Waiting for the Flood We have noticed a proliferation of pundits, newsletter hawkers, and even mainstream market analysts focusing on one aspect of the bitcoin market. Big money, institutional money, public markets money, is soon to flood into bitcoin. Or so they say. We will not offer our guess as to whether this is true. Instead, we want to point out something that should be self-evident. If big money is soon to come in, and presumably drive the price up to whatever new height — perhaps even the magic ,000,000 — what comes after? In the restless churn that has overgrown our capital markets, investors speculators are always seeking to get into whatever asset is bubbling up. Big money leaving will follow big money

Topics:

Keith Weiner considers the following as important: Chart Update, Debt and the Fallacies of Paper Money, Featured, newslettersent, On Economy, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Waiting for the FloodWe have noticed a proliferation of pundits, newsletter hawkers, and even mainstream market analysts focusing on one aspect of the bitcoin market. Big money, institutional money, public markets money, is soon to flood into bitcoin. Or so they say. We will not offer our guess as to whether this is true. Instead, we want to point out something that should be self-evident. If big money is soon to come in, and presumably drive the price up to whatever new height — perhaps even the magic $1,000,000 — what comes after? In the restless churn that has overgrown our capital markets, investors speculators are always seeking to get into whatever asset is bubbling up. Big money leaving will follow big money entering, as surely as a rock thrown into the air will fall back down. |

Bitcoin, Weekly |

In last week’s Supply and Demand Report, we excerpted a quote from economist John Maynard Keynes. He cited Vladimir Lenin discussing how to destroy Western civilization. Here is the full quote (from The Economic Consequences of the Peace):

Keynes is talking about printing currency, which causes rising prices. He went on to note that businesses who buy and sell goods get rich. There is always a price increase between when they buy and sell. And when they borrow to invest in property and plant, they profit again. He is describing the American economy in the 1960’s and 1970’s (except the Fed does not print, it borrows). It does not describe the present environment (see also Keith’s article The Lazy 1970’s vs. the Frenetic 2000’s). Today, prices are not rising, but falling. Crude oil, for example, has not merely fallen a little. It has been an epic collapse (which is likely not over). Commodities show monetary effects most clearly (and skyrocketing healthcare costs are not the effect of monetary policy, but regulatory and fiscal policy). Yet, Lenin’s debauchery is still occurring. The hidden forces of economics are still in operation. The undermining of civilization is still the effect. And it’s still true that not one in a million can diagnose it. |

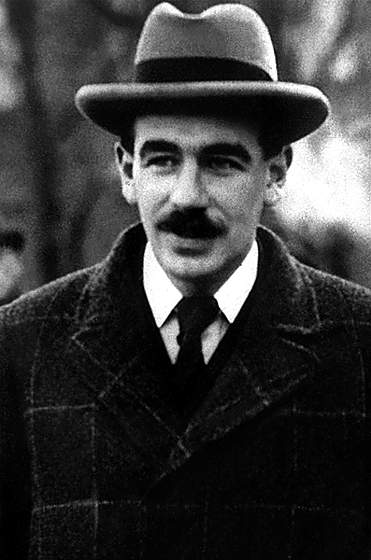

J.M. Keynes at a relatively young age. In his 1919 book The Economic Consequences of the Peace, Keynes sounded quite sane for the most part, both in terms of his political and economic analysis (although his interventionist leanings were already shining through. For reasons unknown he went completely off the rails in the 1930s). - Click to enlarge He wrote the book after attending the Paris Peace conference, where he argued for much more generous peace terms than the victorious allied nations were prepared to grant. While no-one will ever be able to prove it, there is a reasonable chance that a less vindictive peace treaty may have helped avert the German hyperinflation catastrophe and further down the road, perhaps the rise of Hitler as well. After all, Hitler’s influence grew on the fertile soil of Germany’s impoverished, antagonized and increasingly radicalized former middle class – and the event that arguably contributed to this state of affairs like no other was the collapse of the currency after the war. [PT] Photo credit: Bettmann / Corbis |

