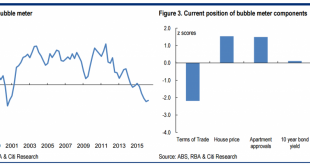

Australian property bubble on a scale like no other Yesterday Citi produced a new index which pinned the Australian property bubble at 16 year highs: Bubble trouble. Whether we label them bubbles, the Australian economy has experienced a series of developments that potentially could have the economy lurching from boom to bust and back. In recent years these have included: the record run up in commodity prices and...

Read More »Gold Sector Correction – Where Do Things Stand?

Sentiment and Positioning When we last discussed the gold sector correction (which had only just begun at the time), we mentioned we would update sentiment and positioning data on occasion. For a while, not much changed in these indicators, but as one would expect, last week’s sharp sell-off did in fact move the needle a bit. Gold – just as nice to look at as it always is, but slightly cheaper since last week. Photo...

Read More »FX Daily, October 10: Dollar after the Second Debate

Swiss Franc EUR/CHF - Euro Swiss Franc, October 10 2016(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar has started the new week on a firm note. The light news stream and holidays in Japan, Canada and the United States make for a subdued session. Notable exceptions to the dollar’s gains are the Canadian dollar and Mexican peso. Both currencies appear to have been. underpinned by US...

Read More »Why Krugman, Roubini, Rogoff And Buffett Hate Gold

Why Krugman, Roubini, Rogoff And Buffett Dislike Gold By Jan Skoyles Edited by Mark O’Byrne A couple of weeks ago an article appeared on Bitcoin Magazine entitled ‘Some economists really hate bitcoin’. I read it with a sigh of nostalgia. As someone who has been writing about gold for a few years, I am used to reading similar criticisms as those bitcoin receives from mainstream economists, about gold. As with...

Read More »Partial Silver Crash

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Don’t be a Spruiker On 18 September we said, “the market is in the grips of a mini silver mania (we would not dare say bubble, at least not without trigger warnings).” Since then, we have warned every week that the fundamentals of silver were lousy. Last week we said, “Buying silver right now—at least if you’re buying it...

Read More »USA 2017-2020: An Ungovernable Nation?

The only way to govern successfully is to actually solve the underlying systemic problems, but doing that requires overthrowing a corrupt, self-serving elite. Regardless of who wins the presidency, a much larger question looms: will the U.S. be ungovernable 2017-2020? There are multiple sources of the question. One is of course the remarkable unpopularity of the two candidates for the presidency. For all the reasons...

Read More »Swiss real and minimum wages increase by 0.4% and 0.7% respectively

Swiss social partners signing the collective labour agreements (CLA) have agreed a nominal rise in real wages estimated at 0.4% for 2016, of which 0.2% is to be awarded collectively and 0.2% at individual level. Minimum wages were increased by 0.7%. The graph shows nominal wages since 1993. Changes in Swiss Nominal and Minimum WagesChanges in Swiss Nominal and Minimum Wages - Click to enlarge Download this press...

Read More »Swiss Franc Net Shorts Getting Reduced

Swiss Franc Last week SNB Q3 window cleaning that led to a big CHF net short position. This week this changed again. Both longs and shorts on CHF increased, but the net short position fell. During the CFTC’s Commitment of Traders week ending October 4, speculators took on risk. Of the sixteen gross currency positions we track, speculators added to their exposure in all but five. Bulls and bears saw...

Read More »Emerging Markets: What has Changed

Summary China reported lower than expected September reserve figures. Polish central bank Governor Glapinski adjusted the forward guidance. Brazil will open up development of its so-called pre-salt oil fields to foreign companies. Colombia’s referendum on the FARC peace agreement failed by a razor-thin 50.2% to 49.8% margin. In the EM equity space as measured by MSCI, Brazil (+5.3%), Czech Republic (+4.4%), and...

Read More »British Pounding

Flash-Crashed Earlier this morning the British Pound suddenly found itself on the receiving end of a 6% flash crash during Asian trading hours. Some of the losses have been recouped since then, but that will be of little consolation to anyone who may have been long the GBP overnight. Oops. Photo credit: Time & Life Pictures / Getty Images - Click to enlarge Now before you strike this up to some ‘fat...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org