© Phattha Intharakamhaeng | Dreamstime.com Swiss chocolate sales went into steep decline in 2020, according to ChocoSuisse, Switzerland’s chocolate industry association. The amount of chocolate produced in Switzerland in 2020 was 10% lower than in 2019 and sales revenue was down by 14.5%, a sharp drop. In 2020, Swiss chocolatiers produced around 180,000 tons, 20,000 tons less than the year before and sales fell by CHF 260 million to CHF 1.53 billion. The export...

Read More »What Really Happened With the Texas Power Grid

Since the deep freeze in February caused millions of Texas homes to lose their power, partisans have been fighting over the blame. The governor blamed wind turbines and the green agenda, whereas Paul Krugman said the fault was with natural gas. Bob shows the numbers; natural gas was to blame only in the sense that nobody expected wind to be useful during a winter crisis. Mentioned in the Episode and Other Links of Interest: Bob’s article at Mises.org, which gives...

Read More »Regulators want firms to own up to climate risks

AMERICA’S MAIN financial regulator is taking an interest in climate change—and wants everyone to know. The Securities and Exchange Commission (SEC) has created a task-force to examine environmental, social and governance (ESG) issues, appointed a climate tsar and said it will “enhance its focus” on climate-related disclosures for listed firms. It looks poised to introduce, among other things, rules forcing firms to reveal how climate change or efforts to fight it may...

Read More »Swiss Voters Approve ‘Burqa Ban’

Swiss voters have narrowly approved a proposal to ban face coverings in public spaces. The measure comes just over a decade after citizens voted to ban the construction of minarets, the tower-like structures on mosques that are often used to call Muslims to prayer. The referenda reflect the determination of a majority of Swiss voters to preserve Swiss traditions and values in the face of runaway multiculturalism and the encroachment of political Islam. Switzerland...

Read More »Printing Money in Times of Corona

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events. Just as there are epidemiological factors to consider in this crisis, there are also economic, social, cultural, political and other health factors at play. It is precisely...

Read More »The Cannibalization Is Complete: Only Inedible Zombies Remain

Poor powerless Fed, poor starving cannibals, poor zombies turning to dust. That’s the American economy once the curtains are ripped away. Setting aside the fictional flood of zombie movies for a moment, we find the real-world horror is the cannibalization of our economy, a cannibalization that is now complete. Every organic source of prosperity and productivity has been captured and consumed, hidden behind the convenient curtains of central bank intervention,...

Read More »More parcels, fewer letters: pandemic dents Swiss Post finances

Far more people ordered goods by parcel during the pandemic. © Keystone / Peter Klaunzer The Covid-19 pandemic cost the state-owned Swiss postal service CHF139 million ($150 million) last year, which was largely responsible for driving down profits by 30%. Swiss Post delivered a record 182.7 million parcels in 2020, up nearly a quarter in volume from the previous year. But the number of letters being posted declined by 5.6%. The pandemic also negatively impacted the...

Read More »More rare earth metals detected at Swiss wastewater plants

The team carried out investigations into the presence of rare earth metals in sewage at 63 treatment plants across Switzerland. © Keystone / Christian Beutler Rare earth metals like cerium and gadolinium, which are used in industry and hospitals, are increasingly being detected at Swiss wastewater plants, new research shows. For the first time scientists from the Swiss Federal Institute of Aquatic Science and Technology (Eawag) carried out investigations into the...

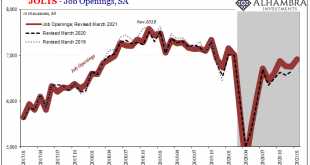

Read More »JOLTS Revisions: Much Better Reopening, But Why Didn’t It Last?

According to newly revised BLS benchmarks, the labor market might have been a little bit worse than previously thought during the worst of last year’s contraction. Coming out of it, the initial rebound, at least, seems to have been substantially better – either due to government checks or, more likely, American businesses in the initial reopening phase eager to get back up and running on a paying basis again. The JOLTS labor series annual revisions took about...

Read More »In Some Countries, Lockdowns May Be the “New Normal”

Like many mainstream economists who make predictions that inform and shape government policy, medical experts make predictions which can determine how a government addresses a perceived problem. A good example here is Professor Neil Ferguson, who led the flawed Imperial College covid-19 study which played a major role in the lockdowns implemented throughout Europe, and even in the US and Canada. The model used by Imperial offered many predications, including the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org