario is still for the Federal Reserve to cut the fed funds rate by a total of 50 bps in the coming months for ‘insurance’ purposes (with the first 25bps cut on 31 July) as it tries to bolster business sentiment hurt by the increase in tariffs on Chinese imports to 25% from 10% in early May. The Fed has signalled it wants to keep the US expansion going, so we expect its communication will remain dovish.

Tags: Featured,Macroview,newsletter,tariff war,Trade truce,us china trade