It has now been 318 trading days since the S&P 500 suffered a 5% drawdown – the 4th-longest streak since 1928… So everything is awesome… [embedded content] BUT…US ‘hard’ economic data has not been this weak (and seen the biggest drop) since Feb 2009… US Data Surprise Index, 2006 - 2017 - Click to enlarge Q3 Was a Roller-Coaster… Q3 was the 8th straight quarterly gain in a row for The Dow – the longest streak since Q3 1997. The Long bond was unch, gold up 3.2%,. but stocks outperformed in Q3… Gold(see more posts on Gold, ) - Click to enlarge Nasdaq just outperformed Small Caps on the quarter as stocks reversed their down-trend seemingly around Yellen’s J-Hole speech… Yellen J-Hole Speech - Click to

Topics:

Tyler Durden considers the following as important: Aussie, Bitcoin, Bond, Business, Copper, Crude, Donald Trump, Dow 30, economy, Featured, Finance, fixed income, Florida, gold price, KIM, Money, NASDAQ, newsletter, Russell 2000, S&P 500, S&P 500 Index, S&P 500, S&P 500 Index, silver price, SNB, Stock market crashes, Swiss National Bank, U.S. Dollar Index, US Dollar Index, VIX, Volatility, Yield Curve, Zerohedge on SNB

This could be interesting, too:

investrends.ch writes UBS-Prognose: Dollar tendiert seitwärts – Euro steigert sich

investrends.ch writes Bitcoin nach Kurseinbruch mit fulminantem Comeback

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

| It has now been 318 trading days since the S&P 500 suffered a 5% drawdown – the 4th-longest streak since 1928… So everything is awesome… | |

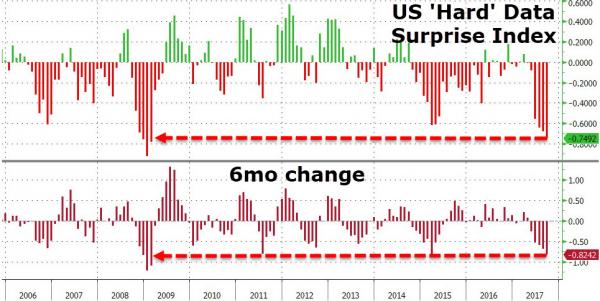

| BUT…US ‘hard’ economic data has not been this weak (and seen the biggest drop) since Feb 2009… |

US Data Surprise Index, 2006 - 2017 |

Q3 Was a Roller-Coaster…Q3 was the 8th straight quarterly gain in a row for The Dow – the longest streak since Q3 1997. The Long bond was unch, gold up 3.2%,. but stocks outperformed in Q3… |

Gold(see more posts on Gold, ) |

| Nasdaq just outperformed Small Caps on the quarter as stocks reversed their down-trend seemingly around Yellen’s J-Hole speech… |

Yellen J-Hole Speech |

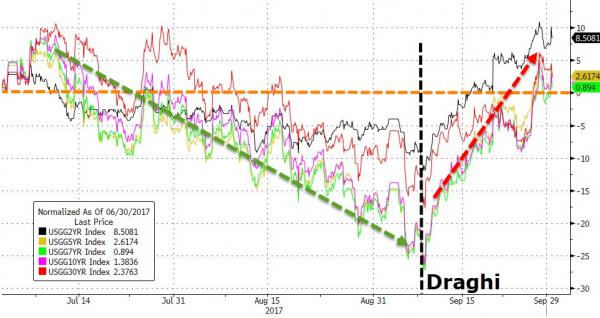

| Treasury Yields are mixed for Q3 with 2Y notably higher but the rest of the curve barely budged…reversing early gains on Draghi’s hawkish comments… |

Treasury Yields, Jul - Sep 2017 |

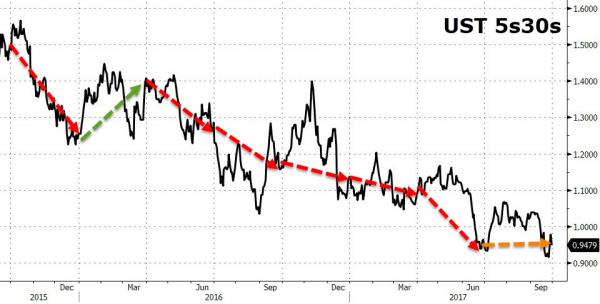

| Interestingly the yield curve – 5s30s – ended unchanged on the quarter (after 5 quarterly declines in a row)… |

US Treasuries, Dec 2015 - Sep 2017(see more posts on U.S. Treasuries, ) |

| The Dollar declined for the 3rd quarter in a row as Gold managed to eke out some gains as oil soared… |

Gold and Silver Prices, Jul - Sep 2017(see more posts on gold price, silver price, ) |

