We expect the ECB to announce a tapering of its asset purchase programme in the summer, but not to overreact to strong economic data. Our first choice as the title for our 2018 ECB outlook was “The courage not to act”, but regular readers will know that we used this hommage to Ben Bernanke earlier this year. Yet our faith in ECB’s courage knows no bounds and this still feels relevant today, with the caveat that the ECB...

Read More »Chinese demand leads the Swiss watch industry’s recovery

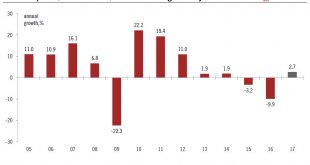

The most important driver of the Swiss watch industry’s recovery has been the revival of the mainland China market. After years of impressive growth, the Swiss watch industry faced difficult conditions in 2015 and 2016, when exports declined by 3.2% and 9.9% respectively in value terms. The last time that there were two consecutive years of decline was in 1995-96. The appreciation of the Swiss franc, the collapse of...

Read More »US to overtake Switzerland in WEF competitiveness survey?

The US is about to enact significant corporate tax cuts, and could therefore edge closer to the number 1 spot in the World Economic Forum’s ranking – currently held by Switzerland. The US is about to enact significant corporate tax cuts, that will see the federal statutory corporate tax rate drop to 21%, from 35%, starting in January (see our latest note ‘US tax cuts update – 19 December 2017’). This will significantly...

Read More »Increasingly optimistic on Swiss outlook

At its December meeting, the Swiss National Bank (SNB) left its accommodative monetary policy unchanged. More specifically, the SNB maintained the target range for the three-month Libor at between – 1.25% and-0.25% and the interest rate on sight deposits at a record low of – 0.75%. The SNB also reiterated its commitment to intervene in the foreign exchange market if needed, taking into account the “overall currency...

Read More »ECB closer to the 2% inflation target than meets the eye

During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation. The key word was “confidence” – in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its mandate. That said, ECB President Mario Draghi...

Read More »Euro area: The sky is the limit

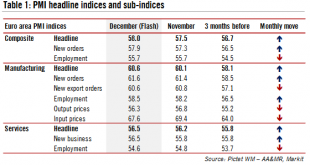

Momentum in the euro area picked up further at the end of the year. The flash composite purchasing managers’ index (PMI) increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2). The improvement was once again broad-based across sectors. Both the manufacturing (+0.5 to 60.6) and services (+0.3 to 56.5) indices improved in December, with the former reaching its highest level since the...

Read More »Slow wage growth to keep Fed on prudent normalisation track

The November employment report showed another ‘Goldilocks’ set of conditions for investors: employment growth remained firm, especially in cyclical sectors like manufacturing and construction. At the same time, wage growth stayed soft – which means the Federal Reserve is unlikely to shift its current prudent communication on interest -rate hikes (although it is still very likely to hike 25bps on 13 December)....

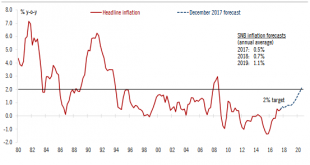

Read More »ECB preview: close to target…by 2020

The ECB’s meeting on 14 December would be a non-event if it were not for two specific points to make clear before the Christmas break – the staff forecasts for inflation, and the not-so-constructive ambiguity on QE horizon. We expect no major surprise from the new staff projections, reflecting the ECB’s cautiously upbeat tone. Euro area real GDP growth forecasts will likely be revised higher for the fifth...

Read More »Fed rate unlikely to move much above 2% next year

The Federal Reserve is probably looking back at 2017 with satisfaction. After on the rate rise expected on 13 December, it will have pushed through the three rate hikes it signalled earlier in the year. For once, it has not under-delivered. Meanwhile, the gradual, ‘passive’ decline in the Fed’s balance sheet has been mostly ignored by markets. In fact, broader financial conditions have eased this year despite the...

Read More »A crucial step towards US tax cuts

With the approval of the Senate tax bill in the early hours of Saturday 2 December, a key step has been taken toward tax cuts. The next chapter in the process is to reconcile this version with the House of Representatives’ tax bill, most likely in a ‘conference committee ’ from which a final version will emerge. Various lobbies have been taken by surprise by the speed with which tax legislation has moved forward in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org