In a blog post, Douglas Campbell offers a ranking of economics journals by response times (based on non-representative data). The ranking (with # indicating the rank according to citations): # Journal Name Accept % Desk Reject % Avg. Time Median Time 25th Percent. (Months) 75th Percent. (Months) N = 1 Quarterly Journal of Economics 1% 62% 0.6 0 0 1 71 12 Journal of the European Economic Association 4% 56% 1.2 0.5 0 2 ...

Read More »Say’s Law

From The Economist’s economics brief on Say’s Law: Supply gives people the ability to buy the economy’s output. But what ensures their willingness to do so? According to the logic of Say and his allies, people would not bother to produce anything unless they intended to do something with the proceeds. … Even if people chose to save not consume the proceeds, Say was sure this saving would translate faithfully into investment in new capital … But what if the sought-after thing was [money] …...

Read More »Federalism Trends in Switzerland

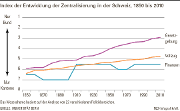

In the NZZ, Sean Müller und Paolo Dardanelli report about long-term trends in the Swiss federalist structure. Legislation has become more centralized. Implementation less so. Cantons increasingly implement federal legislation. But decentralized authority to collect taxes has remained largely in place. Figure from the NZZ:

Read More »Theory of the Firm

The Economist’s economics brief on theories of the firm. For a nice exposition, see the 1998 JEP article by Partrick Bolton and David Scharfstein.

Read More »Corporate Governance of Crypto Currencies

The Economist reports about conflicting strategies among important Bitcoin players; the struggle aligns pragmatists against libertarian ideologists. It also reports about attempts by competing crypto currencies to strengthen corporate governance: Tezos, another blockchain, will … not only have regular votes on competing proposals for how to change the system, but a more scientific approach to evaluating them and a way to compensate the developers for coming up with ideas. If their...

Read More »Bitcoin, Arbitrage, and the Human Side of the Blockchain

On Bloomberg view, Matt Levine discusses the recent bitcoin fork. The handling of long and short positions on Bitfinex, a bitcoin exchange, created an arbitrage opportunity, until Bitfinex changed its mind. Bitfinex announced a policy to deal with the fork, people took advantage of the policy, and Bitfinex changed its mind after the fact. Each of its decisions was rational, and quite plausibly the fairest option available to it. None of those decisions were required by, like, the nature...

Read More »Switzerland’s Changing International Linkages

In a CEPR discussion paper, Cedric Tille argues that Switzerland’s international linkages have been transformed over the last decade. Abstract: - Click to enlarge Over the last decade, the economic linkages between Switzerland and the rest of the world have been transformed. First, merchanting and the chemical industry account for an increasing share of international trade, with chemicals exports expanding...

Read More »Switzerland’s Changing International Linkages

In a CEPR discussion paper, Cedric Tille argues that Switzerland’s international linkages have been transformed over the last decade. Abstract: Over the last decade, the economic linkages between Switzerland and the rest of the world have been transformed. First, merchanting and the chemical industry account for an increasing share of international trade, with chemicals exports expanding robustly in recent years despite the European crisis and the strong Swiss franc. Second, the nature of...

Read More »Dictionary Money

On his blog, JP Koning discusses “dictionary money” and the ancient practice of simply redefining what “pound,” say, means. People have historically advertised prices for wares using a word, or unit of account, the LSD unit being the most prevalent. … from the Latin librae/solidi/denarii. The monarch was responsible for declaring what these words meant. … something to the effect that a pound, or £, was worth, say … silver coin[s]. This definition was subject to change. … Dictionary...

Read More »Limits of Arbitrage and Covered Interest Parity

In a BIS working paper, Dagfinn Rime, Andreas Schrimpf, and Olav Syrstad analyze the apparent breakdown of covered interest parity (CIP). They argue that CIP holds remarkably well for most potential arbitrageurs when applying their marginal funding rates. With severe funding liquidity differences, however, it becomes impossible for dealers to quote prices such that CIP holds across the full rate spectrum. A narrow set of global top-tier banks enjoys risk-less arbitrage opportunities as...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org