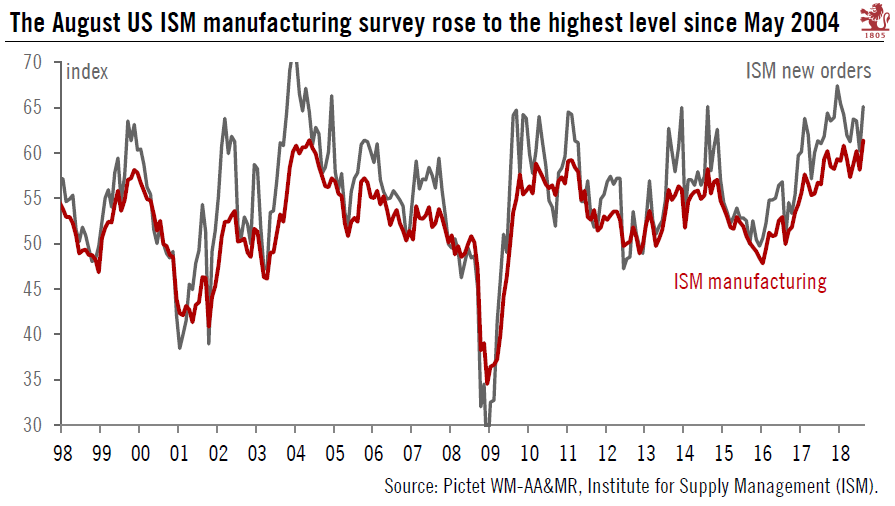

August’s US ISM manufacturing survey rise confirms that economic momentum is strong.The flagship ISM manufacturing survey, a series released by the Institute for Supply Management, with data going back to 1948, rose to 61.3 in August, its highest level since May 2004. Details of the survey were strong, for instance ‘new orders’ rose to 65.1, from 60.2 in July. The ISM index is a diffusion index, with any reading above 50 indicating expansion in activity.These healthy data are another reminder that the US economy is doing well at the moment, powered by strong internal drivers, and especially solid growth in corporate capex. Based on historical regression with GDP, the average ISM index over the past two months is consistent with underlying GDP growth of 3.2%.It is not to say that the US

Topics:

Thomas Costerg considers the following as important: Macroview, US economy, US ISM surveys, US manufacturing surveys

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

August’s US ISM manufacturing survey rise confirms that economic momentum is strong.

The flagship ISM manufacturing survey, a series released by the Institute for Supply Management, with data going back to 1948, rose to 61.3 in August, its highest level since May 2004. Details of the survey were strong, for instance ‘new orders’ rose to 65.1, from 60.2 in July. The ISM index is a diffusion index, with any reading above 50 indicating expansion in activity.

These healthy data are another reminder that the US economy is doing well at the moment, powered by strong internal drivers, and especially solid growth in corporate capex. Based on historical regression with GDP, the average ISM index over the past two months is consistent with underlying GDP growth of 3.2%.

It is not to say that the US economy is firing on all potential cylinders – and that’s why getting to 4% annual growth as President Trump promised looks still too ambitious at this stage. Potential curbs to optimism include housing, which is slowing partly due to affordability issues, and also the car market, which has been flat to slightly down in recent months.

But the good news is that with underlying growth confirmed in the vicinity of 3% (which is consistent with our long held forecast of 3% annual growth this year), the US economy continues to weather the vagaries in global growth. It is also resilient in the face of Trump’s erratic trade policy (which to some degree negates the tailwinds from the tax cuts), including the recent tariffs on steel and aluminium, as well as the tariffs on a portion of Chinese imports. The business community remaining so sanguine is encouraging on that front, although it also risks encouraging the administration to go further.