Wild FluctuationsLet’s focus on something else Keynes said, that the value of the currency fluctuates wildly. That means in both directions (we don’t have a graph of the value of the German mark, but this page by University of California Santa Barbara Professor Harold Marcuse shows it in a table). |

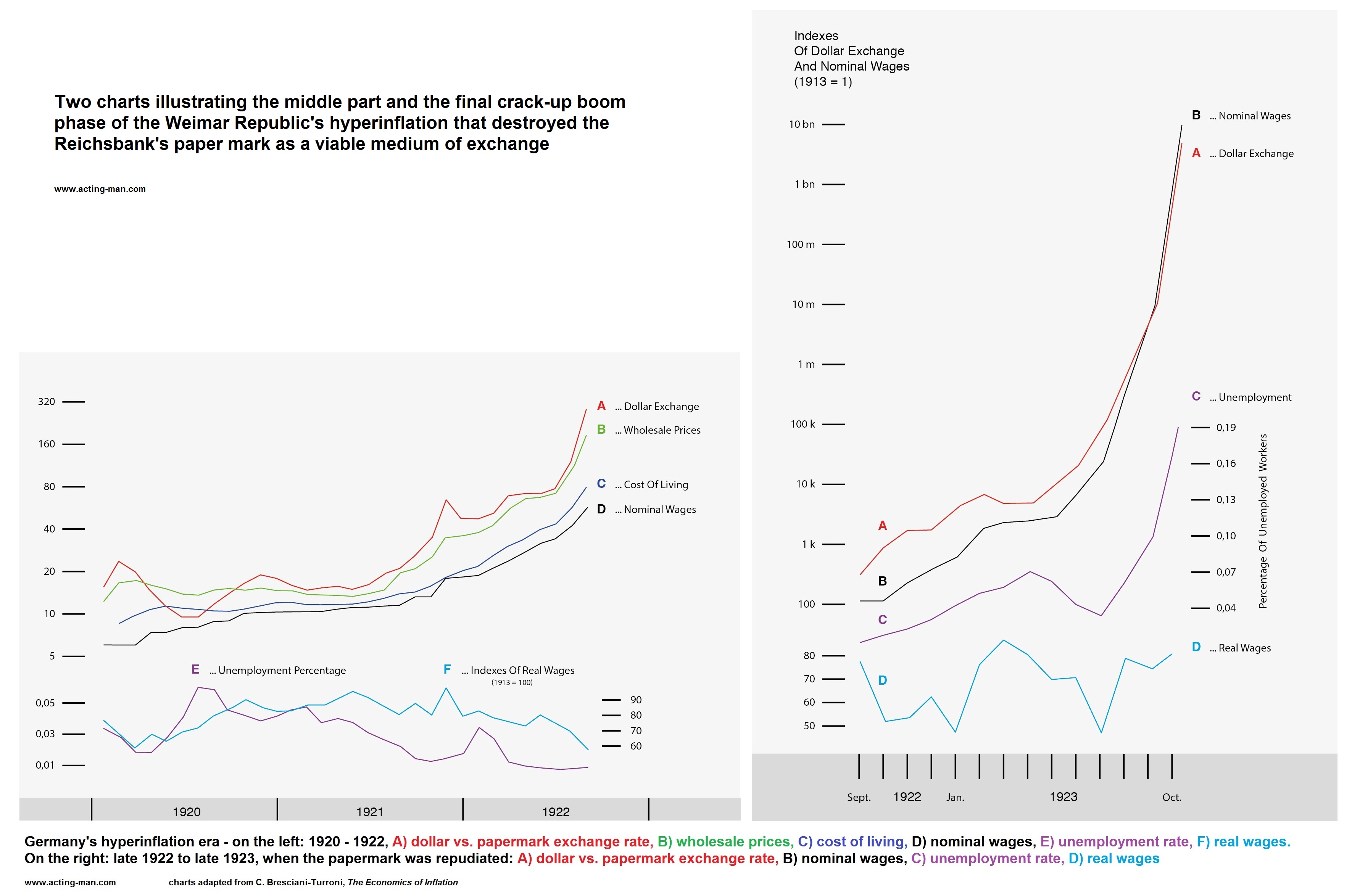

Luckily, we actually do have the chart. Two phases of the Weimar Republic’s hyperinflation are shown above: the middle phase from early 1920 to late 1922, in which the Reichsmark began to increasingly lose ground, and nominal prices and wages began to surge at an increasingly frantic pace, while real wages and unemployment rates both collapsed (because real wages were so low, businesses could afford to hire people to do essentially useless jobs), and the final phase from late 1922 to late 1923, which depicts the hyperinflation phase that ended with the repudiation of the currency. Note the surge in real wages and the concomitant explosion in unemployment in 1923 – this happened because government forced companies by law to index wage payments to some extent to the plummeting purchasing power of the currency. Many employees were suddenly no longer affordable and were fired. As an aside, we have to disagree with Keith on one point here: the Fed can and does “print” money. It doesn’t have to “borrow” a red cent (these days it mainly creates electronic book entries from thin air, but these are money substitutes that can be and are used for payment and can be