Those looking up from their “free fish!” frolicking will see the tsunami too late to save themselves. It’s an amazing sight to see the water recede from the bay, and watch the crowd frolic in the shallows, scooping up the flopping fish. In this case, the crowd doing the “so easy to catch, why not grab as much as we can?” scooping is frontrunning inflation, the universally expected result of the Great Reflation Trade. You know the Great Reflation Trade: the world...

Read More »Die ökonomischen Effekte der Pandemie: Eine Österreichische Analyse

5. März 2021 – Nachfolgend finden Sie die Einleitung des Aufsatzes „Die ökonomischen Effekte der Pandemie: Eine Österreichische Analyse“ von Jesús Huerta de Soto. Den Text in voller Länge können Sie hier herunterladen. [Aus dem Spanischen übersetzt von Philipp Bagus.] ***** Einleitung: Wiederkehrende Boom- und Bust-Zyklen versus einmalige Krisen aufgrund außergewöhnlicher Phänomene Traditionell haben die Theoretiker der Österreichischen Schule den wiederkehrenden...

Read More »Swiss government wants to keep control of weapons exports

The government wants to retain control of weapons exports in connection with peace-keeping missions. © Keystone / Christian Beutler The Swiss government has rejected calls to allow voters and cantons to set conditions for weapons exports. A people’s initiative collected enough signatures in 2019 to force a nationwide vote on the issue. It proposes enshrining rules for war materiel exports in the constitution, which would take this responsibility away from the...

Read More »Playing Games with Stocks

The GameStop saga—can we call it an insurrection?—wants easy heroes and villains. Both are available. The populist version of the story goes like this: a few thousand angry gamers, colluding via the now infamous WallStreetBets subreddit, brought at least one powerful hedge fund to its knees. Melvin Capital and other short sellers, completely blindsided, lost a reported $5 billion in what must have seemed like a sure-bet opportunity for their model of vulture...

Read More »Swiss parliament demands cabinet reopen restaurants and theatres

© Tetiana Soares | Dreamstime.com A recent parliamentary vote on whether to issue a formal request to the Federal Council, Switzerland’s executive, to reopen restaurants on 22 March 2021, found a majority of 97 to 90, according to Le Matin. The main parties supporting the demand were the Swiss People’s Party (UDC/SVP) and the PLR (FDP). The Socialist and Green parties were against it. The formal demand to the Federal Council stipulates: Increased testing and...

Read More »Kennedy’s Policy Toward Third World Nations

Last night, we had the first presentation in our online conference “The National Security State and the Kennedy Assassination.” Our first speaker was James DiEugenio, who has been the leading figure in the JFK assassination research community highlighting how President Kennedy’s policy toward independence movements in Third World countries was contrary to the policy held by the U.S. national-security establishment, namely the Pentagon and the CIA. After World War...

Read More »Central Banks Will Still Do “Whatever It Takes”!

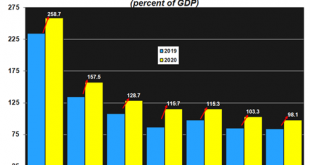

Governments are taking a page out of the play book that monetary policy began a decade ago – which will lead to even higher debt levels. During the throes of the financial crisis almost a decade ago Mario Draghi, then President of the European Central Bank (ECB) pushed the ECB’s mandate to the limits with his speech in July 2012: “within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough” This was during a...

Read More »Rothbard Week: 5 Great Things About Murray

Ryan McMaken and Tho Bishop discuss five reasons why Rothbard’s work is so memorable. From his fearlessness in the face of opposition, to his commitment to peace and decency, Rothbard provides us with a model of principled scholarship. Additional Resources “Nations by Consent”: Mises.org/RR_54_02 Egalitarianism as a Revolt Against Nature, and Other Essays: Mises.org/RR_54_03 “A Strategy for the Right”: Mises.org/RR_54_04 A History of Money and Banking in the...

Read More »Gender equality continues to make progress in Swiss workforce

Magdalena Martullo-Blocher, CEO and vice-chair of Ems Chemie, is one of five leaders of top Swiss firms. © Keystone / Walter Bieri The proportion of women in Swiss company boardrooms and management ranks continues to rise, according to an annual survey of the largest employers in both private and public sectors. The share of management positions held by women increased from 10% in 2019 to 13% last year, says the latest edition of the Schilling ReportExternal link...

Read More »UBS publishes Annual Report 2020

Zurich/Basel, 5 March 2021 – The Annual Report 2020 provides comprehensive and detailed information on the firm, its strategy, business, governance and compensation, financial performance and risk, treasury and capital management, as well as on the regulatory and operating environment for the 2020 financial year. It presents the fully audited results for the year ending 31 December 2020. UBS’s net profit attributable to shareholders for 2020 was USD 6,557 million...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org