On the month…

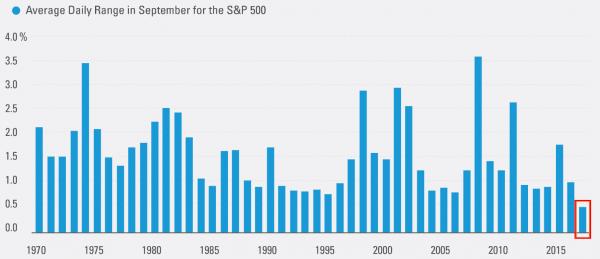

September is now in the books and it’s official – it was the least volatile September for stocks in history… |

S&P 500 Daily Range. 1970 - 2017 |

Some high- and low-lights for September include:

Bonds & Bullion were the month’s laggard as stocks and the dollar surged… |

Gold, S&P 500 and US Treasuries(see more posts on Gold, U.S. Treasuries, ) |

| Trannies & Small Caps ripped… |

Trannies, Small Caps and Nasdaq |

| As Energy, Retailers, and Financials were best (year’s laggards)… |

Energy, Retailers, Financials, Tech and Utes |

| AAPL was a notable laggard in September as FANGs managed small gains… |

FANG and AAPL |

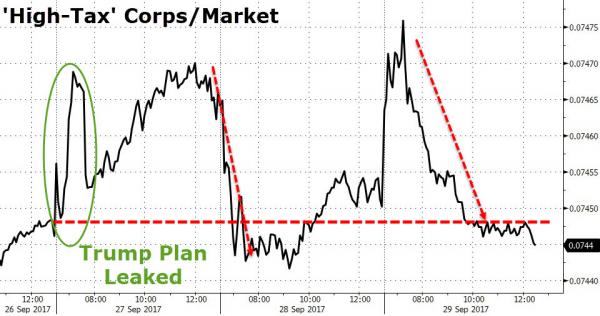

| Equity market gains were also driven by hopes about taxes… |

High Tax Corps and Market, Sep 2017 |

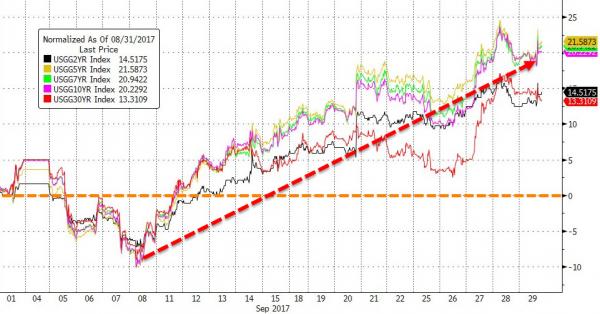

| September was an ugly month for Treasuries…(worst month since Nov 2016 for bonds) |

US Treasuries, Sep 2017(see more posts on U.S. Treasuries, ) |

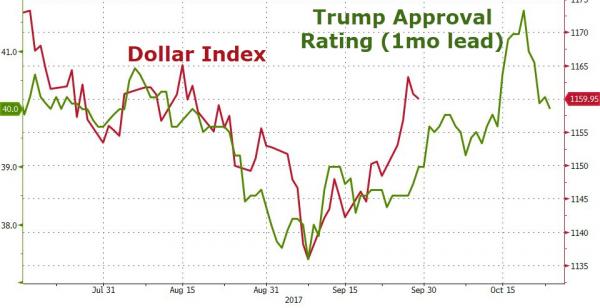

| The Dollar Index reversed its medium-term downtrend in early September after Draghi’s comments… |

Bloomberg Dollar Index, Oct 2016 - 2017(see more posts on Dollar Index, ) |

| It appeared to also coincide with the lagged upturn in President Trump’s approval rating… |

US Dollar Index, Jul - Oct 2017(see more posts on U.S. Dollar Index, ) |

| Notably EURUSD suffered its first monthly loss since February breaking the longest run of monthly gains versus the dollar since January 2013… as 1.20 seemed like the line in the sand for Draghi… |

Euro and USD Index, Oct 2016 - Sep 2017 |

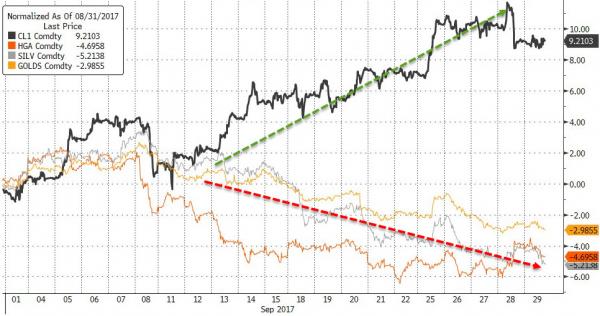

| Oil had a big month as PMs and Copper dropped… |

Gold and Silver Prices, Sep 2017(see more posts on gold price, silver price, ) |

Finally we focus down on this week…The Dow was the laggard on the week, barely scratching out a gain as Small Caps surged – Russell 2000’s best week since Dec 2016 |

