Many investors still think about gold as if it were money. Economists identify three functions of money: store of value, means of exchange, and a unit of account. It can be a store of value, but the price fluctuates compared with other forms of money, or other commodities, like oil or silver. Some argue that it is a store of value because of the limited supply, but that argument applies to many other goods, including commodities and real estate (which Mark Twain said you have to...

Read More »G7 Summit: Risk of a Global Crisis, Maritime Disputes and the Dollar

The G7 heads of state summit has begun. The host, Japan’s Prime Minister Abe began with doom and gloom. Accounts suggest he warned of the risk of a crisis on the scale of Lehman if appropriate policies are not taken. It is not clear to whom Abe was addressing. It may not have been the other heads of state. It may have been a domestic audience Abe had in mind. At the finance ministers and central bankers meeting last week, Japan’s Aso indicated that contrary to speculation, the retail...

Read More »FX Daily, May 26: Dollar Softer in Consolidation Mode

The US dollar is trading with a softer bias today after the momentum stalled yesterday. The pullback is shallow but could be extended a bit more in the North American session. The US reports weekly jobless claims, durable goods orders and pending home sales. However, the market already appeared to take on board that the US economy is rebounding strongly in Q2 and that the prospects of a Fed hike have increased, but a June/July hike is still not a done deal. The next important step...

Read More »FX Daily, May 25: Dollar Marks time

The US dollar is little changed against the major currencies as yesterday’s moves are consolidated and traders wait for fresh developments. Global equities were higher after Wall Street’s advance yesterday. Asia-Pacific bond yields were firm, following the US lead, but European 10-year benchmark yields are lower, led by the continued rally in Greek bonds after an agreement was struck that will free up a tranche of aid. Source Dukascopy The relative stable capital markets are itself...

Read More »The Yuan and Market Forces: Declaratory and Operational Policy

The Wall Street Journal is reporting that minutes of a meeting in China two months ago reveal that officials there have abandoned their commitment to give market forces greater sway in setting the yuan’s exchange rate. Reportedly, in response to economists and banks request that officials stop resisting market pressure, one PBOC official explained that “the primary task is to maintain stability.” The WSJ cites the minutes of the meeting and interviews with Chinese officials and...

Read More »FX Daily May 23

The capital markets are off to a mixed start to start the last week of the month. Asian shares were mostly higher, though the Nikkei shed 0.5%. European shares are also higher, extending the three-week high seen last week. FX Rates The US dollar is mixed. The yen is the strongest of the majors. The media continues to play up tension between the US and Japan at the weekend G7 meeting over the appropriateness of intervention, but Europe is not very sympathetic either. Today’s...

Read More »FX Week Ahead: Evolving Investment Climate

The US dollar’s weakness in recent months, despite negative interest rates in Europe and Japan likely had many contributing factors. These factors include shifting views of Fed policy, weaker US growth, the recovery in commodity prices, including oil, gold and iron ore, and market positioning. A new phase began in late-April/early May. The dramatic rally in iron prices reversed, and the Australian dollar, bottomed against the US dollar in mid-January, seemingly to anticipate the...

Read More »Daily FX, May 20: Divergence Reasserted, Extends Greenback’s Recovery

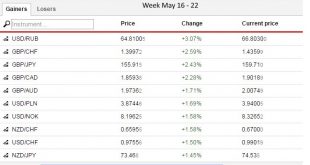

The combination of stronger US economic data and signals from the Federal Reserve that it is looking to continue the normalization process helped the dollar extended its recovery. The dollar posted a significant technical reversal against many of the major currencies on May 3. The Dollar Index rose for its third week, as the greenback climbed against all the major currencies but sterling (+0.9%). Sterling was aided by some polls indicating a shift toward the Remain camp. The...

Read More »FX Daily, May 19: FOMC Minutes Extend Dollar Gains

We felt strongly that the FOMC minutes would be more hawkish than the statement that followed the meeting, and we were not disappointed. However, our caveat remains: the minutes dilute the signal that emanates from the Fed’s leadership, Yellen, Fischer, and Dudley. The latter two speak in the NY morning. Fischer and Dudley’s comment will be scrutinized for confirmation of the hawkish read of the FOMC minutes. Yellen speaks at Harvard at the end of next week. Her comments at the...

Read More »FX Daily, May 18: Greenback Recovers as Rate Support is Enhanced

The US dollar is rising against all the major currencies today. The Australian dollar is retracing a sufficient part of its recent gains to suggest that the current phase of the US dollar’s recovery is not over. Given that the Aussie topped out a week before the other major currencies, it is reasonable that it begins recovering first. Its recent resilience was noted, but that has evaporated today, but a 0.8% drop by early European activity. We had noted the divergence between what...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org