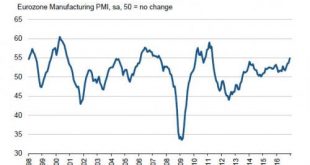

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia’s major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April...

Read More »FX Weekly Review, December 26 – 30: Dollar Correction Poised to Continue

Swiss Franc Currency Index With last Friday’s break-down of the dollar, the Swiss Franc index could recover a bit. Its loss over December is now 1%. But the dollar index had a gain of 2%. Trade-weighted index Swiss Franc, December 30(see more posts on Swiss Franc Index, ) Source: FT.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency...

Read More »Why I’m Hopeful

Why am I hopeful? the Status Quo is devolving, and a better way of living lies just beyond the corrupt, wasteful, ruinous consumerist debt/financial tyranny we now inhabit. Readers often ask me to post something hopeful, and I understand why: doom-and-gloom gets tiresome. Human beings need hope just as they need oxygen, and the destruction of the Status Quo via over-reach and internal contradictions doesn’t leave much...

Read More »UBS Consumption Indicator: Subdued private consumption in 2017 despite solid November figures

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS Consumption Indicator climbed to 1.43 points in November from 1.39. Another strong month in domestic tourism and the positive trend on the automobile market made the rise possible. Initially a solid...

Read More »Cool Video: Double Feature on Bloomberg

I am finishing the year like I began it, on Bloomberg Television, talking about the dollar and Fed policy. Bloomberg has made two clips of my interview available. In the first clip (here), I discuss the dollar. I reiterate my forecast for the the Dollar Index to head toward 120.00. The consolidation between Q2 15 and end of Q3 16 appears to me to be the base of the new leg up that has already begun.[embedded...

Read More »FX Daily, December 28: Short Note for Holiday Markets

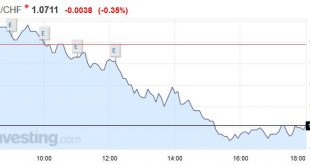

Swiss Franc EUR/CHF - Euro Swiss Franc, December 28(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Equities: Good day in Asia, where the MSCI Asia-Pacific Index rose 0.3% to snap a six-day slide. Of note the Hang Seng re-opening from a long holiday weekend rose (0.8%) from a five-month low. Chinese shares that trade in HK also did well, rising 1.5%. Indonesia, which broke a nine-day slide yesterday,...

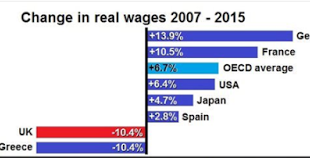

Read More »Great Graphic: Real Wages

This Great Graphic caught my eye. It was tweeted by Ninja Economics. Her point was about immigration. German had much higher immigration than the UK, but also saw real wage increase of nearly 14% in the 2007-2015 period, while real wages in the UK fell nearly 10.5%. She noted that Greece is the only developed country where real wages have collapsed as much as in the UK. This is amazing, and not because of...

Read More »Grab-Bag of Resolutions for 2017

I resolve to acquire skills, not credentials. Here’s a grab-bag of resolutions with something for just about every persuasion. 1. I resolve to never utter or write the word “Trump” in 2017. (Good luck with that…) 2. Having watched bitcoin rise from $250 (or perhaps from $25 or even 25 cents) to $900+, I resolve to finally buy some bitcoin before it soars over $1,000. (Please file under “this is intended as bemused...

Read More »Switzerland KOF Economic Barometer December: Unchanged

In December 2016, the KOF Economic Barometer stayed at its previous month’s reading of 102.2. The currently observable sideward trend, at a level slightly above the long-term average, indicates that the Swiss economy should grow at rates close to its long-term average in the near future. In December 2016, the KOF Economic Barometer, with a value of 102.2 being unchanged compared to the previous month, continued...

Read More »FX Outlook 2017: Politics to Eclipse Economics

Investors are familiar with a broad set of macroeconomic variables that often drive asset prices. Many are familiar with corporate balance sheets, price-earning ratios, free cash flow, Q-ratio, and the like. However, political factors are more difficult for investors to integrate into their analysis. Therein lies the main challenge in the year ahead. There will be many opportunities for political factors to overwhelm...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org