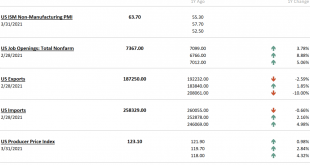

The economic news recently has been better than expected and in most cases just pretty darn good. That isn’t true on a global basis as Europe continues to experience a pretty sluggish recovery from COVID. And China is busy shooting itself in the foot as Xi pursues the re-Maoing of Chinese society, damn the economic costs. But here in the US, the rebound from the Q3 slowdown is in full bloom. Just last week we had pending home sales, ADP employment, both ISM reports,...

Read More »Weekly Market Pulse: Nothing To See Here. No, Really. Nothing.

The answer to the question, “What should I do to my portfolio today (this week, this month)? is almost always nothing. Humans, and especially portfolio managers, have a hard time believing that doing nothing is the right response….to anything…or nothing. We are programmed to believe that success comes from doing things, not not doing things. And so, often we look at markets on a day to day or week to week basis and think something of significance happened and we...

Read More »“The U.S. economy felt like a balloon in search of a needle” – Part II

Interview with Robert Mark: Claudio Grass (CG): In this surreal policy environment, how has the role and the investment process of the value investor evolved, especially over the last decade? How can one still identify value in a world of subsidized binge borrowing, extreme indebtedness, and stock buybacks? Robert Mark (RM): The patriarch of value investing, Ben Graham, once said, “In the short run the market is a voting machine, but in the long run it is a...

Read More »“The U.S. economy felt like a balloon in search of a needle” – Part II

Interview with Robert Mark: Claudio Grass (CG): In this surreal policy environment, how has the role and the investment process of the value investor evolved, especially over the last decade? How can one still identify value in a world of subsidized binge borrowing, extreme indebtedness, and stock buybacks? Robert Mark (RM): The patriarch of value investing, Ben Graham, once said, “In the short run the market is a voting machine, but in the long run it is a weighing...

Read More »“The U.S. economy felt like a balloon in search of a needle” – Part I

Interview with Robert Mark As we move deeper and deeper into this covid crisis, more and more people understand that there’s a lot more to fear besides the disease itself. As the economic impact and the full scale of the damage caused by the lockdowns and the shutdowns become undeniable, there are too many questions lacking any sort of convincing answer and the future for so many employees, business owners, investors and ordinary savers seems bleak and uncertain....

Read More »“The U.S. economy felt like a balloon in search of a needle” – Part I

Interview with Robert Mark As we move deeper and deeper into this covid crisis, more and more people understand that there’s a lot more to fear besides the disease itself. As the economic impact and the full scale of the damage caused by the lockdowns and the shutdowns become undeniable, there are too many questions lacking any sort of convincing answer and the future for so many employees, business owners, investors and ordinary savers seems bleak and uncertain. The one thing...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org