The die is cast. The Federal Reserve is on an extended pause after the rate hike last December. The market remains convinced that the risk of a June hike are negligible (~ less than 12% chance). The ECB has yet to implement the TLTRO and corporate bond purchase initiatives that were announced in March. The impact of its programs have to be monitored before being evaluated. It is unreasonable to expect any new initiative in the coming months. The Bank of Japan did not take...

Read More »Billion Dollar Lawsuits Filed Following Deutsche Bank’s Admission Of Gold, Silver Rigging

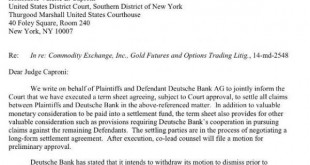

Barely a day had passed since the historic admission of gold and silver price rigging by Deutsche bank, which as we reported on Thursday was settled with not only "valuable monetary consideration", but Deutsche's "cooperation in pursuing claims" against other members of the cartel, i.e., exposing the manipulation of other cartel members, and the class action lawsuits have begun. Overnight, two class action lawsuits seeking $1 billion in damages on behalf of Canadian gold and silver...

Read More »Brexit: Minor Costs, Unclear Benefits (Given the Political Constraints)

A report by Open Europe argues that for the UK the cost of Brexit would be minor. The benefits might be minor as well. For interest groups could make it hard to reap the potential benefits of newly gained flexibility. … the path to prosperity outside the EU lies through: free trade and opening up to low cost competition, maintaining relatively high immigration (albeit with a different mix of skills), and pushing through deregulation and economic reforms in areas where the UK has...

Read More »Inequality and the Welfare State

A new book on inequality by Branko Milanovic adopts an international perspective. The Economist reviews the book: Like Mr Piketty, he begins with piles of data assembled over years of research. He sets the trends of different individual countries in a global context. Over the past 30 years the incomes of workers in the middle of the global income distribution—factory workers in China, say—have soared, as has pay for the richest 1% (see chart). At the same time, incomes of the working class...

Read More »U.S. Futures Slide, Crude Under $39 As Dollar Rallies For Fifth Day

Following yesterday's dollar spike which topped the longest rally in the greenback in one month, the prevailing trade overnight has been more of the same, and in the last session of this holiday shortened week we have seen the USD rise for the fifth consecutive day on concerns the suddenly hawkish Fed (at least as long as the S&P is above 2000) may hike sooner than expected, which in turn has pressured WTI below $39 earlier in the session, and leading to weakness across virtually all...

Read More »Anticipation of Osborne’s Budget Weighs on Sterling

If UK Chancellor of the Exchequer Osborne wants to position himself to be the next Prime Minister, the budget to be unveiled tomorrow may not be particularly helpful. There is little room to relax fiscal policy, given the self-imposed constraints. The deficit for the current fiscal year was projected to be GBP73.5 bln, but through January, the deficit has been GBP66.5 bln. This suggests the deficit will be closer to GBP80 bln. The budget deficit was 4.4% of GDP last year, down from...

Read More »What to Expect from a Brexit Vote

The threat of secession has dogged both European governments and the region as a whole for the last four years. Greece has come perilously close to leaving the euro a number of times since 2012, Scottish voters rejected a proposition to leave the United Kingdom in 2014, and 80 percent of those who voted in Spain’s Catalonia region said they would like to be an independent state in a non-binding poll the same year. (Catalonian separatists plan another push for independence over the next 18...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org