The easing package delivered by the ECB at its 3 December policy meeting fell short of market expectations. However, the new measures are still likely to boost the on-going recovery. The ECB’s President Mario Draghi was under a great deal of pressure not to disappoint today. In the end, the ECB delivered a policy package that was largely in line with our baseline, but fell short of (extremely high) expectations. However, we would not get carried away by short-term market disappointment. The economic recovery continues, deflation risks have been contained, and today’s new steps, on top of existing credit and quantitative easing measures, should provide an additional boost to the real economy and to European risk assets. Essentially, the ECB strengthened its forward guidance, promising to keep monetary conditions looser for longer, while standing ready to do more if needed, using all the available instruments and possibly increasing their flexibility going forward. In terms of policy rates, the ECB decided to cut the deposit rate by ‘only’ 10bp, to -0.30%, in line with our forecast. The main refinancing rate and the rate on the marginal lending facility were left unchanged, at 0.05% and 0.30%, respectively, creating an asymmetric rate corridor.

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The easing package delivered by the ECB at its 3 December policy meeting fell short of market expectations. However, the new measures are still likely to boost the on-going recovery.

The ECB’s President Mario Draghi was under a great deal of pressure not to disappoint today. In the end, the ECB delivered a policy package that was largely in line with our baseline, but fell short of (extremely high) expectations. However, we would not get carried away by short-term market disappointment. The economic recovery continues, deflation risks have been contained, and today’s new steps, on top of existing credit and quantitative easing measures, should provide an additional boost to the real economy and to European risk assets. Essentially, the ECB strengthened its forward guidance, promising to keep monetary conditions looser for longer, while standing ready to do more if needed, using all the available instruments and possibly increasing their flexibility going forward.

In terms of policy rates, the ECB decided to cut the deposit rate by ‘only’ 10bp, to -0.30%, in line with our forecast. The main refinancing rate and the rate on the marginal lending facility were left unchanged, at 0.05% and 0.30%, respectively, creating an asymmetric rate corridor. Contrary to recent press reports, there was no change to the way those are charged on banks’ excess reserves, nor did Draghi hint at possible changes in the future.

Meanwhile, the period of fixed rate, full allotment liquidity procedure was extended “for as long as necessary”, and “at least until the end of 2017”. The latter decision, while not really a surprise, was specifically aimed at strengthening forward guidance. In the same spirit, one could imagine a loosening of TLTRO conditions in the future (e.g. a maturity extension or an increase in the leverage ratio) as part of the ECB’s toolkit.

In terms of asset purchases, the ECB’s Asset Purchase Programme (APP) was extended by 6 months, “until March 2017 or beyond, if necessary, and in any case until the Governing Council sees a sustained adjustment in the path of inflation”. Therefore APP remains de facto open-ended, and the ECB can easily decide to extend it again should inflation not return to the 2% target at the desired speed. This extension will result in EUR360bn in additional asset purchases, at the lower end of our estimates of what was required given the downward revision to the ECB staff projections for inflation (see below).

Moreover, the ECB decided to reinvest the principal payments on the assets purchased under the APP as they mature, which as Draghi noted will support balance sheet expansion even beyond March 2017. Lastly, regional and local government debt will be included the pool of assets that are eligible for QE. Importantly, today’s decision was not unanimous although Draghi said that there was a “large majority” in favour.

Contributing to the negative market reaction was the lack of details on which specific measures the ECB might be contemplating if it were to ease its monetary stance again.

In particular, Draghi declined to comment on the ‘new’ lower bound for policy rates as the ECB now sees it, and so did not fuel market expectations of further rate cuts at this stage. However, he did note that negative rates “vastly improved” the transmission of monetary policy. There was no mention either of a possible drop of the QE yield floor, currently set at the ECB’s deposit rate, which would have helped to increase the range of German bonds that are eligible for QE. Arguably, the sell-off in short-term rates will help for now as more German bonds become eligible again, with a yield above the new deposit rate of -0.30%. Lastly, Draghi made it clear that other technical changes to QE modalities could be envisaged in the spring of 2016, adding that the ECB would find ways to overcome operational constraints if needed. The 10 March 2016 policy meeting could end up being a very important one as the macro projections for 2018 will be first published.

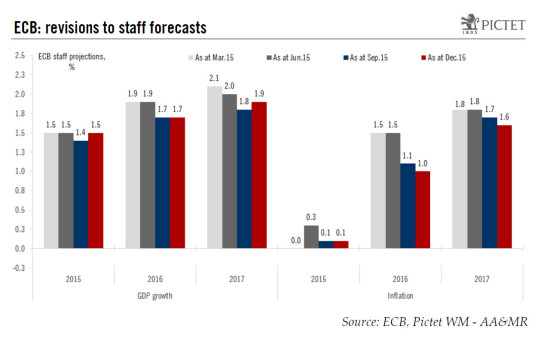

The ECB’s staff forecasts were revised accordingly, broadly in line with our expectations, with the important caveat that it is not clear to what extent the new easing measures are taken into account. Inflation forecasts by the staff were revised down only slightly, mostly due to lower oil prices and despite a slightly weaker euro. The key figure here is the 2017 HICP median projection which was lowered by 0.1pp, to 1.6%, clearly below the ECB’s 2% target. As a result, it should be no surprise that Draghi stressed downside risks to price stability over the medium-term. Real GDP projections were revised slightly higher, to 1.9% by 2017 (well above potential), with downside risks relating to foreign demand as well as to broader geopolitical risks.

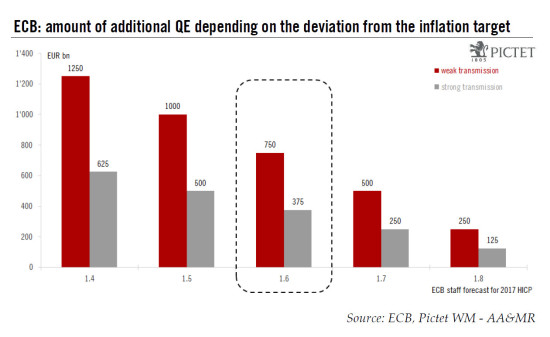

On the basis of the new staff forecasts, the QE extension delivered by the ECB fell short of what would have been required using ECB’s own elasticities, as we noted in our preview. Indeed, assuming EUR125bn to EUR250bn in additional asset purchases for each 0.1pp deviation from the inflation target, the revision the staff projection for 2017 HICP inflation to 1.6% would have called for a larger extension, up to EUR750bn or a 12-month extension (see chart below) under the assumption of a weaker policy transmission. One reason for the ECB’s under-delivery, beside the opposition of the hawks, could be that the ECB has become more confident that its unconventional measures are filtering through the real economy, as suggested by evidence from the Bank Lending Survey, for instance.

From a broader macro perspective, we consider today’s announcement as another positive step that should contribute to strengthening the recovery in the euro area in 2016 and beyond, barring an exogenous shock. On balance, we continue to see upside risks to our macroeconomic forecasts, which include euro area real GDP growth of 1.8% in 2016.