Submitted by Michael Shedlock via KMichTalk.com, Looking for group think, extrapolation of extreme silliness, linear thinking, and belief in absurd models? Then look no further than Fed presidents, their advisors, and academia loaded charlatan professors. Today’s spotlight is on Marvin Goodfriend, a former economist and policy advisor at the Federal Reserve’s Bank of Richmond, and Ken Rogoff, a chaired Harvard...

Read More »Jan Skoyles Appointed Research Executive At GoldCore

(Media Release - September 8, 2016 - Immediate Release) – Jan Skoyles - @Skoylesy has been appointed Research Executive at international gold specialist @GoldCore . As a recognized thought leader in the gold and fintech space, Jan will augment GoldCore’s research capabilities and will focus on the UK economy and gold’s role as an important diversification, payment and savings vehicle. As one of the world's largest and fastest growing gold bullion delivery...

Read More »“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that – as we predicted last week – Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed...

Read More »The Yuan and Market Forces: Declaratory and Operational Policy

The Wall Street Journal is reporting that minutes of a meeting in China two months ago reveal that officials there have abandoned their commitment to give market forces greater sway in setting the yuan’s exchange rate. Reportedly, in response to economists and banks request that officials stop resisting market pressure, one PBOC official explained that “the primary task is to maintain stability.” The WSJ cites the minutes of the meeting and interviews with Chinese officials and...

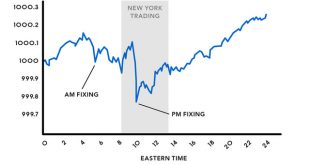

Read More »Every Single Bloody Market Is Manipulated … See For Yourself

Gold and Silver Are Manipulated Deutsche Bank admitted today that it participated with other big banks in manipulating gold and silver prices. In 2014, Switzerland’s financial regulator (FINMA) found “serious misconduct” and a “clear attempt to manipulate precious metals benchmarks” by UBS employees in precious metals trading, particularly with silver. Reuters reported: Swiss regulator FINMA said on Wednesday that it found a “clear attempt” to manipulate precious metals benchmarks during...

Read More »Guess Which Major Bank Loses The Most From Brexit?

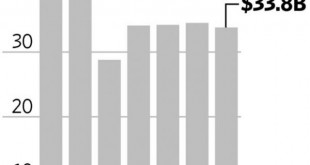

Banks have been lobbying intensively against Brexit. Among those leading the charge is Goldman Sachs. For three years, the bank’s executives have publicly warned about the downsides of leaving the EU... and now we know why (hint - it's not concern for the common man). As The Wall Street Journal reports, about a decade ago, Goldman launched project “Armada,” a plan for a hulking European headquarters on the site of an old telephone exchange in London. Unbundling this kind of structure...

Read More »A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world’s savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published “Negative Rates: How One Swiss Bank Learned to Live in a Subzero World“: Alternative Bank Schweiz AG late last year became Switzerland’s first bank to comprehensively pass along negative rates to all of its customers. Violating an almost religious precept in the financial...

Read More »A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world's savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published "Negative Rates: How One Swiss Bank Learned to Live in a Subzero World": Alternative Bank Schweiz AG late last year became Switzerland’s first bank to comprehensively pass along negative rates to all of its customers. Violating an almost religious precept in the financial...

Read More »Big Players (Read: Governments) Make Markets Unsafe

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke. Reportage in The Wall Street Journal on April 4th states that “A fund owned by China’s foreign-exchange regulator has been taking stakes in some of the country’s biggest banks, raising speculation that it may be a new member of the so-called ‘national team’ of investors the Chinese government unleashes to support its stock market.” Statists and interventionists around the world (read: `those who...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org