Swiss Franc The Euro has fallen by 0.05% at 1.1078 EUR/CHF and USD/CHF, July 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Summer in the northern hemisphere contributing to the subdued activity in the global capital markets. The MSCI Asia Pacific index stalled after a four-day advance, with Japanese, Chinese, and Australian equities offsetting gains in Taiwan,...

Read More »Is the Fed too focused on corporates?

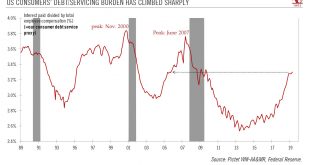

Fed dovishness is helping to curb financing costs for corporates but does not seem to be percolating down to the US consumer, whose debt-servicing costs are rising. This could be something to watch. The Federal Reserve (Fed)’s leading priority now is to help sustain the US business cycle, hence the concept of ‘insurance’ rate cuts put forward by Fed chairman Jerome Powell, with some echoes of Alan Greenspan’s philosophy...

Read More »How to Fix GDP, Report 14 Jul

Last week, we looked at the idea of a national balance sheet, as a better way to measure the economy than GDP (which is production + destruction). The national balance sheet would take into account both assets and liabilities. If we take on another $1,000,000 debt to buy a $1,000,000 asset, then we have not added any equity. This is so, even though assets have gone up. But unfortunately, as a consequence of assets going...

Read More »FX Daily, July 15: Marking Time on Monday

Swiss Franc The Euro has fallen by 0.10% at 1.108 EUR/CHF and USD/CHF, July 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new record highs in US equities ahead of the weekend coupled with Chinese data that suggested the economy was gaining some traction as Q2 wound down is helping underpin risk appetites to start the week. Japanese markets were closed...

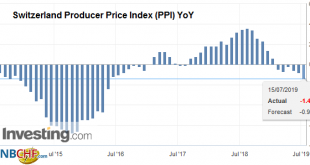

Read More »Swiss Producer and Import Price Index in June 2019: -1.4 percent YoY, -0,5 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »FX Weekly Preview: What to Watch if Fed and ECB are Committed to Easing

There is little doubt after the Federal Reserve Chairman Powell’s testimony last week and the FOMC minutes that a rate cut will be delivered at the end of the month. Similarly, after comments by several ECB officials and the record of their recent meetin.g confirms it too is prepared to adjust policy. The timing of the ECB’s move is more debatable, an adjustment at the July 25 meeting appears to have increased. While a...

Read More »Old Swiss trains get chance at new life online

Switzerland has the densest railway network in the world. The Swiss Federal Railways (SBB) is selling its old locomotives on the Internet. Control cars, rails, switches and a firefighting train with a CHF1 million ($1 million) price tag are among the vintage vehicles on sale. You will be hard pressed to find anything for less than CHF25,000 on SBBresale.ch, according to the Sunday editions of the German-language Blick...

Read More »Competition watchdog fines car leasing companies for collusion

The firms were swapping information on rates for years, COMCO said. The Swiss competition commission (COMCO) has fined eight car leasing firms a total of CHF30 million ($30.4 million) for having swapped information on rates. The fines were announced on Thursday and come after some years of regular and systematic information exchanges between the companies on interest rates, COMCO announcedexternal...

Read More »Number below poverty line rises in Switzerland

© David Carillet | Dreamstime.com In Switzerland, the revenue poverty line is income of CHF 27,108 (US$ 27,490) a year for someone living alone and CHF 47,880 (US$ 48,550) for a family of four. In 2017, the percentage of Switzerland’s population living below the poverty line was 8.2% or 675,000 people. In 2016, the percentage was 7.6%. Those most likely to be below the poverty line are those in single parent families...

Read More »As Chinese Factory Deflation Sets In, A ‘Dovish’ Powell Leans on ‘Uncertainty’

It’s a clever bit of misdirection. In one of the last interviews he gave before passing away, Milton Friedman talked about the true strength of central banks. It wasn’t money and monetary policy, instead he admitted that what they’re really good at is PR. Maybe that’s why you really can’t tell the difference Greenspan to Bernanke to Yellen to Powell no matter what happens. Testifying before Congress today, in prepared...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org