The Dow |

| Dow was rammed above 22,400 into the close… |

The Dow |

| But while Small Caps have ripped, high-tax names appear unimpressed by Trump’s plan… |

High Tax Corps and Market, Sep 2017 |

| FANG Stocks manage to recoup all of Monday’s losses… |

FANG Stocks, Sep 2017 |

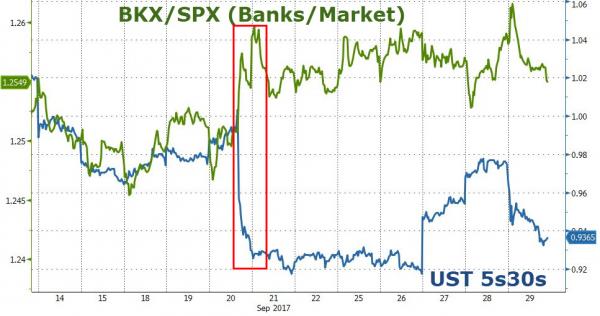

| Banks continue to decouple from the yield curve… |

Banks and Markets, Sep 2017 |

| Notably XIV – the inverse VIX ETF – hit a new record high today… |

VIX ETF |

| As VIX closed at a weekly closing record low, monthly closing record low, and quarterly closing record low… |

VIX |

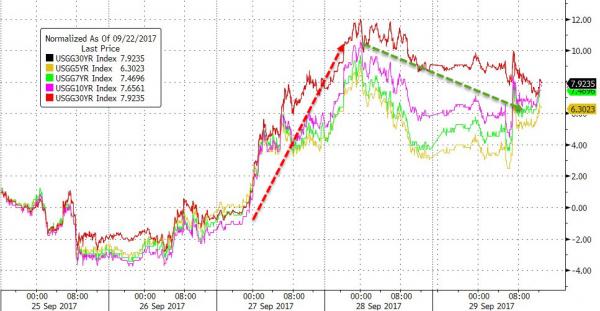

| Treasury yields all rose together this week by 6-8bps… |

US Treasury Yields, Sep 2017(see more posts on U.S. Treasuries, ) |

| The Dollar Index rose 1% on the week – its biggest weekly gains since Dec 2016, led by Aussie and Euro weakness…(NOTE last two days have seen some give back) |

Currencies, Sep 2017 |

| Bitcoin +15% on the week, -12% in September (worst month since Aug 2016), +66% in Q3 (4th quarterly gain in a row) |

Bitcoin Price, Jun - Sep 2017(see more posts on Bitcoin, ) |

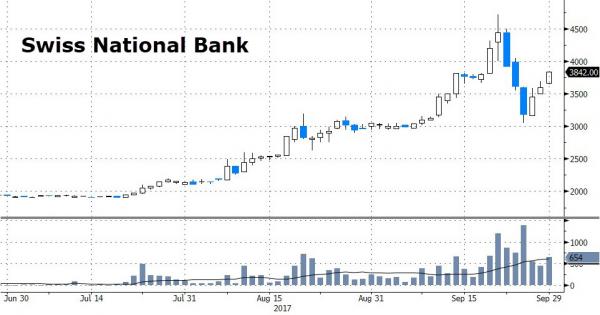

| And then there’s real bubble… Swiss National Bank -2% on the week (worst week since May), +26% in September (6th monthly rise in a row), +98% in Q3 (most since 1997) |

Swiss National Bank, Jun - Sep 2017(see more posts on Swiss National Bank, ) |

| Crude rallied on the week as PMs slipped lower… |

US Crude Oil, Sep 2017 |

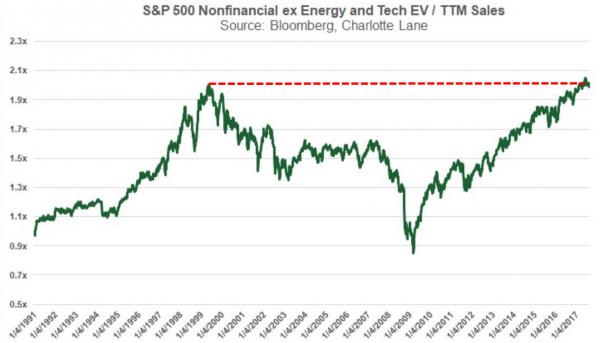

| And finally, a quick reminder – stocks have never… ever… been more expensive than this… |

S&P 500 Nonfinancial Energy and Tech, Jan 1991 - 2017 |

Tags: Aussie,Bitcoin,Bond,Business,Copper,Crude,Dollar Index,Donald Trump,Dow 30,economy,Featured,Finance,Fixed income,Florida,gold price,KIM,money,NASDAQ,newsletter,Russell 2000,S&P 500,S&P 500 Index,silver price,Stock market crashes,Swiss National Bank,U.S. Dollar Index,VIX,Volatility,Yield Curve