China’s official manufacturing purchasing manager index (PMI) came in at 51.3 in January, down slightly from December (51.6). The Markit PMI (also known as the Caixin PMI) stayed at 51.5, the same as in the previous month (Chart 1). The official non – manufacturing PMI rose slightly to 55.0 in January from 44.8 the previous month. The official composite index, which is a weighted average of the manufacturing and non –...

Read More »Strong growth and Abenomics mean Japanese equities continue to provide opportunities

Momentum in the Japanese economy remains strong Japanese growth momentum is at its strongest in over a decade, with the quarterly Tankan survey of business conditions and sentiment strengthening to an 11 – year high in Q4 2017. The economy may have expanded by 1.8% in 2017, up from 0.9% in the previous year. In 2018, the growth rate may moderate slightly to 1.3%, but should remain well above Japan’s potential growth,...

Read More »Tax cuts and ‘animal spirits’ mean higher US growth in 2018

December’s US tax cuts – which saw corporate taxation reduced particularly sharply – are being echoed in signs that ‘animal spirits’ are finally kicking in. Both set the stage, in our view, for higher US growth, in large part driven by greater investment. We therefore upgrade our 2018 US growth forecast from 2.0% to 3.0%. We forecast that real non-residential investment growth will accelerate to 7.0% in 2018, up from an...

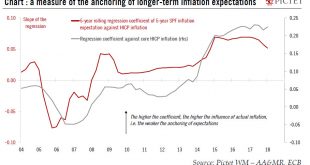

Read More »Europe chart of the week – The beginning of the ‘re-anchoring’

Professional Forecasters survey shows a substantial improvement in economic growth and employment, consistent with the ECB’s own assessment. The ECB will be pleased by its latest Survey of Professional Forecasters (SPF). The headlines are unambiguously positive, fuelled by the uninterrupted improvement in economic data, with expectations of GDP growth and HICP inflation revised higher for the next couple of years,...

Read More »US chart of the week – Texas rebounds

One of the major rivalries in the US is that between California and Texas, the country’s biggest and second-biggest states respectively in GDP terms. They have different growth drivers (most notably Silicon Valley in California and the energy industry in Texas), and they also have different political landscapes – and local taxation regimes. But which one’s ahead when it comes to employment growth? The two states were...

Read More »Euro area: Business activity expanding at its fastest pace in nearly 12 years

The flash composite Purchasing Managers’ index for the euro area increased to 58.6 in January from 58.1 in December, above consensus expectations (57.9). The services sector index rose, offsetting the decline in the manufacturing index . Companies also expressed growing optimism about this year’s outlook, with business expectations up to an eight-month high. The only piece of less positive news was a modest drop in...

Read More »Upside risks to wages from IG Metall negotiations

German wage negotiations are in full swing amid growing calls for strikes. This comes at a crucial time for the ECB as strong growth and falling unemployment are expected to feed into higher inflation. IG Metall is by far the most important union to watch, representing almost 4 million German workers and being seen as a benchmark, including in the car industry or the construction sector this year. Importantly, the...

Read More »China: FX reserves rise again

According to the Chinese State Administration of Foreign Exchange (SAFE), China’s FX reserves amounted to USD3.14 trillion at end – December 2017, up USD20.7 billion from the previous month. This marks the 11th consecutive monthly increase in Chinese FX reserves since February 2017. In full – year 2017, Chinese FX reserves increased by USD129.4 billion, in contrast with a drop of USD512.7 billion in 2015 and USD320...

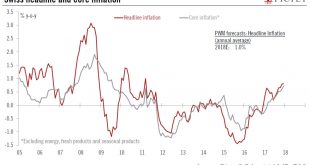

Read More »Switzerland: Inflation at a seven-year high

According to the Swiss Federal Statistical Office (FSO), consumer prices in Switzerland remained broadly stable at 0.8% y-o-y in December, in line with consensus expectations, meaning that Swiss inflation stayed at its highest rate in almost seven years at the end of 2017. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) rose slightly from 0.6% y-o-y in November to...

Read More »Global macro: 10 surprises for 2018

Having laid down our expectations for the World economy in 2018, in this note we describe a number of potential surprises to the outlook. The usual suspects, or ‘known unknowns’, include a larger-than-expected fiscal boost from US tax cuts, (geo-)political risks, economic policy mistakes, inflation surprises, a financial bubble burst, or a Minsky moment in China, to name a few. We chose to include some of the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org