and are transformed into standard currency on demand). We have described the mechanics of this in the appropriately titled “Can the Fed Print Money?” (the older article “Quantitative Easing Explained” which we recently republished, also discusses the topic in detail). To briefly get back to the above chart: the red line is the USD – Reichsmark exchange rate. As you can see, there were brief periods when the German currency actually caught a bid, such as in early 1920. Incidentally, the German stock market plunged by 40% when that happened, and industrialists across the country started pleading with the government to “do something” about this untoward bout of currency strength. The government, or rather the Reichsbank, promptly and happily obliged. Rudolf von Havenstein and his fellow central bank governors were strong believers in G.F. Knapp’s “State Theory of Money” (Chartalism, today known as “MMT”, which essentially was/is hoary inflationism dressed up in fresh apologias). |

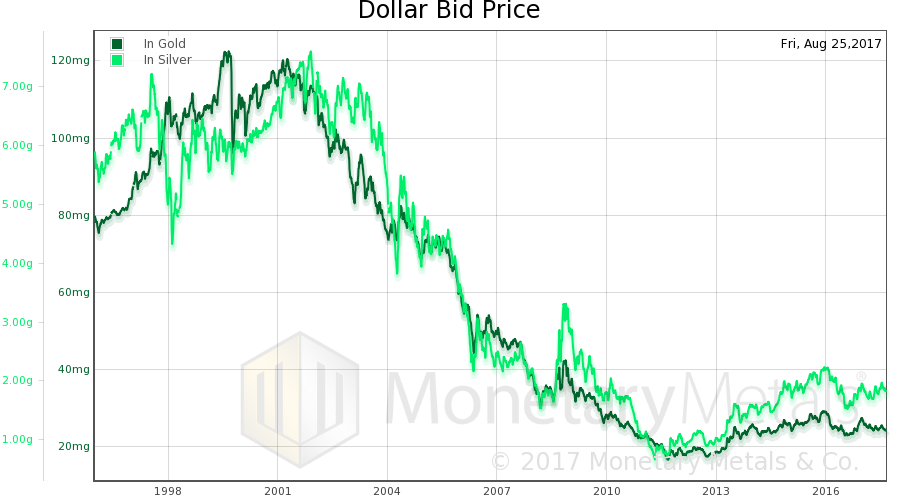

| The US dollar certainly fluctuates wildly in both directions. Look at this graph of the price of the dollar. The dollar goes up from 80mg gold to 120mg, then down to 16mg then up to 29.27mg on Dec 3, 2015. Since then, it’s been choppy. |

US Dollar Bid Price |

| The price of the dollar is not the only thing that fluctuates wildly. The interest rate also fluctuates wildly. In the same period, the interest rate on the benchmark 10-year Treasury has fluctuated from 7% to 1.4%.

