The two day rise in the gold price of more than US$50 fizzled out on Tuesday. The gold price is down about 7% (in US dollar terms) since its year-to-date high set on January 6. It is also down 13% from its all-time high set in August 2020. The silver price, boosted by social media attention, did not set its year-to-date high until February 1. Since then the silver price has slid about 5% from that high. Chairman Powell testified to Congress on Tuesday stating that...

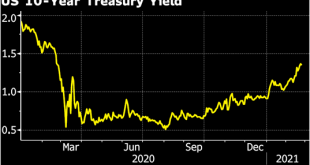

Read More »FX Daily, February 26: Fed Hike Ideas Give the Beleaguered Greenback Support

Swiss Franc The Euro has fallen by 0.31% to 1.0977 EUR/CHF and USD/CHF, February 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Overview: A poor seven-year note auction and ideas that the first Fed hike can come as early as the end of next year spurred a steep sell-off in bonds and equities. Technical factors like the triggering of stops losses, large selling in the futures market, which some also link to hedging of mortgage...

Read More »The end of central banking as we know it

The severest crisis the European Central Bank (ECB) ever faced coincided with the early days of a new Executive Board. Over the past year and a half, the board’s six members, including the ECB’s president and vice president, have all been replaced, either because they resigned, or because their eight-year mandate expired. New team By order of appointment, the new board consists of: Luis de Guindos, who replaced Vitor Constancio as vice president in June 2018...

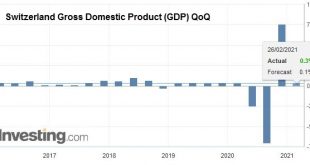

Read More »Switzerland GDP Q4 2020: +0.3 percent QoQ, -1.6 percent YoY

Switzerland’s GDP growth slowed to 0.3 % in the 4th quarter after reaching 7.6 % in the 3rd quarter. Major losses were recorded in the services directly affected by the tightening of the containment measures. Other industries continued to recover. On the whole, the second wave of the coronavirus until the end of 2020 had much less of an impact on the economy than the first wave did last spring. Switzerland Gross Domestic Product (GDP) QoQ, Q4 2020(see more posts on...

Read More »Record fall in Swiss hotel occupancy in 2020

© Tanya Keisha | Dreamstime.com In 2020, the number of overnight stays in Swiss hotels fell by 40% to 23.7 million, a fall of 15.8 million nights compared to 2019. The fall, driven by Covid-19, is the largest fall in overnight stays in Switzerland since the end of the 1950s, according to Switzerland’s Federal Statistical Office. Plummeting hotel stays were driven mainly by a large slump in foreign visitors. Hotel nights spent by Swiss tourists dropped by only 8.6%...

Read More »Want More Entrepreneurship? Embrace Long-Term Legal Stability.

Prudent economic calculation becomes more difficult as legal and regulatory regimes are subject to frequent changes and political upheaval. Original Article: Continuous change in the regulatory framework in which market players do business is a feature of modernity: while the perimeter of the state’s intrusiveness gets larger, rules expand and change constantly. On the other hand, every investment calls for a certain amount of calculation,1 given that business as...

Read More »Episode 13: The Pressing Problem With “Money Printing”

The phrase “money printing” conjures images of a giant printing press spitting out sheets of hundred dollar bills somewhere in the basement of the Fed. But is that what’s actually happening lately? Absolutely not. Join John Flaherty and Monetary Metals CEO Keith Weiner for a conversation that will likely make you say “WOW!” or “Whaaat?” or maybe even “Oh, NOW I get it…” [embedded content] Episode Transcript John: Hello again and welcome to the Gold Exchange podcast....

Read More »Swiss press divided over phased easing of Covid restrictions

Swiss President Guy Parmelin (right) and Health Minister Alain Berset at Wednesday’s press conference to confirm the relaxation measures on Wednesday Keystone / Peter Klaunzer Is the government showing some backbone or being cowardly by keeping to its gradual pandemic reopening plans? The Swiss media can’t agree. For the German-speaking Neue Zürcher ZeitungExternal link broadsheet, the government – which confirmed its measures on Wednesday – is simply being...

Read More »Swiss To Vote In Referendum On Government’s Emergency COVID-19 Measures

After mounting a national campaign, and the work of determined local organisations, Swiss campaigners have managed to trigger a referendum for ending the government’s destructive COVID regulations. If successful, this will also be a blow for the extremists at the World Economic Forum in Davos, Switzerland, who have been pushing the idea of a global economic shutdown since the beginning of the alleged ‘global pandemic.’ Among other things, the peoples’ revolt is...

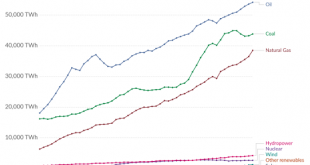

Read More »Oil and Debt: Why Our Financial System Is Unsustainable

How much energy, water and food will the “money” created out of thin air in the future buy? Finance is often cloaked in arcane terminology and math, but the one dynamic that governs the future is actually very simple. Here it is: all debt is borrowed against future supplies of affordable hydrocarbons (oil, coal and natural gas). Since global economic activity is ultimately dependent on a continued abundance of affordable energy, it follows that all money borrowed...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org