Submitted by Gordon T Long via FinancialRepressionAuthority.com, A FALLING MARKET CANNOT BE ALLOWED – at any cost! The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment, excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and...

Read More »Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

[unable to retrieve full-text content]As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »What to Make of the Japanese Market

What’s next for Japanese corporate earnings? Well, that depends. Consider the April-to-June Japanese earnings season, which can be considered a pleasant surprise or a bleak portend based on which numbers you choose to accentuate. Where you stand on Japan depends on where you sit. The quarter was a winner in terms of performance relative to past expectations. Japanese companies beat consensus estimates for both operating and net profits by 11 percent, and twice as many companies beat...

Read More »Greenspan explains negative Swiss Yields

Jeff Gundlach is not the only person who is feeling “maximum negative” on Treasuries. In an interview, none other than the “Maestro” Alan Greenspan, the man whose “great moderation” policy made the current global bond bubble possible, said that he is worried bond prices have risen too high. Asked if he finds what is happened in the bond market right now “in any way, shape, or form concerning for financial...

Read More »Trump, Clinton, “Ugliest” Election Coming – Gold’s “Summer Doldrums” Prior To Resumption of Bull Market

The Trump and Clinton election is set to be one of the "ugliest" and "messiest" U.S. elections ever, astute gold analyst Frank Holmes warned this week. He believes this is a reason to own gold and will be one of the factors that will see a resumption of gold's bull market after the summer doldrums which we explore below. Republican presidential candidate Donald Trump delivers a speech at the Republican National Convention on July 21, 2016 (Photo by John Moore/Getty Images) Gold...

Read More »Central Bankers Around The Globle Scramble To Defend Markets: BOE Pledges $345BN; ECB, Others Promise Liquidity

There was a reason why we warned readers two days ago that "The World's Central Bankers Are Gathering At The BIS' Basel Tower Ahead Of The Brexit Result": simply enough, it was to facilitate an immediate response when a worst-cased Brexit vote hit. And that is precisely what has happened today in the aftermath of the historic British decision to exit the EU. It started, as one would expect, with Mark Carney who said the Bank of England is ready to pump billions of pounds into the financial...

Read More »As Of This Moment, Barclays Is Not Accepting FX Stop Loss Orders

Anyone wondering why gaps and volatility in FX, and especially cable is reaching on the absured today, with 100 pips swings in minutes the norm, the reason is that there is virtually no liquidity, and a main catalyst for this is that as HFTs conduct their usual stop hunts to stop out proximal limit orders, they simply find no such stops. They can blame banks such as Barclays for this development: as of 600 GMT...

Read More »IIF Chief Warns “Brexit Bigger Threat To Global Economy Than Lehman”

As Brexit appears to gathering pace among British voters, Bloomberg Briefs interviews Hung Tan, executive managing director at the Institute of International Finance in Washington, DC., to understand the global impact of a decision by Britain to leave The EU… Q: What would happen if Britain voted to leave the EU? A: It is not Lehman in the short term in terms of markets being in a panic or chaotic mood, because the...

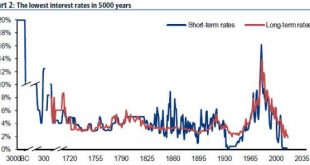

Read More »Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML’s Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financial assets, interest rates & bond yields, economic growth, inflation & debt… The Longest Pictures reveals the astonishing history investors are living through...

Read More »Global Stocks Slide, S&P Set To Open Red For The Year As Hawkish Fed Ignites “Risk Off”

After yesterday's algo-driven mad dash to close the S&P green both for the day and for the year following Fed minutes that came in shocking hawkish, the selling has continued overnight, led by the commodity complex as rate hike fears have pushed oil back down some 2% from yesterday's 7 month highs, which in turn has dragged global stocks lower to a six-week low, while pushing bond yields higher across developed nations as the market suddenly reprices the probability of a June/July rate...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org