See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Don’t be a Spruiker On 18 September we said, “the market is in the grips of a mini silver mania (we would not dare say bubble, at least not without trigger warnings).” Since then, we have warned every week that the fundamentals of silver were lousy. Last week we said, “Buying silver right now—at least if you’re buying it on speculation of a price gain—is almost the textbook definition of a Ponzi scheme.” Part of the crash we predicted occurred this week. The price was .15 at the end of last week, but fell to a low of .11 before dead-cat bouncing a bit to .50. The drop of over is almost 11%. Wait – part of the crash?! Yes. Last week, we said the fundamentals of silver would put its price at just over . Even after the crash this week, it’s still almost a buck fifty over that level. We haven’t written anything about the persistent manipulation conspiracy theories in a long time. However, now that the prices of the metals have dropped for “no reason” (we have been discussing the reason week after week in this report), the conspiracy theorists are out in full force. They assert that manipulation is “obvious”.

Topics:

Keith Weiner considers the following as important: Featured, Gold and its price, newslettersent, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Don’t be a SpruikerOn 18 September we said, “the market is in the grips of a mini silver mania (we would not dare say bubble, at least not without trigger warnings).” Since then, we have warned every week that the fundamentals of silver were lousy. Last week we said, “Buying silver right now—at least if you’re buying it on speculation of a price gain—is almost the textbook definition of a Ponzi scheme.” Part of the crash we predicted occurred this week. The price was $19.15 at the end of last week, but fell to a low of $17.11 before dead-cat bouncing a bit to $17.50. The drop of over $2 is almost 11%. Wait – part of the crash?! Yes. Last week, we said the fundamentals of silver would put its price at just over $16. Even after the crash this week, it’s still almost a buck fifty over that level. We haven’t written anything about the persistent manipulation conspiracy theories in a long time. However, now that the prices of the metals have dropped for “no reason” (we have been discussing the reason week after week in this report), the conspiracy theorists are out in full force. They assert that manipulation is “obvious”. In addition to our caution about putting your money in harm’s way based on trust in permabulls, we would add something else. Australia has a great word. A spruiker is a showy salesman, a huckster, a pitchman, who touts his product. The gold and silver spruiker has a simple modus operandi. He touts buying the metals. It’s always a good time to buy! When it turns out not to have been so good, as for example anyone who bought silver last Friday at $19.15, well then he says “manipulation”. Everyone is supposed to nod sagely. The spruiker gets off the hook, just like that. Except… except he did not see the price drop coming (readers of this report did). He thought that prices are supposed to keep rising to $5,000 for gold (or is it $30,000) and $150 for silver, and advised everyone accordingly. Manipulation is his ready excuse for when it doesn’t work. Trading is a tough game. All sorts of things can happen. Long-time readers will know that even when we are bearish on the price of the metals, we say we don’t recommend naked shorting. A central bank could, for example, announce some cockamamie scheme on a weekend and by Monday morning, the price of silver could be +10%. You shouldn’t try to trade based on your picture of the end game, nor based on debunked conspiracy theories. And when you’re wrong, you should learn from your mistakes, not externalize it and blame others. This is good advice not just for trading, but for life and business in general. Don’t be a spruiker. By the way, we have had a running inside joke for three weeks so far. Now four: Just repeat after me: “The Fed makes the economy more stable.” A major currency crashed this week. The British pound closed last week about $1.30. It hit a low under $1.20 before bouncing back to close the week at $1.24, down six cents or 4%. |

Silver Daily(see more posts on silver, ) |

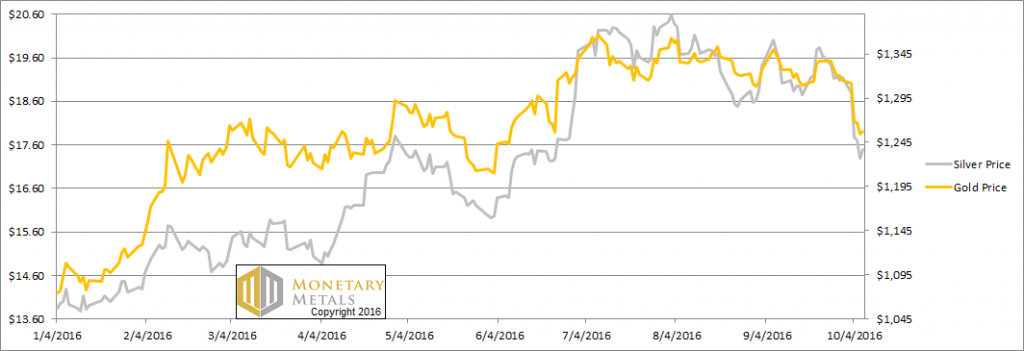

Fundamental DevelopmentsAnyway, back to silver. What is the fundamental price of silver this week? Read on for the only true picture of the fundamentals of the monetary metals. But first, here’s the graph of the metals’ prices. |

