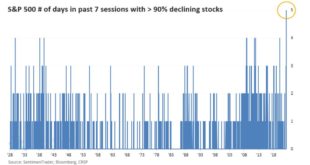

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets. Stocks are now down 10 of the last 11 weeks but the pain was concentrated in the last two weeks. 5 of the last 8 trading days...

Read More »Weekly Market Pulse: Inflation Scare!

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year. Or are we? Well, yes, the 10 year is back where it was but that doesn’t mean everything else is and, as you’ve probably...

Read More »The End of an Epoch, Report 8 Dec

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” What the heck did John Maynard Keynes mean by saying this? Overturning the existing basis of society?! Let’s begin by stating something that is both obvious and unpopular. We are living in days...

Read More »The Perversity of Negative Interest, Report 17 Nov

Today, we want to say two things about negative interest rates. The first is really simple. Anyone who believes in a theory of interest that says “the savers demand interest to compensate for inflation” needs to ask if this explains negative interest in Switzerland, Europe, and other countries. If not, then we need a new theory (Keith just presented his theory at the Austrian Economics conference at King Juan Carlos University in Madrid—it is radically different)....

Read More »Wealth Accumulation Is Becoming Impossible, Report 20 Oct

We talk a lot about the falling interest rate, the too-low interest rate, the near-zero interest rate, the zero interest rate, and the negative interest rate. Hat Tip to Switzerland, where Credit Suisse is now going to pay depositors -0.85%. That is, if you lend your francs to this bank, they take some of them every year. Almost 1% of them. A bank deposit comes with a risk. But instead of compensating you for the risk, the bank pays you nothing. So it’s a return-free...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org