The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events. Just as there are epidemiological factors to consider in this crisis, there are also economic, social, cultural, political and other health factors at play. It is precisely these other factors that are so often forgotten in the panicky reporting, in the constant, manic tracking of the current infection numbers, that we want to take a look at in our series “The Costs of Coronavirus Lockdowns” in the coming weeks. Monetary policy is the second primary tool, alongside fiscal

Topics:

Simon Sarevski considers the following as important: 6b.) Austrian center, 6b) Austrian Economics, blog, coronavirus, Featured, Federal Reserve, Lockdowns, Monetary Policy, Money, newsletter

This could be interesting, too:

Clemens Schneider writes Café Kyiv

Clemens Schneider writes Germaine de Stael

Clemens Schneider writes Museums-Empfehlung National Portrait Gallery

Clemens Schneider writes Entwicklungszusammenarbeit privatisieren

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events. Just as there are epidemiological factors to consider in this crisis, there are also economic, social, cultural, political and other health factors at play. It is precisely these other factors that are so often forgotten in the panicky reporting, in the constant, manic tracking of the current infection numbers, that we want to take a look at in our series “The Costs of Coronavirus Lockdowns” in the coming weeks.

Monetary policy is the second primary tool, alongside fiscal policy, used by governments to influence economic activity. When a crisis hits, an economy is stimulated either by the state budget – which arises from the taxpayers – or silently through monetary expansion. By either lowering interest rates, issuing government-backed securities, or even purchasing corporate bonds the central banks increase the money supply in the economy. Ever since the beginning of the crisis, the U.S. Federal Reserve has done all of the above.

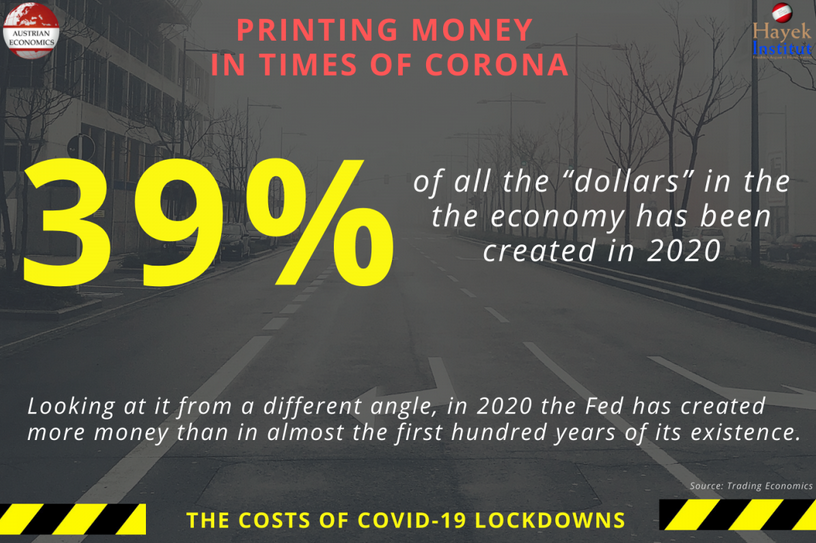

One of the most popular measures of the money supply used by economists is M1. It consists of the most highly liquid assets. In other words, the most easily exchangeable assets are used as payment for goods and services. As Trading Economics data shows, the Fed has created 39% of all the “dollars” in the economy in 2020. To put it on its head, in 2020 the Fed has created more money than in almost a hundred years of its existence.

Monetary policy effectiveness has its boundaries. As good as it might seem at first glance, creating money “out of thin air” doesn’t bring prosperity. It is true, inflation still hasn’t start banging on our doors. But looking no further than the asset prices, we can see that the low inflation rate is masked by the asset price inflation. Even with the sharp drop of the GDP and an unemployment rate that stands more than double the rate before the crisis started, the S&P 500 is more than 10% higher than on the day the pandemic rolled around. This also shows who profits from the economic response to the COVID-19 crisis: those with assets, i.e. those already wealthy anyway. The middle and lower classes, meanwhile, lose out, either having their businesses shut down or stuck in unemployment or short-term work schemes. Thus, the equality warriors of the political elite continue to increase economic inequality in the fight against the Coronavirus.

