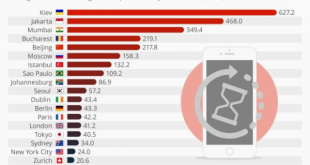

How many hours must you work to buy a new iPhone? It varies dramatically around the world, reflecting disparities in productivity and purchasing power. According to a recent report by UBS that aims to measure well-being by estimating how many minutes workers in various countries must work to afford either an iphone, a Big Mac, a kilo of bread or a kilo of rice, the average worker in Zurich or New York can buy an iPhone...

Read More »Who Has To Work The Longest To Afford An iPhone?

How many hours must you work to buy a new iPhone? It varies dramatically around the world, reflecting disparities in productivity and purchasing power. According to a recent report by UBS that aims to measure well-being by estimating how many minutes workers in various countries must work to afford either an iphone, a Big Mac, a kilo of bread or a kilo of rice, the average worker in Zurich or New York can buy an iPhone...

Read More »Who Has To Work The Longest To Afford An iPhone?

How many hours must you work to buy a new iPhone? It varies dramatically around the world, reflecting disparities in productivity and purchasing power. According to a recent report by UBS that aims to measure well-being by estimating how many minutes workers in various countries must work to afford either an iphone, a Big Mac, a kilo of bread or a kilo of rice, the average worker in Zurich or New York can buy an iPhone...

Read More »Who Has To Work The Longest To Afford An iPhone?

How many hours must you work to buy a new iPhone? It varies dramatically around the world, reflecting disparities in productivity and purchasing power. According to a recent report by UBS that aims to measure well-being by estimating how many minutes workers in various countries must work to afford either an iphone, a Big Mac, a kilo of bread or a kilo of rice, the average worker in Zurich or New York can buy an iPhone 6 in under three working days. In Kiev, by contrast, it would take 13...

Read More »Tax Evasion in a (the) New World

In the FT, Vanessa Houlder reports about the tax evasion business. The new regulatory environment has led to portfolio adjustments and new types of behavior, and it exposes vast differences in enforcement across countries: Diamonds in vaults rather than financial assets. Trusts in South Dakota rather than anonymous bank accounts. Moving to a different country rather than just shifting assets. FATCA versus the Common Reporting Standard. The article also links to an article by Kara Scannell...

Read More »India’s Fight Against Shady Cash Holdings

India follows suggestions to fight tax evasion by taking high denomination notes out of circulation … and introducing new ones. Until the end of the year, Indians may exchange the old banknotes against new ones, at banks or post offices, by identifying themselves. On his blog, J P Koning discusses earlier demonetization episodes in Iraq and Sweden. India’s move does not exactly follow the well publicized suggestions currently debated. But it might work.

Read More »The Demand for Cash

On his blog, J P Koning discusses Kenneth Rogoff’s proposal to abolish high denomination notes (discussed earlier). Koning concludes: I agree with Rogoff’s general point that it makes sense to burden cash users with ever more work since this burden disproportionately falls on heavy users like criminals. But Rogoff hasn’t yet convinced me that the status quo policy of gradually increasing the workload involved in cash usage (via inflation) needs to be sped up by a sudden removal of every...

Read More »FATCA in Reverse?

The Greens/EFA group in the European Parliament wants the European Union to exert more pressure on the United States: the US should no longer serve as a “tax haven” for European tax dodgers. Proposed measures include blacklisting and a FATCA-type 30% withholding tax on EU-sourced payments. From the executive summary of the report commissioned by the group: Two global transparency initiatives are underway that could help tackle financial crimes including tax evasion, money laundering and...

Read More »Nevada Shell Companies, Elliott and Argentina—Some Unforeseen Consequences

In an earlier post (April 2015) I wrote: The Economist reports about Nevada shell companies. In its eternal struggle against the Republic of Argentina, Elliott Management is inquiring about several shell companies in the state. They are suspected to own funds that might have been stolen from the Republic. The hedge fund reasons that it is entitled to those funds because they belong to Argentina, and Argentina owes 2 billion dollars to Elliott according to earlier court rulings. Elliott sued...

Read More »The Panama Papers

Key figures from The Panama Papers.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org