“Time To Position In Gold Is Right Now” – Rickards - "Time to position in gold is right now” - James Rickards- Fed has hit the ‘pause’ button; No more rate hikes for foreseeable future- Fed’s theories "bear no relation to reality" and has "blundered by raising rates"- Growth is weak, inflation is weak, retail sales ...

Topics:

GoldCore considers the following as important: 8.5%, Bank of England, Business, China, currency, Federal Reserve, Finance, Gold, Gold as an investment, Hong Kong, India, inflation, Jim Rickards, Market Crash, Money, Pound sterling, Precious Metals, Reality, Reuters, Silver as an investment, US Federal Reserve, Zurich

This could be interesting, too:

Dirk Niepelt writes Does the US Administration Prohibit the Use of Reserves?

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Claudio Grass writes Year in review: A tectonic shift has only just begun

“Time To Position In Gold Is Right Now” – Rickards

- "Time to position in gold is right now” - James Rickards

- Fed has hit the ‘pause’ button; No more rate hikes for foreseeable future

- Fed’s theories "bear no relation to reality" and has "blundered by raising rates"

- Growth is weak, inflation is weak, retail sales and real incomes are weak

- Tight money, weak economy & stock bubble classic recipe for market crash

- Reduce allocations to stocks and reallocate to defensive assets such as gold

- "Gold will be the big winner when the Fed suddenly realizes its blunder”

James Rickards, geopolitical and monetary analyst and best selling author of 'Currency Wars', 'The Death of Money' and ‘The New Case for Gold’ wrote yesterday in the Daily Reckoning that the "time to position in gold is right now.”

In an timely piece, Rickards points out how the Federal Reserve is behind the curve, has "theories that bear no relation to reality" and has "blundered by raising rates." This is happening at a time when the U.S. economy and stock markets are very vulnerable.

Rickards warns that growth in the U.S. remains weak, as are inflation, retail sales and real incomes. Tighter money in a weak economy with a stock market bubble is a classic recipe for stock market crash.

After making his case succinctly Jim concludes:

"It’s time for investors to go into a defensive crouch by selling stocks and reallocating assets to cash, Treasury notes, gold and gold mining shares.

In particular, gold will be the big winner when the Fed suddenly realizes its blunder and has to pivot quickly to ease, probably by late summer. The time to position in gold is right now.”

Jim Rickards

for The Daily Reckoning

News and Commentary

Dollar Falls as Trump Agenda Falters; Gold Climbs (Bloomberg.com)

Gold Prices Aim Higher as Fed Rate Hike Bets Continue to Wilt (DailyFX.com)

Gold steady near highest in over two weeks on weaker dollar (Reuters.com)

U.S. Republicans left scrambling after health bill sinks again (Reuters.com)

Homebuilder Sentiment in U.S. Declines to an Eight-Month Low (Bloomberg.com)

New U.S. Subprime Boom, Same Old Sins: Auto Defaults Are Soaring (Bloomberg.com)

Financial Repression To See Balanced Portfolio Return Just 1% Annually (HussManFunds.com)

China just had a 'Black Monday' (BusinessInsider.com)

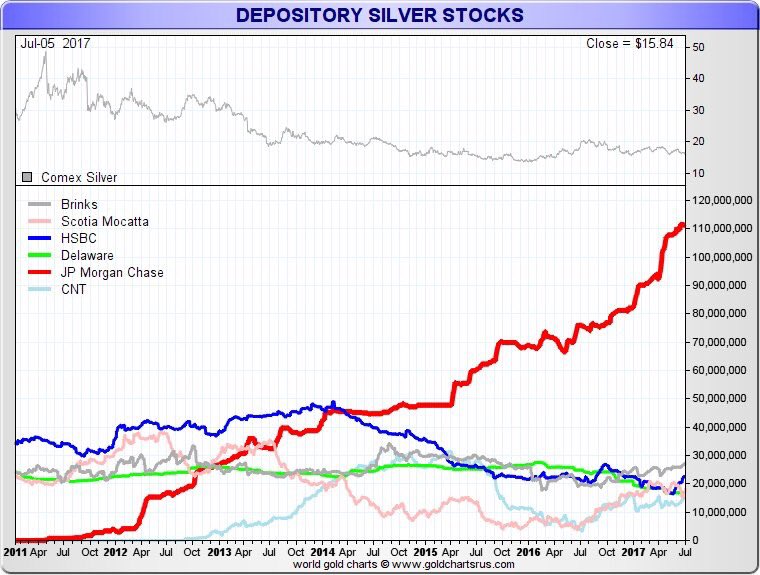

JPM seems to have stopped stacking Comex metal (TFMetalsReport.com)

Gold gains new lustre as global threats go (DailyMail.co.uk)

Gold Prices (LBMA AM)

19 Jul: USD 1,239.85, GBP 950.84 & EUR 1,074.83 per ounce

18 Jul: USD 1,237.10, GBP 949.47 & EUR 1,071.82 per ounce

17 Jul: USD 1,229.85, GBP 940.71 & EUR 1,074.03 per ounce

14 Jul: USD 1,218.95, GBP 940.54 & EUR 1,067.92 per ounce

13 Jul: USD 1,221.40, GBP 944.51 & EUR 1,071.05 per ounce

12 Jul: USD 1,219.40, GBP 947.60 & EUR 1,064.29 per ounce

11 Jul: USD 1,211.90, GBP 938.98 & EUR 1,063.68 per ounce

Silver Prices (LBMA)

19 Jul: USD 16.23, GBP 12.44 & EUR 14.08 per ounce

18 Jul: USD 16.17, GBP 12.41 & EUR 13.99 per ounce

17 Jul: USD 16.07, GBP 12.30 & EUR 14.02 per ounce

14 Jul: USD 15.71, GBP 12.11 & EUR 13.76 per ounce

13 Jul: USD 15.95, GBP 12.34 & EUR 14.00 per ounce

12 Jul: USD 15.83, GBP 12.31 & EUR 13.82 per ounce

11 Jul: USD 15.51, GBP 12.02 & EUR 13.61 per ounce

Recent Market Updates

- Bloomberg Silver Price Survey – Median 12 Month Forecast Of $20

- “Bigger Systemic Risk” Now Than 2008 – Bank of England

- “Financial Crisis” Coming By End Of 2018 – Prepare Urgently

- Video – “Gold Should Probably Be $5000” – CME Chairman

- India Gold Imports Surge To 5 Year High – 220 Tons In May Alone

- “Silver’s Plunge Is Nearing Completion”

- China, Russia Alliance Deepens Against American Overstretch

- Silver Prices Bounce Higher After Futures Manipulated 7% Lower In Minute

- Precious Metals Are “Best Defence” Against Bail-ins In Economic Crisis

- Buy Gold Near $1,200 “As Insurance” – UBS Wealth

- UK House Prices ‘On Brink’ Of Massive 40% Collapse

- Gold Up 8% In First Half 2017; Builds On 8.5% Gain In 2016

- Pensions Timebomb In America – “National Crisis” Cometh

"It is important to note that all portfolios under all conditions actually perform better with exposure to gold and silver" - David Morgan

In the short video above, David Morgan, the Silver Guru, speaks briefly about the importance of owning silver bullion coins and bars as financial insurance in an uncertain world. He speaks about GoldCore Secure Storage and how he recommends GoldCore's ultra secure allocated and segregated gold, silver, platinum and palladium bullion storage (Zurich, London, Singapore and Hong Kong) to his retail and high net worth clients.