This is important because the net present value of a long-term loan or bond fluctuates (inversely) with the interest rate. As the rate falls, the net present value rises. This is an example of “permanent relations between debtors and creditors … becom[ing] so utterly disordered as to be almost meaningless”. We refer to the capital gains that go to bond speculators, and the corresponding capital losses that go to bond issuers (though conventional accounting does not recognize it). Keynes described this perfectly too, “this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth”. When bond prices rise and bond yields fall, then by a process of arbitrage stock prices rise and stock yields fall. And the same for real estate. When bonds, stocks, and real estate are rising then all asset prices experience upward pressure. And how do most people feel about this? Keynes nailed this too. “Those to whom the system brings windfalls … are the object of the hatred of the bourgeoisie, … not less than of the proletariat.” On the one hand, wages are under downward pressure and jobs are being replaced with capital assets. On the other hand, a few get richer, such asset owners and those whose income is tied to asset prices such as CEOs and brokers. This partly explains the rise of Trump. |

US 10 Year Treasury Index, 1993 - 2017(see more posts on U.S. Treasuries, )In a stable free market money system (which we have every reason to suspect would be based on gold), gross market interest rate fluctuations could indeed be expected to be far less pronounced. This is due to the fact that society-wide time preferences as a rule don’t change very rapidly, so it is fair to assume that the natural interest rate component would be relatively inert. That leaves the price premium as the main component that could move gross market rates (leaving risk premiums aside). The price premium is a reflection of inflation expectations, which are as volatile as they are because we live in a centrally planned fiat money system. Given the historically proven long-term stability of the purchasing power of the gold dollar, there would be no reason for rates to reflect wild swings in inflation expectations if gold were adopted as money again. |

Forced to Play and Money Growing on TreesAnd it brings us back to bitcoin. Bitcoin’s fluctuations are so wild, that the value of the dollar looks like a flat-line by comparison. And its arbitrary enrichment of a few is correspondingly greater (the impoverishment of others will not be obvious until the price collapses). We have seen some comments from readers and in bitcoin discussions elsewhere, that strike us as pugnacious. A chip-on-the-shoulder pseudo-pride, that practically sneers “I got mine, suckaaah!” Most bitcoin millionaires aren’t like this. And we do not begrudge anyone his trading gain. One should not hate the player, but the game master who forces us to play. The Fed. However, this is an important phenomenon. We bring it up as the flip side of the “hatred of the bourgeoisie and the proletariat”. Both sides know that something is screwy. Everyone knows that money does not grow on trees. You do not normally get rich quick by betting on some Internet scheme. Yet, bitcoin seems to say, “Oh yes it does! Oh yes you do!” We offer this insight: speculation converts one person’s wealth into another’s income. No one wants to spend his wealth. But they are happy to spend other people’s wealth — when it comes to them in the form of income. Andy Appleton buys $10,000 worth of bitcoin. Later, he sells it for $20,000 to Bill Baker. Andy takes his original capital back plus 10%, or $11,000. That leaves him $9,000 of Bill’s wealth to spend, to consume. Bill of course bought it, hoping it would go up. And indeed it does. He sells it for $40,000 to Charlie Chilton. He reserves $22,000 of capital, leaving $18,000 of Charlie’s life savings to spend. Charlie forks it over to Bill, in the hopes of spending $36,000 of David Dalton’s wealth. And so on. Until the scheme hits the wall. Bitcoin is promoted as an alternative to fiat currency. However, it “engages all the hidden forces of economic law on the side of destruction” the same as the dollar. At an even faster rate. And this is promoted as a feature, not a bug. The gold standard does not provide a mechanism to convert your wealth to someone else’s income. In our view, this is a feature, not a bug. |

Tags: Chart Update,Featured,newslettersent,On Economy,Precious Metals