Silver/Gold Price(see more posts on gold price, silver prices, ) |

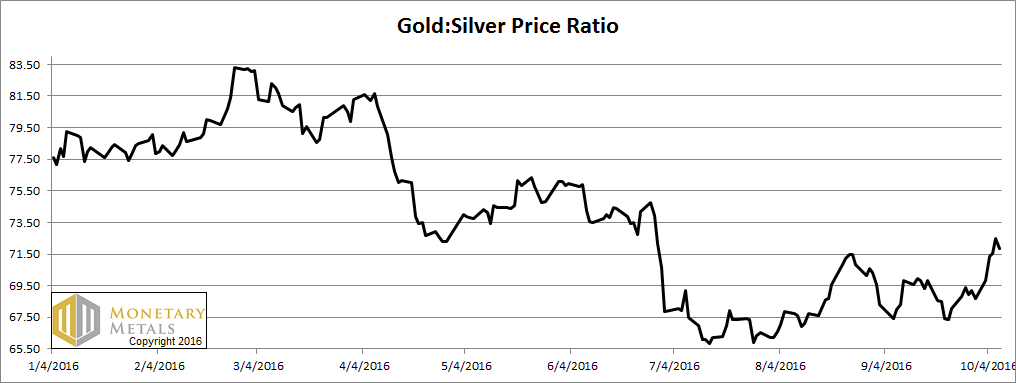

Gold-silver ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It was up sharply this week.

|

Gold: Silver Price Ratio(see more posts on gold silver ratio, ) |

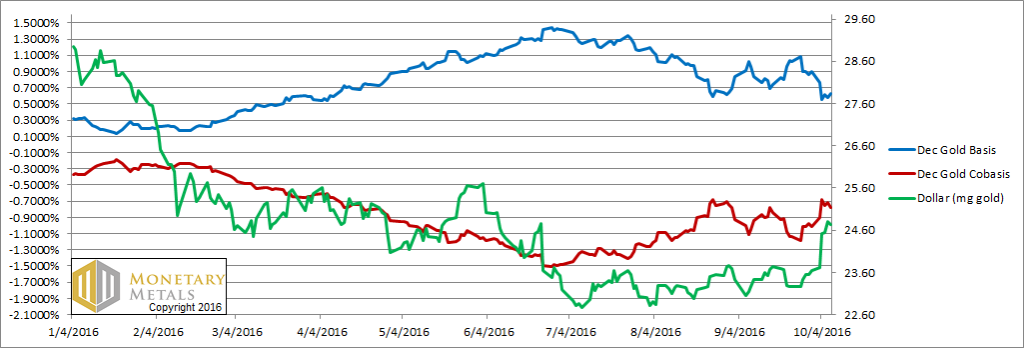

Gold basis and co-basis and the dollar priceHere is the gold graph. There is a big move up in the dollar, from 23.64mg gold to 24.74. However, the corresponding move up in scarcity (i.e., the co-basis) is not as big. Contra the Internet reports about a massive “paper dump”, some real metal came to market this week. The net result is the fundamental price moved down, now about fifteen bucks under the market price of gold. |

Gold basis and co-basis and the dollar price(see more posts on gold basis, Gold co-basis, ) |

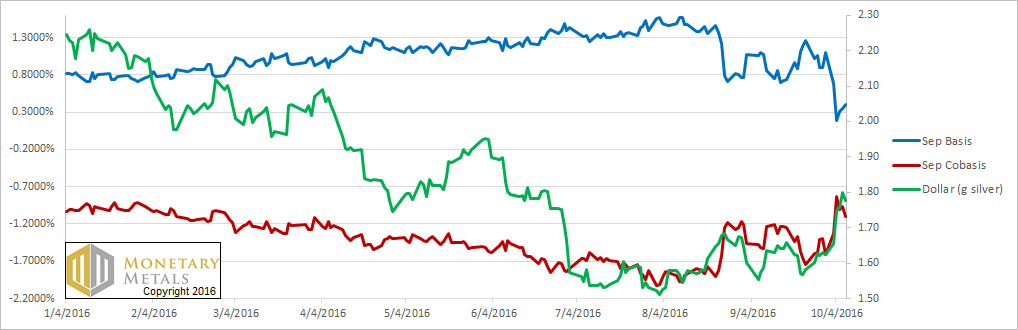

Silver basis and co-basis and the dollar priceNow let’s look at silver. The price of silver fell quite a bit, but the scarcity of the metal didn’t rise quite as much. And on top of that, look at Friday’s move back down in scarcity. Metal came to market on Friday, perhaps from sellers looking to get out at a slightly better price. Last week, we calculated a fundamental price of just over $16. This week, it dropped another buck fifty. At current levels of supply and demand, silver metal would clear at $14.60. In other words, it’s still about three bucks below the market price. So long as leveraged speculators keep bidding up the price, sure that now the price will take off like a rocket, now is a buying opportunity, now is the last chance to buy silver below $20… we will keep reporting on lousy fundamentals. Can they bid up the price this week? Yeah, they sure could. Should they? If there is anything going on in the markets for which there is no reason, it is bidding up the price of silver. Using leverage. That is, needlessly putting your hard-earned dollars in harm’s way. |

Silver basis and co-basis and the dollar price(see more posts on silver basis, Silver co-basis, ) |

Charts by: BarChart, Monetary Metals