More Statistics in Our Costs of Coronavirus Lockdowns Series:

- The Costs of Coronavirus Lockdowns: Introductory Article by Kai Weiss

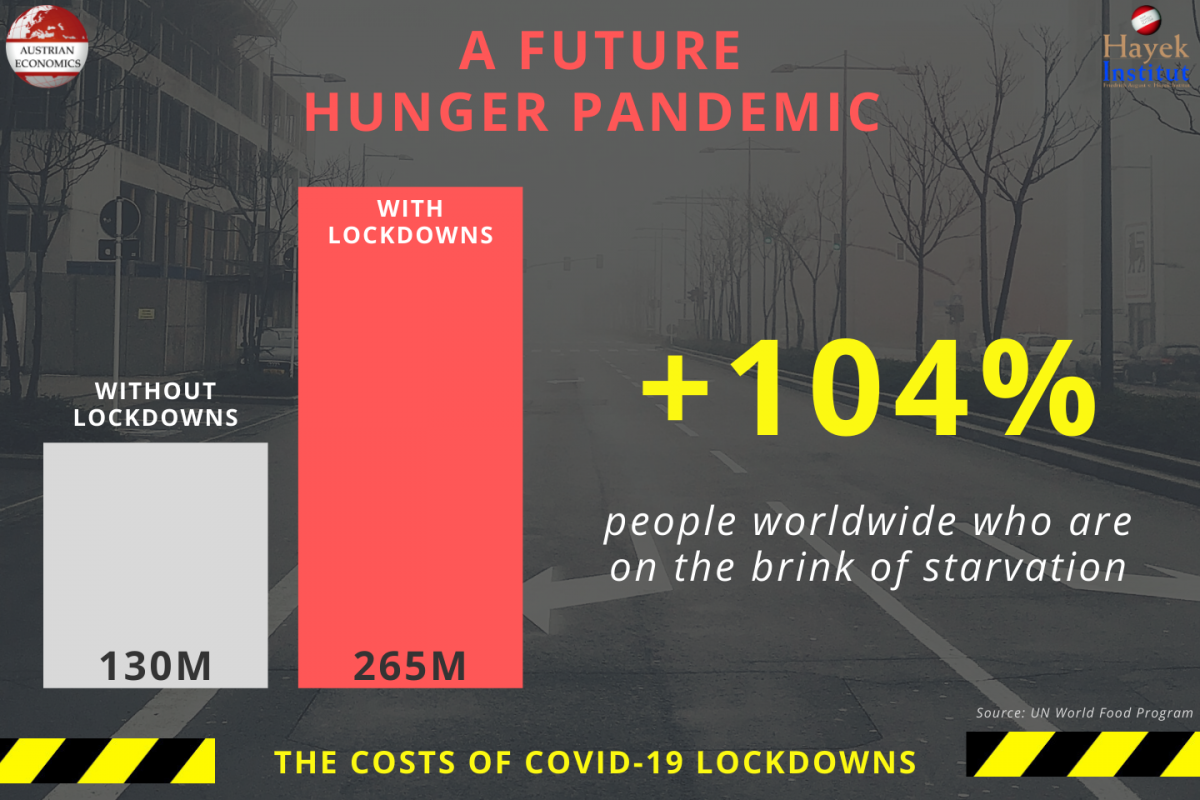

- A Future Hunger Pandemic: 135 million more people are on the brink of starvation (UN World Food Program)

- Fear of Collapse for Small Businesses: 55 percent of European SMEs fear bankruptcy by September 2021 (McKinsley)

- Economies Lock Down, Deaths Spike: 1.4 million excess deaths of tuberculosis, 500.000 from illness related to HIV and 385.000 from malaria (WHO & Stop TB Partnership)

- Children Hurt Not by Corona – But by Lockdowns: children’s mental-health-related visits to the emergency departments in the U.S. increased by approximately 24% and 31% for children aged 5-11 and 12-17, respectively, compared to the same period in 2019 (CDC)

- Record-Breaking Budget Deficit in the U.S.: the U.S. government spent $3.1 trillion more than it collected in 2020. Who is supposed to ever pay back all this money has not been answered yet. (U.S. Department of the Treasury)

- Drug Addiction Intensifies: the number of people dying from drug overdose in the U.S.rose by 17% in the last twelve months. This only includes reported cases until May 31, 2020. (CDC)

- Governments Grow in Size: in Austria, Germany, France, and Italy government spending has risen dramatically in 2020. (European Commission, Statista, and Handelsblatt)

