Mario Draghi can thank Jay Powell at his retirement party. The latter being so inept as to allow federal funds, of all things, to take hold of global financial attention, everyone quickly shifted and forgot what a mess the ECB’s QE restart had been. But it’s not really one or the other, is it? Once it actually finishes, the takeaway from all of September should be the world’s two most important central banks each botching their “accommodations.” It’s only a little...

Read More »Focus Is On The Pre-recession Condition

Before the Great “Recession” ended the business cycle as we once knew it, there was a widely accepted concept known as stall speed. In the US, if GDP growth decelerated down to around 2% it suggested the system had reached a danger zone of sorts. In a such a weakened state, one good push, or shock, could send the economy plunging into recession. Any economy which might slow down into a weakened state for whatever reasons becomes susceptible. What might be a minor,...

Read More »A Bigger Boat

For every action there is a reaction. Not only is that Sir Isaac Newton’s third law, it’s also a statement about human nature. Unlike physics where causes and effects are near simultaneous, there is a time component to how we interact. In official capacities, even more so. Bureaucratic inertia means a lot more than just resistance to change, it also means, at times and in certain capacities, all sorts of biases. When the bureaucracy predicts one set of circumstance,...

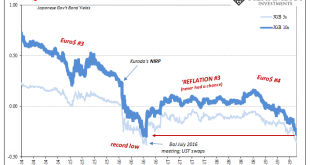

Read More »Japan: Fall Like Germany, Or Give Hope To The Rest of the World?

After trading overnight in Asia, Japan’s government bond market is within a hair’s breadth of setting new record lows. The 10-year JGB is within a basis point and a fraction of one while the 5-year JGB has only 2 bps to reach. It otherwise seems at odds with the mainstream narrative at least where Japan’s economy is concerned. Japan JGB, Jan 2014 - Jul 2019 - Click to enlarge Record lows in Germany, those seem to make sense. By every account, the German...

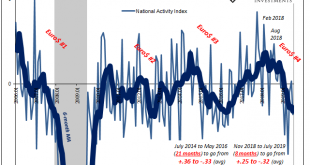

Read More »Definitely A Downturn, But What’s Its Rate of Change?

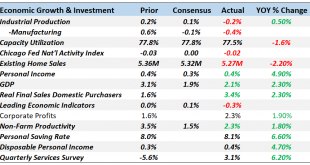

The Chicago Fed’s National Activity Index (NAI) fell to -0.36 in July. That’s down from a +0.10 in June. By itself, the change from positive to negative tells us very little, as does the absolute level below zero. What’s interesting to note about this one measure is the average but more so its rate of change. The index itself is a product of econometric research. Economists had been searching for an alternative to the unemployment rate in order to increase the...

Read More »Monthly Macro Monitor: Does Anyone Not Know About The Yield Curve?

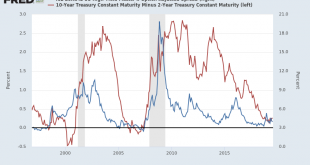

The yield curve’s inverted! The yield curve’s inverted! That was the news I awoke to last Wednesday on CNBC as the 10 year Treasury note yield dipped below the 2 year yield for the first time since 2007. That’s the sign everyone has been waiting for, the definitive recession signal that says get out while the getting is good. And that’s exactly what investors did all day long, the Dow ultimately surrendering 800 points on the day. I don’t remember anyone on CNBC...

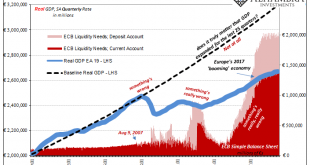

Read More »Germany’s Superstimulus; Or, The Familiar (Dollar) Disorder of Bumbling Failure

The Economics textbook says that when faced with a downturn, the central bank turns to easing and the central government starts borrowing and spending. This combined “stimulus” approach will fill in the troughs without shaving off the peaks; at least according to neo-Keynesian doctrine. The point is to raise what these Economists call aggregate demand. If everyday folks don’t want to spend – because a lot of them can’t – then the government will spend on their...

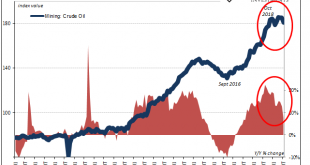

Read More »US Industrial Downturn: What If Oil and Inventory Join It?

Revised estimates from the Federal Reserve are beginning to suggest another area for concern in the US economy. There hadn’t really been all that much supply side capex activity taking place to begin with. Despite the idea of an economic boom in 2017, businesses across the whole economy just hadn’t been building like there was one nor in anticipation of one. The only place where there was a truly robust trend was the oil patch. Since the last crash a few years ago,...

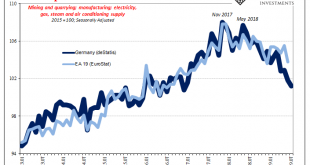

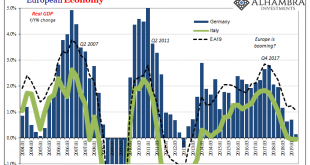

Read More »Why You Should Care Germany More and More Looks Like 2009

What if Germany’s economy falls into recession? Unlike, say, Argentina, you can’t so easily dismiss German struggles as an exclusive product of German factors. One of the most orderly and efficient systems in Europe and all the world, when Germany begins to struggle it raises immediate questions about everywhere else. This was the scenario increasingly considered over the second half of 2018 and the first few months of 2019; whether or not recession. Over the past...

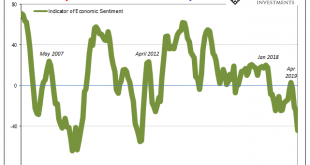

Read More »Monthly Macro Monitor: We’re Not There Yet

It’s been a slow turnin’ From the inside out A slow turnin’ But you come about Slow learnin’ But you learn to sway A slow turnin’ baby Not fade away Now I’m in my car I got the radio on I’m yellin’ at the kids in the back ‘Cause they’re bangin’ like Charlie Watts Slow Turning by John Hiatt “How did you go bankrupt?” Bill asked. “Two ways”, Mike said. “Gradually and then suddenly.” The Sun Also Rises, By Ernest...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org