We finally had a resolution, of sorts, in silver. Since April 13, we have had a falling price of silver (indicated as a rising price of the dollar, as measured in silver). And along with this price trend, a growing scarcity of the metal to the market (i.e. the cobasis, the red line). Indeed, the price (of the dollar) and silver scarcity move with uncanny coordination. Almost as if they are linked. ? Silver Basis and the Dollar This graph goes back one year, through...

Read More »What Problem Does Gold Solve?

Realising that you need to protect your portfolio from financial systemic risks is a tricky thing. Because, not only have you identified that all is not well in the economy but you now need to make a decision about how best to protect your investments. In all likelihood, this is why you own or are thinking about owning gold bullion. Have you ever asked yourself? What problem does gold solve in today’s environment? Should I own gold ETFs or gold bullion? What is and...

Read More »Silver Update: Scarcity Gets More Extreme

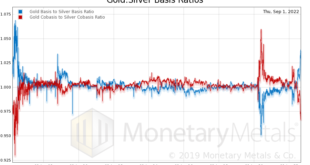

Since our last silver article, the price of silver has dropped. With due respect to Frederic Bastiat, the price is the seen. The basis mostly goes unseen. We will take a look at the market data, revised for a few more days of trading. Warren Buffett, 2008, and the Cobasis But first, let’s look at a chart we have discussed a few times over the years. It shows two ratios: gold basis to silver basis, and gold cobasis to silver cobasis. It shows a measure of gold’s...

Read More »When markets forget that Central Banks cannot fix the world with interest rates

It would be easy for those who have decided to buy gold and silver bullion to lose heart over the precious metals, had they seen how prices reacted to Chairman Powell’s comments, last week. However, to do this would be very short-sighted. Whilst Powell may well have signaled that the Fed will stay on this path of tightening this does not mean that they have resolved the issue. Rather, it likely means that the Fed is reacting a little too hard, a little too late and...

Read More »The Silver Phoenix Market

Listen to the audio version of this article here. The price of silver hit a peak over $26.50 on March 8. It spent about a month and a half breaking down, and then the bottom fell out. It’s currently down from that peak almost 8 bucks. Breaking Down Fundamental Silver Prices However, the opposite has been happening to silver’s scarcity. First, let’s look at a chart of the silver market price and the silver fundamental price. The market price is down a lot since that...

Read More »History Of Money and Evolution Suggests a Crash is Coming

Today’s guest is as much a historian and anthropologist as he is an expert on market events. Jon Forrest Little joins Dave Russell on GoldCore TV today and brings some fascinating insights into what we are currently seeing when it comes to political decisions, financial events and human reactions. From what we can learn from the Romans through to why we need to consider gold’s utility rather than its price, this is an interview bringing a new perspective as to why we...

Read More »Why we couldn’t be happier that gold is boring

We’re the first to admit that investing in gold can be pretty boring. Don’t get us wrong, when you first decide to buy gold then the newness of it is exciting, as you choose which gold bullion dealer to use then it is interesting and when you actually see the gold bars or coins appear in your account then it’s really exciting. But then what? There aren’t any major price moves, it’s not like you see any huge crashes or major leaps to keep you on your toes, not like...

Read More »Will Silver Prices Go Up to $300?

This week’s guest is so bullish on silver that he’s even written a best-selling book ‘The Great Silver Bull’ where he takes an in-depth look at why silver will outperform gold once again and even go as high as $300 an ounce. Author and investments editor Peter Krauth joins Dave Russell on GoldCore TV to discuss the silver price, silver’s future and how industrial demand will continue to grow, outstripping supply. Silver’s a big theme for us at the moment, look out...

Read More »Long Term Gold Price Prediction

What do the weather and the markets have in common? Quite a bit says this week’s guest! Kevin Wadsworth is a meteorologist-turned-chart analyst who has a lot of interesting insight and predictions into market movements and the price of gold. Kevin joins GoldCore TV host Dave Russell to discuss how he applies his 35 years of experience and methodology to financial markets. He takes us through the range of outcomes he sees for the economy, the US Dollar and precious...

Read More »Inflation Crisis 2022 – Marc Faber Interview (Full)

Tune into GoldCore TV where we have just released the full, frank and direct interview with Dr. Marc Faber of the Gloom, Boom, Doom Report in a no-holds barred interview. Following on from the excerpts shown on last week’s The M3 Report we have today released the full interview with the highly-respected veteran of the investment space. Dr. Faber chats inflation, the downfall of central bankers and the war against Putin. Also, find out what the best advice he ever...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org