Political actors will continue to stir up controversy in 2017. The elections scheduled for May in France and autumn in Germany will reveal whether the established parties are capable of channeling voters' disaffection into a smooth course or not. Marine Le Pen has made no secret of her intention to have the French electorate vote on EU membership if she is elected French president – which is not an entirely absurd proposition. An exit by France would spell the end of the EU. This...

Read More »“We want to be more Swiss again”

Mr. Gottstein, we're meeting the morning after Stan Wawrinka beat Novak Djokovic in the US Open. How long did you watch last night? Truthfully? I put the kids to bed, and I was only planning to watch the first set. But I stayed up for the whole thing, and when I looked up at the clock, it was 2:46 am. A fantastic match. Wawrinka is a perfect example of Swiss values in the world – just like Roger Federer, but in his own unique way. Nevertheless, my alarm went off at six this...

Read More »Q1 – Q3 2016 China Net Gold Import Hits 905 Tonnes

Submitted by Koos Jansen from BullionStar.com Withdrawals from the vaults of the Shanghai Gold Exchange, which can be used as a proxy for Chinese wholesale gold demand, reached 1,406 tonnes in the first three quarters of 2016. Supply that went through the central bourse consisted of at least 905 tonnes imported gold, roughly 335 tonnes of domestic mine output, and 166 tonnes in scrap supply and other flows recycled...

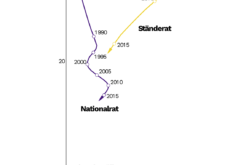

Read More »In Switzerland, the “Elites” Represent Voters

In a post on DeFacto, Michael Hermann argues that in Switzerland the conflict between voters and “political elites” actually has receded. According to Hermann, popular votes helped clarify where voters disagreed with parliamentarians, and this led policy makers to adjust. The figures illustrate how over time, votes in the two chambers of parliament converged towards outcomes in popular votes. Campaigns supported by the right-wing SVP party may have contributed to these developments....

Read More »Global Wealth Update: 0.7 percent Of Adults Control $116.6 Trillion In Wealth

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what is perhaps the biggest reason for the recent “anti-establishment” revulsion: an unprecedented concentration of wealth among a handful of people, as shown in its infamous global wealth pyramid, an arrangement which as observed by the “shocking” political backlash of the past few months suggests that the lower ‘levels’...

Read More »Canadian Bank Starts Charging Negative 0.75% Rate On Most Foreign Cash Balances

BMO Nesbitt Burns - Click to enlarge Despite speculation over the past year that Canada may join Japan and Europe in the NIRP club and launch negative interest rates, so far the BOC has stood its ground. However, starting on December 22, for the broker dealer clients of one of Canada’s most reputable financial institutions, BMO Nesbitt Burns, it will be as if the Canadian bank has cut its deposit rate on most...

Read More »Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered “fake news” within the “serious” financial community, disseminated by fringe blogs? Good times. In an interview with Swiss Sonntags Blick titled appropriately enough “A Recession Is Sometimes Necessary“, the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by...

Read More »Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? Good times. In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks and their ‘supremacy over the...

Read More »BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the “VIX is now broken.” Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the “central banks’ central bank”...

Read More »Are Emerging Markets Still “A Thing”?

By Chris at www.CapitalistExploits.at Last week I jumped on a call with an old friend Thomas Hugger who I hadn’t spoken with in months. I recorded the call for your enjoyment but first a quick bit of background to Thomas. Thomas is a Swiss fund manager living and working in Asian frontier markets such as Vietnam, Bangladesh, and Cambodia, which is a bit like taking a Rolls Royce through the Gobi desert if you think...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org