In light of the Fed’s dovish tilt in March, the global liquidity outlook turned further in favor of EM. As a result, EM extended the bounce off the January/February lows. There’s no clear narrative as to why EM is softer this week, but it just seems to be a much-needed correction and positioning flush-out. Bottom line: a dovish Fed (for now) should limit this sell-off, and the EM rally could resume for a while longer before turbulence returns later this year. We expect many EM...

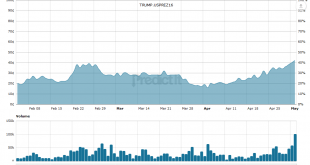

Read More »Great Graphic: Odds of President Trump Rise (Predictit)

TRUMP . USPREZ16 This Great Graphic is a 90-day history of the “betting” at PredictIt that Trump becomes the new US President. With Cruz suspending his campaign, the odds of Trump have risen just above 40%. TRUMP.USPREZ16 The US national interests and challenges to those interests do not change much from year-to-year, and this may help explain the continuity in US foreign policy (including foreign economic policy). Trump’s campaign style emphasized a break from the conventional...

Read More »Greenback Firmer, but has it Turned?

There is one question many investors are asking after noting that with Cruz dropping out of the Republican primary, Trump has secured the nomination, and that is whether the dollar has turned. The greenback has extended yesterday’s reversal higher. The euro had briefly poked through $1.16 and closed on its lows a little below $1.15. Sterling peaked above near $1.4770 and finished near$1.4535 for a potential key reversal. Despite weakness in US stocks and a sharp drop in US yields, two...

Read More »Dollar Continues to Push Lower

The US dollar’s downtrend is extending. The euro traded above $1.16 for the first time since last August. With Japanese markets closed for the second half of the Golden Week holidays, perhaps participants felt less hampered by the risk of intervention and pushed the dollar to almost JPY105.50. Despite an unexpectedly large fall in the UK’s manufacturing PMI (49.2 from 50.7), sterling has pushed to its highest level in four months (~$1.4770). The Australian dollar is the main exception. ...

Read More »FX Daily, May 02: New Month, Same Heavy Dollar

In quiet turnover, with China, Hong Kong, Singapore and London markets closed, the US dollar is trading with a heavier bias against all the major currencies. Lower commodity prices, including oil and copper, appears to be taking a toll on some emerging market currencies, including the South African rand. Japanese markets were closed last Friday and will be closed the next three sessions. The yen appreciated nearly 5% in the aftermath of the FOMC/BOJ meetings last week. The greenback’s...

Read More »Another Strong Jobs Report may Not be Sufficient to Reignite Dollar Rally

The die is cast. The Federal Reserve is on an extended pause after the rate hike last December. The market remains convinced that the risk of a June hike are negligible (~ less than 12% chance). The ECB has yet to implement the TLTRO and corporate bond purchase initiatives that were announced in March. The impact of its programs have to be monitored before being evaluated. It is unreasonable to expect any new initiative in the coming months. The Bank of Japan did not take...

Read More »Weekly Speculative Postions: Euro and Yen Exposure Trimmed ahead of FOMC and BOJ

Speculators in the futures market made mostly small position adjustments in the sessions leading up to the FOMC and BOJ meetings. During the Commitment of Traders reporting week ending April 26, the largest adjustment of speculative position in the currency futures was the 12.5 k build of gross long Australian dollar contracts. The accumulation lifted the gross position to 110.0k contracts, which surpasses the speculative gross long euro position (99.1k contracts) and the speculative...

Read More »Will the Dollar Bloom like May Flowers after April Showers?

April was a cruel month for the US dollar. It fell against all the major currencies; even those whose central banks have negative yields. The greenback also fell against nearly all the emerging market currencies, but the Philippine peso and the Polish zloty. Through the first four months of the year, the dollar is lower against all the major currencies save sterling, which is off about 0.6%. Following the reluctance of the BOJ to ease policy further last week, the yen has moved back...

Read More »FX Daily, April 29: Dollar Losses Extended Ahead of the Weekend

There are two main forces in the foreign exchange market that are rippling through the capital markets. The first is the continued weaker dollar tone. The combination of what appears to be a stagnating US economy (0.5% annualized pace in Q1) and a market that does not believe the Federal Reserve will hike rates in June, and is in fact, judging from the Fed Fund futures strip, skeptical of a single hike this year. The effect of this US dollar weakness help the commodities and emerging...

Read More »Podcast Discussing Dollar, Fed, BOJ on Futures Radio Show

I had the privilege of being interviewed by Anthony Crudele, who is trader at the CME, for the Futures Radio Show. There was much to discuss. The FOMC met yesterday. The market, judging from the Fed funds futures see little chance of a June hike. Economists think otherwise. The Bank of Japan surprised many by not changing policy earlier today. The yen rallied. It seems counter-intuitive. The yen rallied when the BOJ surprised at the end of January when it the rate on some...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org