Over the weekend, Saudi King Salman shocked the world by abruptly announcing the arrests of 11 senior princes and some 38 ministers, including Prince Al-Waleed bin Talal, the world’s sixty-first richest man and the largest shareholder in Citi, News Corp. and Twitter. The purge was orchestrated by a new “supreme committee” to investigate public corruption created by King Salman but under the control of Crown Prince Mohammed bin Salman, who chairs the committee and is widely...

Read More »The Savings Rate Conundrum

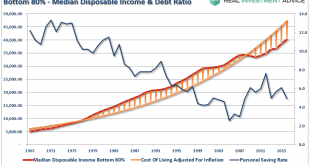

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth. What’s not to love? I just have one question. If things are so good, then why is America’s saving rate posting such a sharp decline? The answer is not...

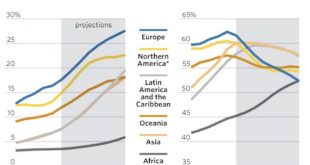

Read More »“This May Be The End Of Europe As We Know It”: The Pension Storm Is Coming

Authored by John Mauldin via MauldinEconomics.com, I’ve written a lot about US public pension funds lately. Many of them are underfunded and will never be able to pay workers the promised benefits – at least without dumping a huge and unwelcome bill on taxpayers. And since taxpayers are generally voters, it’s not at all clear they will pay that bill. Readers outside the US might have felt safe reading those stories....

Read More »Dollar Surge Continues Ahead Of Jobs Report; Europe Dips As Catalan Fears Return

World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

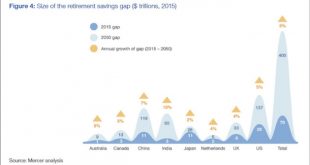

Read More »“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without...

Read More »Top Institutions and Economists Now Say Globalization Increases Inequality

We’ve all heard that globalization lifts all boats and increases our prosperity … But mainstream economists and organizations are now starting to say that globalization increases inequality. The National Bureau of Economic Research – the largest economics research organization in the United States, with many Nobel economists and Chairmen of the Council of Economic Advisers as members – published, a report in May finding: Recent globalization...

Read More »Reports on a Quarterly Survey Conducted: Qualifying Shortage (Labor)

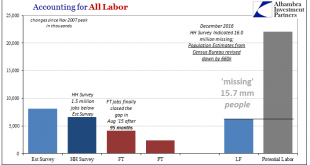

There isn’t a day that goes by in 2017 where some study is released or anecdote is published purporting a sinister labor market development. There is a shortage of workers, we are told, often a very big one. The idea is simple enough; the media has been writing for years that the US economy was recovering, and they would very much like to either see one and be proven right (and that recent revived populism is...

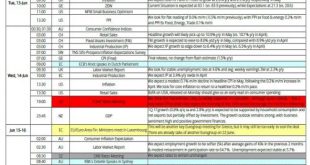

Read More »Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp...

Read More »Forced Finally To A Binary Labor Interpretation

JOLTS figures for the month of April 2017, released today, highlight what is in the end likely to be a more positive outcome for them. It has very little to do with the economy itself, as what we are witnessing is the culmination of extreme positions that have been made and estimated going all the way back to 2014. At that time, the BLS in its various data series suggested an almost perfect labor market acceleration...

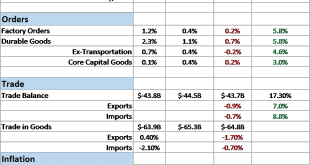

Read More »Bi-Weekly Economic Review

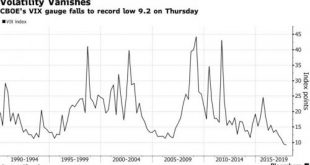

The economic data releases since the last update were generally upbeat but markets are forward looking and the future apparently isn’t to their liking. Of course, it is hard to tell sometimes whether bonds, the dollar and stocks are responding to the real economy or the one people hope Donald Trump can deliver when he isn’t busy contradicting his communications staff. Politics has been front and center recently but...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org