USD/CHF The USDCHF pair succeeded to break 0.9656 level and hold with a daily close below it, which confirms opening the way to extend the bearish wave towards our yesterday’s mentioned next target at 0.9566, noticing that the price approaches retesting the broken level now. Therefore, we are waiting for more decline in the upcoming sessions, noting that breaching 0.9656 might push the price to achieve some intraday...

Read More »The Great Risk of So Many Dinosaurs

The Treasury Borrowing Advisory Committee (TBAC) was established a long time ago in the maelstrom of World War II budgetary as well as wartime conflagration. That made sense. To fight all over the world, the government required creative help in figuring out how to sell an amount of bonds it hadn’t needed (in proportional terms) since the Civil War. A twenty-person committee made up of money dealer bank professionals...

Read More »Weekly Technical Analysis: 18/12/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, EUR/CHF

USD/CHF The USDCHF pair traded with clear negativity yesterday to break 0.9892 level and settles below it, which stops the recently suggested positive scenario and put the price within the correctional bearish track again, noting that there is a bearish pattern that its signs appear on the chart, which means that breaking its neckline at 0.9840 will extend the pair’s losses to surpass 0.9800 and reach 0.9730 as a...

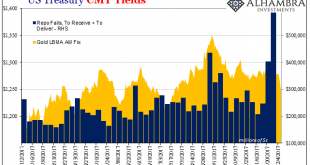

Read More »Chart of the Week: Collateral

It’s been a week of quite righteous focus on collateral. The 4-week bill equivalent yield closes it at just 114 bps, with only three days left before the RRP “floor” is moved up by the FOMC to 125 bps. That’s too much premium in price, though we know why given what FRBNY reported for repo fails last week. With all that, there’s really nothing much to say about what’s below. OK, there is, but I’ll save that for next...

Read More »Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price – FOMC follows through on much anticipated rate-hike of 0.25%– Spot gold responds by heading for biggest gain in three weeks, rising by over 1%– Final meeting for Federal Reserve Chair Janet Yellen– Yellen does not expect Trump’s tax-cut package to result in significant, strong growth for US economy– No concern for bitcoin which ‘plays a very small...

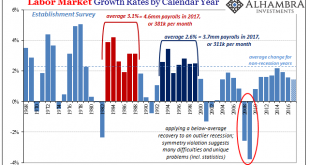

Read More »Defining The Economy Through Payrolls

The year 2000 was a transition year in a lot of ways. Though Y2K amounted to mild mass hysteria, people did have to get used to writing the date with 20 in front of the year rather than 19. It was a new millennium (depending on your view of Year 0) that seemed to have started off under the best possible terms. Not only were stocks on fire at the outset, the economy was, too. The idea of this “new economy” leading...

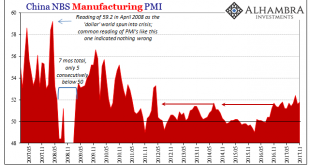

Read More »Three Years Ago QE, Last Year It Was China, Now It’s Taxes

China’s National Bureau of Statistics reported last week that the official manufacturing PMI for that country rose from 51.6 in October to 51.8 in November. Since “analysts” were expecting 51.4 (Reuters poll of Economists) it was taken as a positive sign. The same was largely true for the official non-manufacturing PMI, rising like its counterpart here from 54.3 the month prior to 54.8 last month. China Manufacturing...

Read More »Weekly Technical Analysis: 11/12/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, Gold

USD/CHF The USDCHF pair begins to bounce higher after approaching from 0.9892 level, supported by the EMA50 that meets the mentioned level, while stochastic shows clear bullish trend signals on the four hours time frame. Therefore, these factors encourage us to keep our positive expectations in the upcoming period, waiting for visiting 1.0038 level as a next main station, being aware that breaking 0.9892 will stop...

Read More »Weekly Technical Analysis: 04/12/2017 – USD/CHF, GBP/USD, EUR/GBP, GBP/JPY, GBP/CAD

USD/CHF The USDCHF pair tested the correctional bearish channel’s resistance that appears on the chart and kept its stability below it, accompanied by witnessing clear negative signals through stochastic, which supprots the chances of bouncing bearishly to resume the bearish bias in the upcoming sessions, waiting to test 0.9800 level. Therefore, we suggest witnessing negative trading on the intraday and short term...

Read More »Weekly Technical Analysis: 28/11/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, GBP/JPY

USD/CHF The USDCHF pair fluctuates around 0.9800 level, accompanied by stochastic reach to the overbought areas now, while the EMA50 keeps pushing negatively on the price and protects trading inside the bearish channel that appears on chart. Therefore, these factors encourage us to continue suggesting the bearish trend in the upcoming sessions, and breaking 0.9800 will confirm opening the way to head towards 0.9730...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org