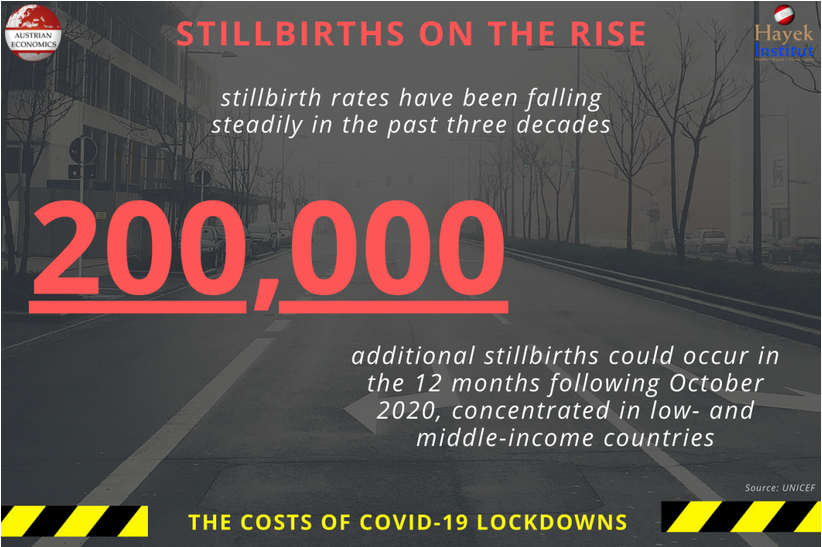

- Stillbirths on the Rise: more than 200.000 additional stillbirths could occur just in the next 12 months, concentrated in low- and middle-income countries. (UNICEF)

- Extreme Poverty Shifts Gear…in Reverse: 2020 is expected to push between 119 and 124 million more people, into extreme poverty. (World Bank)

- The Poor Pay the Higher Lockdowns Price: lockdowns and restrictions have proven to be something that disproportionally affects those already poor, whereas those wealthier are less hurt. (PEW Research Center)

- The Hidden Suicide Explosion During the “Great Lockdown:” due to lockdowns and isolation, suicide rates in Japan went up, especially amongst children and adolescents. (Nature Human Behavior)

- How Women Are More Hurt by Lockdowns Than Men: between the first and second quarter of 2020, on average, women suffered a 6.9 % decline in wages, compared to the 4.7% decline suffered by their male counterparts. (International Labor Organization)

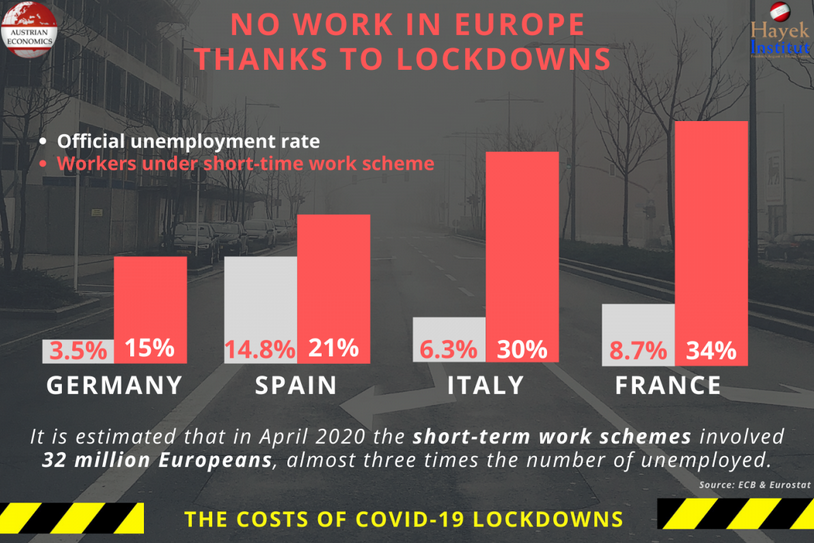

- No Work in Europe Thanks to Lockdowns: The sharp decline in labor market participation and the 32 million people under the short-term work schemes hide the real numbers of the unemployed in the European Union, which most likely averaged a two-digit number. (ECB & Eurostat)

- Printing Money in Times of Corona: Monetary policy effectiveness has its boundaries. As the Fed has created 39% of all the “dollars” in the economy in 2020, those boundaries might have been reached. (Trading Economics)

Tags: Blog,coronavirus,Featured,Federal Reserve,Lockdowns,Monetary Policy,money,newsletter