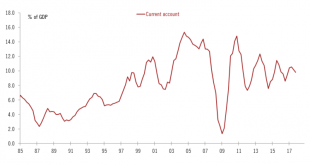

Following the Swiss National Bank’s (SNB) publication of Switzerland’s balance of payments data for Q4 2017, in this note we look deeper into the Swiss current account to try to find out why Switzerland persistently runs a surplus and whether or not the current account balance can be used to assess the fair value of the Swiss franc. In 2017, the current account surplus stood at around 9.8% of GDP or CHF66bn. This was...

Read More »Euro area Flash PMIs: “Growing pains” but no reason to panic

Today’s first batch of euro area March business surveys looks worrying at first sight. The drop in the euro area composite PMI index, from 57.1 to 55.3 in March (consensus: 56.8), was the second one in a row and the largest monthly decline in six years. New orders fell to a 14-month low. The correction in business sentiment was predominantly driven by the manufacturing sector, which could reflect broader concerns of a...

Read More »Europe chart of the week – monetary policy

Much of recent ECB dovish rhetoric has been building around the (not-sonew) idea that potential growth might be higher than previously thought, implying a larger output gap and lower inflationary pressure, all else equal. The argument is both market-friendly and politically welcome – what we are seeing is the early effects of those painful structural reforms implemented during the crisis. Inflation would be low for good...

Read More »Europe chart of the week – Employment

Euro area employment grew for the 18th consecutive quarter in Q4 2017 (+0.3% q-o-q), and is now 1.5% above its pre-crisis (2008) level. By contrast, hours worked per person employed decreased during the same period, remaining 4% below their pre-crisis level. The two data series have followed divergent trends since the start of the economic recovery. Between Q1 2008 and Q2 2013, the total amount of labour input used by...

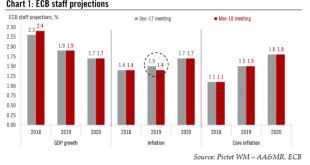

Read More »ECB begins to rotate forward guidance

The ECB made one small change to its communication in March consistent with a normalisation process that is likely to remain very gradual. In line with our expectations, today the Governing Council (unanimously) decided to drop its commitment to increase asset purchases “in terms of size and/or duration” if needed, which had steadily become more difficult to justify and less credible anyway. In effect, the ECB has...

Read More »Europe chart of the week – SNB FX intervention

Despite tensions since the beginning of the year, there is no evidence of FX market interventions by the Swiss central bank. SNB FX Intervention In the wake of the financial crisis, the Swiss National Bank (SNB) increased massively the monetary base to provide liquidity and limit the Swiss franc’s appreciation. The expansion in the monetary base can essentially be seen in the form of an increase in sight deposits held...

Read More »SNB confirms record profit for 2017

The Swiss National Bank (SNB) published its 2017 annual result today. The SNB confirmed a profit of CHF54.4bn in 2017. This was more than double the 2016 figure (CHF24.5bn) and its biggest profit ever. Earnings from the SNB’s foreign currency positions amounted to CHF49.7bn, its gold holdings increased in value by CHF3.1bn and its Swiss positions by CHF2bn (see Chart below). The CHF2bn profit the SNB made on its Swiss...

Read More »China: February PMIs point to deceleration in industrial activity

China’s official manufacturing Purchasing Manager Index (PMI) for February, compiled by the National Bureau of Statistics of China and the China Federation of Logistics and Purchasing, came in at 50.3, down from 51.3 in January and 51.6 in December 2017. This is the lowest reading of this gauge since October 2016. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in...

Read More »Europe – ECB preview

Market participants have enjoyed a protracted period of very low volatility, but it may well have come to an end in 2018. Central banks are often said to be responsible for the disappearance of volatility, for example through their large-scale asset purchases, which have compressed the term premium. But, now that the same central banks are heading for the exit from unconventional policies, they, too, need to relearn how...

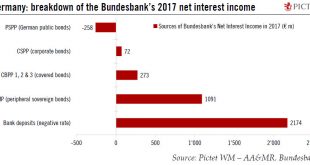

Read More »ECB policy is boosting the Bundesbank’s profits

This week the German Bundesbank published its 2017 annual report, which includes a number of interesting figures that are relevant to the broader (monetary) policy debate in the euro area. In particular, the Bundesbank provided details of the amount of securities held on its balance sheet for policy purposes, including QE, at the end of 2017, and the corresponding flows of income stemming from its asset purchases....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org