CEPR Discussion Paper 14791, May 2020, with Martin Gonzalez-Eiras. PDF (local copy). We contrast the canonical epidemiological SIR model due to Kermack and McKendrick (1927) with more tractable alternatives that offer similar degrees of “realism” and flexibility. We provide results connecting the different models which can be exploited for calibration purposes. We use the expected spread of COVID-19 in the United States to exemplify our results.

Read More »U.S. National Park Virtual Tours

Links provided by Wanderu.

Read More »Edward Snowden’s “Permanent Record”

An intriguing description of America’s intelligence community and the industry surrounding it; the slippery slopes; and Snowden’s motivation for following his conscience rather than the money. From the book, how we got here: [After 9/11] [n]early a hundred thousand spies returned to work at the agencies with the knowledge that they’d failed at their primary job, which was protecting America. … In retrospect, my country … could have used this rare moment of solidarity to reinforce...

Read More »FX Weekly Preview: Economic Data in the Holiday-Shortened Week

The capital markets will turn increasingly quiet in the week ahead as the Christmas holiday thins participation. If this is the season of goodwill, investors are lapping it up. Global equity markets are finishing a strong year on a high note. Record highs were recorded in the S&P 500 and the Dow Jones Stoxx 600. The MSCI Emerging Markets equity index is at its best level since August 2018. Risk assets are doing well, while interest rates have backed up. The CRB...

Read More »Treasury Direct

A common argument against retail central bank digital currency (CBDC) is that CBDC would undermine financial stability by allowing the general public to swiftly move funds from banks to a government account. But in several countries such swift transfers are possible already today—in the US through Treasury Direct. (The argument also has conceptual flaws, see the paper On the Equivalence of Public and Private Money with Markus Brunnermeier.)

Read More »US Money Markets

For over a year the federal funds rate has increased relative to the rate the Fed pays on excess reserves. In mid September 2019, the federal funds rate increased abruptly, triggering the Fed to inject fresh funds. In parallel, the repo market rates spiked dramatically. On the Cato Institute’s blog, George Selgin argues that structurally elevated demand collided with reduced supply. He mentions explicit and implicit regulation; Treasury General Account (TGA) balances; the NY Fed’s foreign...

Read More »Harvard’s Admissions Policy

A paper by Peter Arcidiacono, Josh Kinsler, and Tyler Ransom offers some glimpses. The lawsuit Students For Fair Admissions v. Harvard University provided an unprecedented look at how an elite school makes admissions decisions. Using publicly released reports, we examine the preferences Harvard gives for recruited athletes, legacies, those on the dean’s interest list, and children of faculty and staff (ALDCs). Among white admits, over 43% are ALDC. Among admits who are African American,...

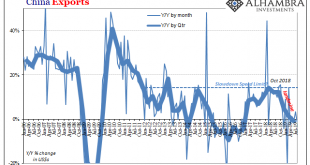

Read More »Is The Negativity Overdone?

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009. And there’s more to come. As Bloomberg reported late last week: Over the next 12 months, interest-rate swap markets have priced in around 58 more...

Read More »FedNow and Fedwire

The Federal Reserve Banks will develop a round-the-clock real-time payment and settlement service, FedNow. The objective is to support faster payments in the United States. From the FAQs (my emphasis): … there are some faster payment services offered by banks and fintech companies in the United States, their functionality can be limited. In particular, due to the lack of a universal infrastructure to conduct faster payments, most of these services rely on “closed-loop” approaches, meaning...

Read More »Where the Phillips Curve is Alive

In an NBER working paper, James Stock and Mark Watson argue that the correlation between cyclically sensitive inflation (CSI) and bandpass filtered activity measures is high and has not declined over the last decades, contrary to standard measures of the slope of the Phillips curve. … we construct a new price index designed to maximize the cyclical variation in the price index. This index, which we call Cyclically Sensitive Inflation (CSI), estimates the weights on the component prices...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org