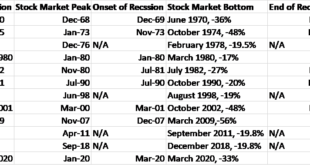

Stocks had a rip snorter of a rally last week and a lot of people are pondering the question in the title over this long weekend. The S&P 500 was down 20.9% from intraday high (4818.62, January 4th) to intraday low (3810.32, May 20th). From that intraday low the market has risen 9.1% in just six trading days. That still leaves the market 13.7% from the intraday high and most investors still down double digits on the year (-11.5% for the standard 60/40 portfolio)....

Read More »Macro and Prices: Sentiment Swings Between Inflation and Recession

(On vacation for the rest of the month. Going to Portugal. Commentary will resume on June 1. Good luck to us all.)The market is a fickle mistress. The major central banks were judged to be behind the inflation curve. Much teeth-gashing, finger-pointing. Federal Reserve Chair Powell was blamed for denying that a 75 bp hike was under consideration. Bank of Japan Governor Kuroda was blamed for keeping the 0.25% cap on the 10-year Japanese Government Bond yield....

Read More »Weekly Market Pulse: Welcome Back To The Old Normal

Stagflation. It’s a word that strikes fear in the hearts of investors, one that evokes memories – for some of us – of bell bottoms, disco, and Jimmy Carter’s American malaise. The combination of weak growth and high inflation is the worst of all worlds, one that required a transformational leader and a cigar-chomping central banker to defeat the last time it came around. Or at least that’s how it’s remembered. Whether the cigar-chomping central banker was really...

Read More »Weekly Market Pulse: What Now?

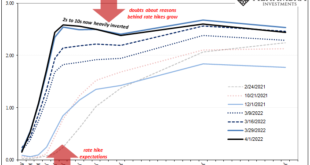

The yield curve inverted last week. Well, the part everyone watches, the 10 year/2 year Treasury yield spread, inverted, closing the week a solid 7 basis points in the negative. The difference between the 10 year and 2 year Treasury yields is not the yield curve though. The 10/2 spread is one point on the Treasury yield curve which is positively sloped from 1 month to 3 years, negatively sloped from 3 years to 10 years and positively sloped again from 10 out to 30...

Read More »The Short, Sweet Income Case For Ugly Inversion(s), Too

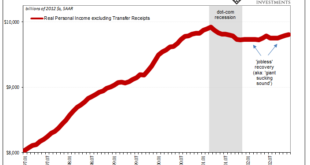

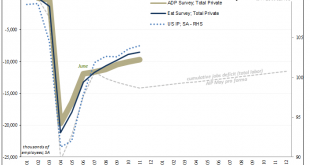

A nod to just how backward and upside down the world is now. The economic data everyone is made to pay attention to, payrolls, that one is, in my view, irrelevant. As is the consumer price estimates from earlier this week, the PCE Deflator. That’s another one which receives vast amounts of interest even though it is already old news. Yet, in the very same data release as the PCE, some other accounts importantly tied to labor, personal income, they slip unnoticed...

Read More »White-Hot Cycles of Silence

We’re only ever given the two options: the economy is either in recession, or it isn’t. And if “not”, then we’re led to believe it must be in recovery if not outright booming already. These are what Economics says is the business cycle. A full absence of unit roots. No gray areas to explore the sudden arrival of only deeply unsatisfactory “booms.” Every once in a while, however, even the mainstream media meanders closer to the actual economics (small “e”) of the...

Read More »The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

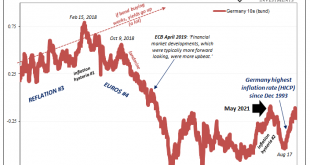

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup? You can’t blame COVID at the tail end for a woeful string which actually dates back farther than the last pandemic (H1N1). Emil Kalinowski has it absolutely right; what happened in 2013 in the Treasury...

Read More »Revisiting The Last Overhang

One reason why I still believe the US most likely would have entered a recession at some point in 2020 even without COVID wasn’t just the yield curve inversion that popped up several months before then. In August of 2019, the small part of the Treasury curve most people pay attention to (2s10s) did send out that dreaded signal, suggesting already to expect contraction in the intermediate term ahead of then. But there was more to it than that, much moving in the...

Read More »Seizing The Dirt Shirt Title

In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn. This view had been punctuated by Fed Vice Chairman Richard Clarida, among many others, who in early January...

Read More »Consumers, Too; (Un)Confident To Re-engage

There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend). Once the snowball of macro contraction begins rolling downhill, rational prudence dictates some degree of caution on all parts (pro-cyclicality). Bathed in the unearned glow of the Great “Moderation”,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org