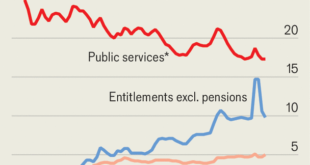

Says The Economist. The authors argue that falling state capacity, incompetence, corruption, and transfer/entitlement spending, which crowds out public investment and services, are to blame. Update: Related, in VoxEU, Martin Larch and Wouter van der Wielen argue that [g]overnments lamenting a stifling effect of fiscal rules on public investment are often those that have a poor compliance record and, as a result, high debt. They tend to deviate from rules not to increase public investment...

Read More »Is gold too expensive?

Over the last couple of years we witnessed quite an extraordinary ride in gold prices. An impressive ascent until the last quarter of 2020 was followed by a pullback that scared many speculators away, which in turn transformed into a period of strength and then came another ebb… And recently, once again, we saw the yellow metal shoot up, fueled by inflation fears and the situation in Ukraine. Given that the fundamentals remain unchanged and that the only way is up for gold, another...

Read More »Is gold too expensive?

Over the last couple of years we witnessed quite an extraordinary ride in gold prices. An impressive ascent until the last quarter of 2020 was followed by a pullback that scared many speculators away, which in turn transformed into a period of strength and then came another ebb… And recently, once again, we saw the yellow metal shoot up, fueled by inflation fears and the situation in Ukraine. Given that the fundamentals remain unchanged and that the only way...

Read More »Defaults Are Coming, Market Report, 22 June

We are reading now about possible regulations for air travel. In brief: passengers might be forced to spend hours at the airport. Authorities will perform medical checks, including possibly needles to draw blood, no lounges, no food or drink on board the plane, masks required at all times, and even denied the use of a bathroom except by special permission. We would wager an ounce of fine gold against a soggy dollar bill that people will hate this. The majority of...

Read More »Monetary Policy and the Wealth Distribution

In a Staff Working Paper, the Bank of England’s Philip Bunn, Alice Pugh, and Chris Yeates discuss how monetary policy easing following the financial crisis affected income and wealth of different age groups. The authors analyze survey panel data (ONS Wealth and Assets Survey) on households’ characteristics and balance sheet positions. They argue that the overall effect of monetary policy on standard relative measures of income and wealth inequality has been small. Given the pre-existing...

Read More »Bankrupt US Public Sector Pension Schemes

In a Hoover Institution Essay, Joshua Rauh describes the extent to which US states and communities under fund public sector pensions. Even under states’ own disclosures and optimistic assumptions about future investment returns, assets in the pension systems will be insufficient to pay for the pensions of current public employees and retirees. Taxpayer resources will eventually have to make up the difference. Despite the implementation of new Governmental Accounting Standards Board (GASB)...

Read More »Social Insurance in Switzerland

Information from the Swiss Federal Social Insurance Office on the social insurance system in Switzerland: Brief Overview: HTML. Longer overview: PDF. Social Insurance Accounts with links to data, in German (Schweizerische Sozialversicherungsstatistik): PDF. Pocket statistics, in English: PDF. In German: PDF.

Read More »Chile’s Fully Funded Pension System

On Project Syndicate, Andres Velasco argues that one of the sources of the current problems with the Chilean pension system are the high fees charged by fund managers: A government-appointed commission recently concluded that managers have generated high gross real returns on investments: from 1981 to 2013, the annual average was 8.6%; but high fees cut net returns to savers to around 3% per year over that period. The commission’s report.

Read More »I Testified Before the AZ Senate

Please bear with a brief quote from a favorite author of mine. I promise it relates to gold. Having fought in World War I, and seen senseless loss of life, J.R.R. Tolkien had an extraordinary insight into the nature of evil. His iconic character, Gandalf the wizard, said this to Frodo in The Lord of the Rings: ‘Ever since Bilbo left I have been deeply concerned about you…. It would be a grievous blow to the world, if the Dark Power overcame the Shire; if all your kind [hobbits] … became...

Read More »I Testified Before the AZ Senate

Please bear with a brief quote from a favorite author of mine. I promise it relates to gold. Having fought in World War I, and seen senseless loss of life, J.R.R. Tolkien had an extraordinary insight into the nature of evil. His iconic character, Gandalf the wizard, said this to Frodo in The Lord of the Rings: ‘Ever since Bilbo left I have been deeply concerned about you…. It would be a grievous blow to the world, if the Dark Power overcame the Shire; if all your kind [hobbits] … became...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org